For hackers crypto currency protocols are a robbery area where they can easily lose their traces. That’s why we constantly see new ones. A bank account hacking and moving billions of dollars is very difficult in today’s technology. However, we have seen examples in crypto currencies that it is possible. The last victim was the Abracadabra Stablecoin platform.

Spell attack

The report, which was shared by Goplus Security by Goplus Security stablecoin The platform says Abracadabra (Spell) has been attacked by a new attacked that caused a $ 1.77 million damage. Crypto cyber security Companies are now a part of our lives and there are a few more companies that follow abnormal mobility. In the past, difficult events have become easier with the increase in employment in this field and even small attacks are heard.

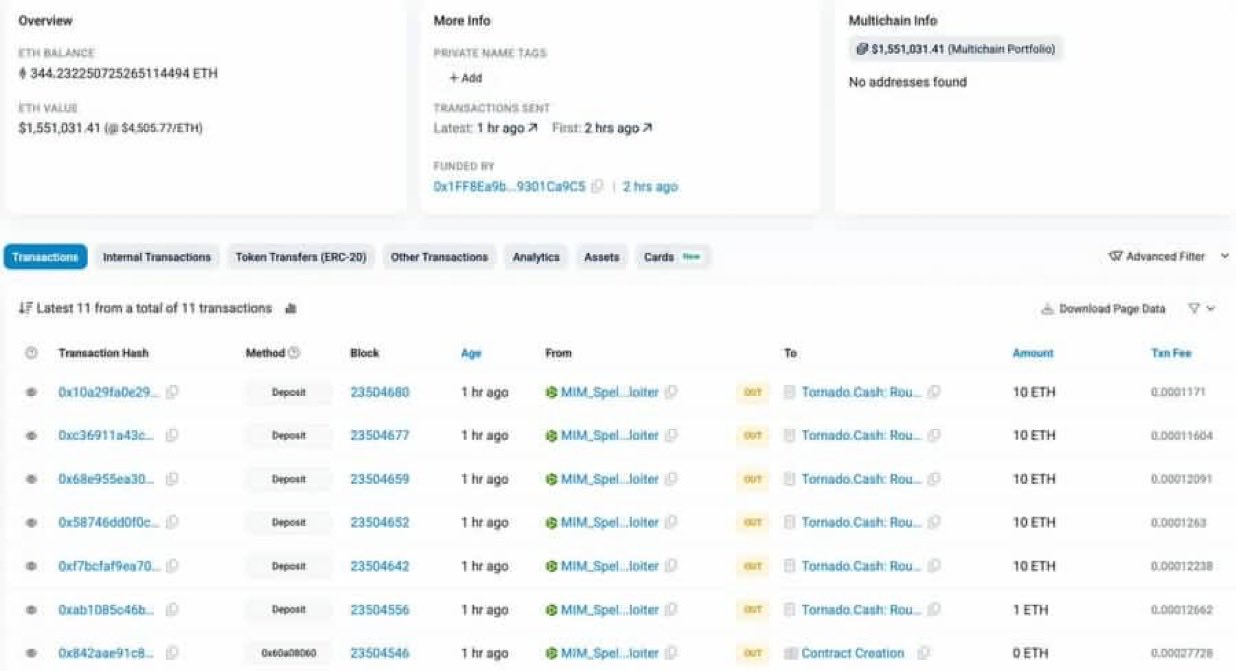

The cyber security team pointed out that the MIM_Spell X account does not update after the attack. The last sharing was made on September 9th. The attacker contract address is 0xB8e0a4758df2954063CA4BA3D094F2D6ADA9B993 (destroyed himself after the attack) and the attacker’s address was 0x1aaade3e9062D124b7deb0ed6DDC705Afa7354d.

The attacked contract is 0xd96f48665a1410c0cd669a88888ca36b9fc2cce (Abracadabra Money).

“After the attack process is completed, 51 ETH Tornadocashwas transferred to. The address of the attacker (0x1aaade) still contains an unacked asset in the amount of 344 ETH (~ ~ 1.55 million dollars).

The team then responded to the Discord community and said that DAO spare funds will be used to buy the affected MIMs back. However, the official Twitter account has not been sharing new for about 1 month. ” – Goplus Security

Warnings to Crypto Money Investors

Central platforms Ftx There is a risk of defrauding and disappearing customers such as. Therefore, after the collapse at the end of 2022, defi interest increased. However Defi’s It has a bigger problem. Today, the central stock exchanges are hacked because it does not have sufficient penetration tests, even though it is under monitoring and under monitoring, because it does not have sufficient penetration tests and does not devote the budget to the upper level of code controls.

If you have backups when a website hacked, you can easily lift your site. However, a hacked crypto currency The protocol is because of the irreversibility of Blockchain’s reversibility, the stolen beings fly away. So central exchanges and Dex It may be useful to distribute risk between.

Abracadabra Money was attacked twice previously due to the security vulnerabilities of the contract. Apparently, they did not create the necessary budget for the detection/closure of code control and weaknesses and did not take their work seriously. Or as the extreme scenario we can say “they hacked themselves”? We’ve seen this in the crypto before, just like the bank owners do many times, like the hose of their banks.

- On January 30, 2024, a Flash credit attack that uses a rolling calculation vulnerability in the contract broke the PEG of MIM Stabilcoin, causing a loss of approximately $ 6.5 million.

- On March 25, 2025, a hack, which used the security vulnerability during the liquidation of the collateral, caused a loss of approximately $ 13 million.