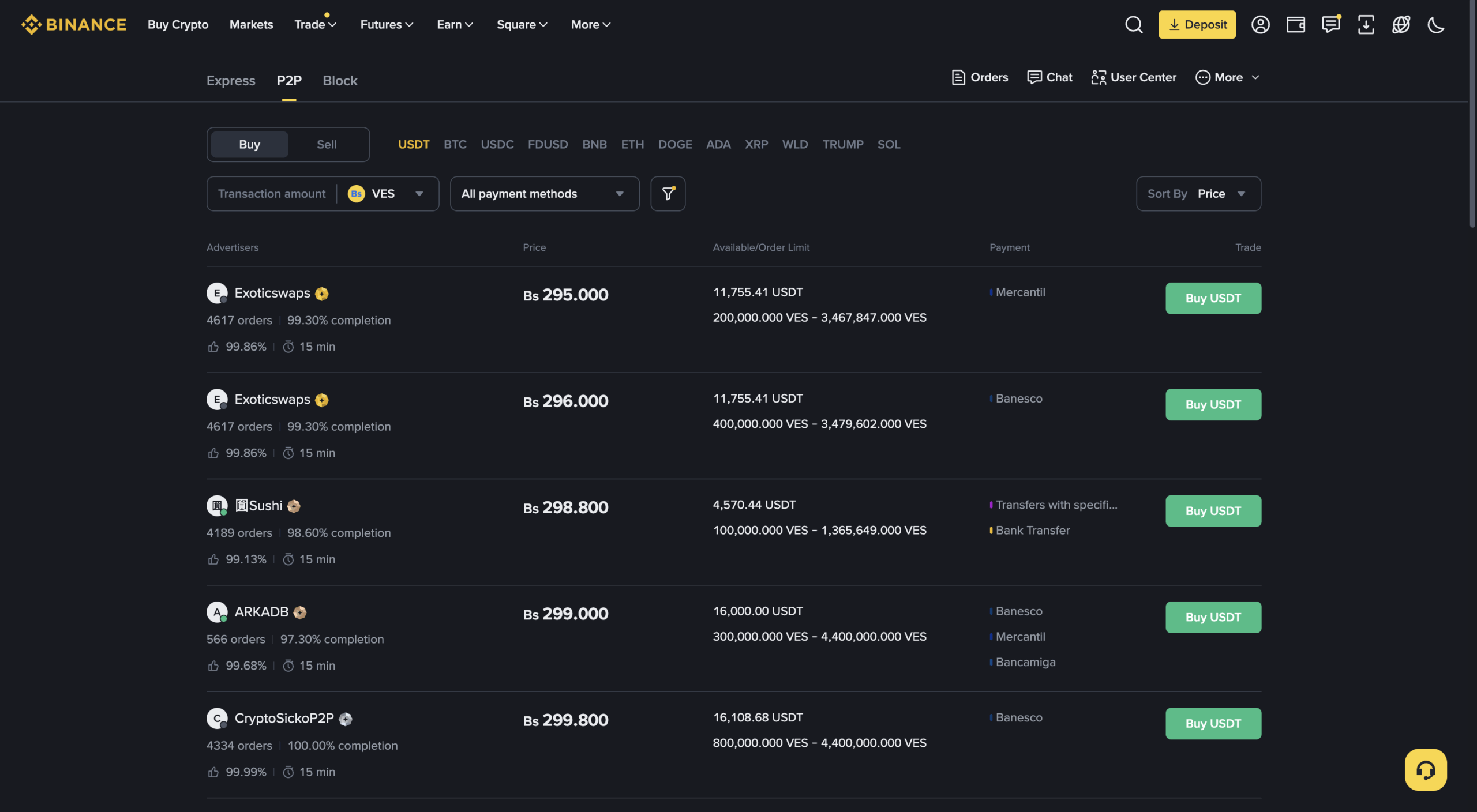

In the shadow of high inflation VenezuelanIn the tradesmen, apartment administrations and free employees, pricing and collection is gradually carrying Tether’s USDT (Local Binance Dollar). Annual annual in May 2025 inflationThe climbing of the flour to 229 percent, while the country’s currency takes the Venezuela Bolivar to the bottom, as a practical reference of daily pricing Binance P2P He came forward. Cash dollar shortage, harsh depreciation of Venezuela Boliva and low-paid tron (trc-20) transfers have transformed digital dollars into small payments and working capital into the basic vehicle. Although the authorities make initiatives to determine parallel exchange references, the actual tolerance that opens space for dollar crypto currencies in the private sector enables the operation in the field.

How does the actual dollarization based on USDT work?

Price tags in Venezuela mostly US dollars In terms of the type and collections are made over the current P2P USDT dry. The cashiers regularly refresh the quotation, the buyer sends to TRC-20 with QR and approval is obtained in seconds. Low trading fees and use of widespread wallet make digital dollars superior to cash even in small consistent transactions. Businesses, from the USDT partially to the venezuela bolivar by turning salaries, invoices and tax payments welcome. Directly to suppliers stablecoin is sent.

Approximately half of the transfers of $ 10,000 in the country’s in -blockchain in the country last year. stablecoinIt shows that households and SMEs connect the unit account and agreement to digital dollars. In May 2025, the monthly inflation began to increase again, the continuation of the opening of the scissors between the official and informal exchange rates, and the depreciation of the Venezuela Bolivar in July 2024 and 2025 was reinforced by USDT.

Dynamics of Flow, Risks and Washing in the Field

Since the day -out exchange rate volatility can lead to the differences in cash -mutabakat, businesses limit the exchange rate risk by methods such as time stamped invoices, short payment windows and instant reconciliation. On the device safety and storage side, PIN/Biometry, offline backup of recovery expressions and hardware wallets are preferred in balances on a certain threshold.

The central export structure of the USDT and the risk of black list require the discipline of using multiple wallets, using multiple wallets and safe off-ragged. Moreover, the country has become standardized in the country against P2P/OTC frauds, high reputation score, Blockchain internal approval and verifiable payment proof. Regional Argentina The table seen in high inflation economies such as Venezuela. Accordingly, stablecoins close the cash deficit and increase the access of the dollar in daily payments.