Reaching a few hours ago to $ 125,708 Bitcoin  $124,408.17 price New has determined the record level of all time. However, it still continues to linger over 122 thousand dollars, ie the summit can be moved further up. So what’s the reason? What do the data in the stock market tell us?

$124,408.17 price New has determined the record level of all time. However, it still continues to linger over 122 thousand dollars, ie the summit can be moved further up. So what’s the reason? What do the data in the stock market tell us?

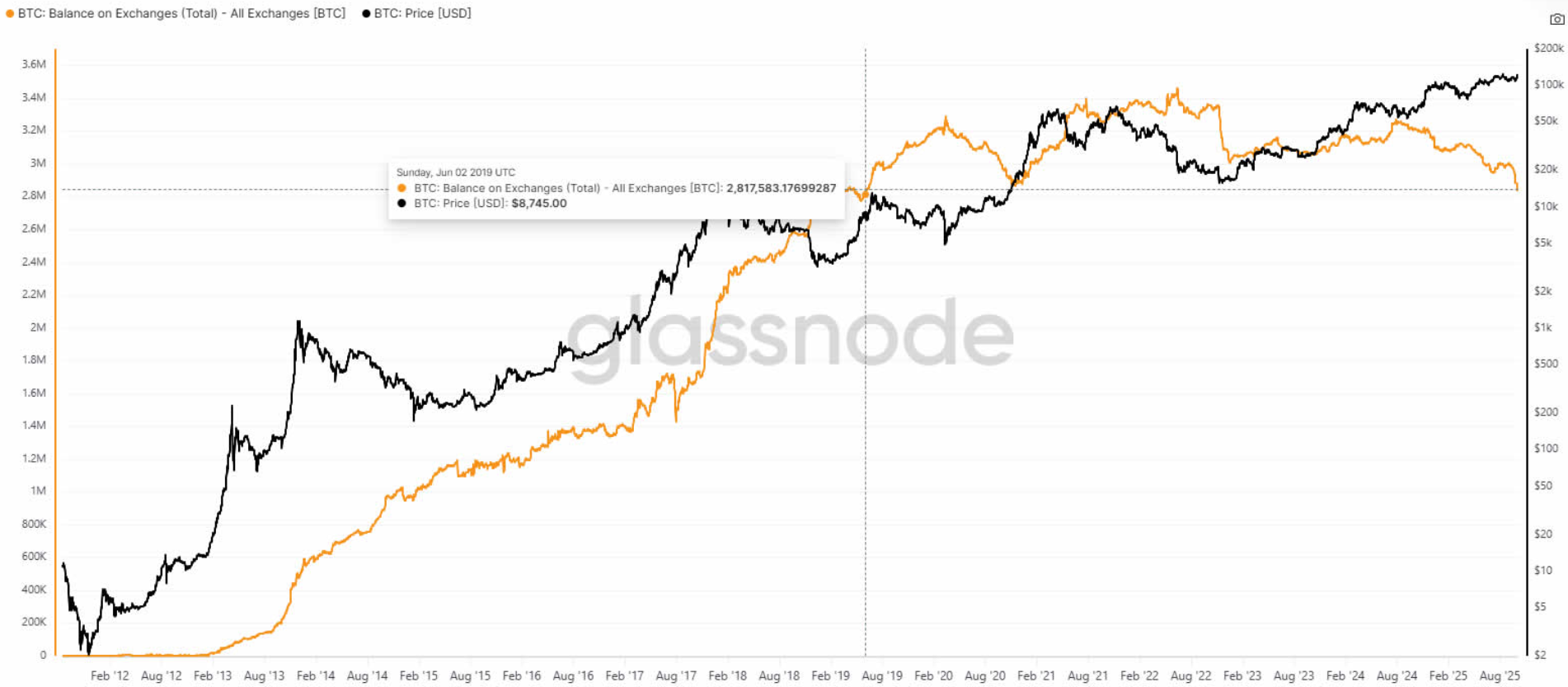

Bitcoin amount in stock markets

The amount of BTC in the central exchanges is decreasing rapidly. While both crypto currency reserve companies and ETFs absorb the supply, investors attract the assets they buy in line with their long -term goals to their cold wallets. The presence of fewer BTCs in the stock exchanges makes the price increased with the shortage of shortage due to the narrowing of the ready -to -sell supply.

Within two weeks, $ 14 billion assets withdrew from the stock markets and on the stock markets BTC The amount has reached the lowest level of the last 6 years. This means that we have experienced something bigger than the previous bull markets. Although miners have a significant BTC in 6 years, only 100 companies have already exceeded 1 million BTC accumulation in the reserves of 100 companies. If we take into account ETF and others, the figure is based on 4 million.

According to Glassnode data, the amount of BTC in stock exchanges is 2.83 million BTC. There is only 2.8 times the BTC of the BTC reserve of the crowd, mostly US -based companies. In other words, unlike the previous cycles, we are in a new era in which the corporate investor segment absorbs incredibly supply.

Cryptoquant’s total stock market reserve report is 2,445 million BTCHe says it was held by the stock exchanges. This is the bottom of 7.5 years.

Crypto currency bull

One of the most interesting comments came from Nate Geraci while BTC ran to new records. “BTC reaches record levels, and most people are still unaware of what Bitcoin is still unaware of what the growth potential is. When you look around you can see this clearly. Global is no different. People know gold and silver, but very few people compared to him BitcoinHe is aware of the BTC six -digit prices.

The analyst named Rekt Capital said that if 126 thousand dollars breaks firmly, that is, if we see the receiver volume on it, there will be much faster new summits.

Vaneck said about the shortage of supply of Matthew Sigel, President of Digital Asset Research and said on Monday that big buyers may not find as much BTC as they wanted. Investor and Trader Mike Alfred said I talked to the man who ruled the most important OTC table and said;

“He told me this, if the price does not go between $ 126,000-129,000, our BTCs will be completely released 2 hours after the opening of the futures tomorrow. This is out of the ground.”

This is of course Your crypto coins Big news for the rest. When BTC starts to be saturated with liquidity, it will come to the subcoins.