Asset Management Company VaneckEthereum, which is planned to be commissioned on the main network in December in the Crypto Money Market Report in December  $4,500.36 He said that the verifiers will facilitate the scaling of Layer-2s by reducing the data load, which will reduce costs and increase corporate charm. In the same context, as well as corporate actors (ETFs and crypto currency treasure companies) accumulated and stake, the warning that investors who do not stak may face the risk of losing return. Bitcoin in September Table

$4,500.36 He said that the verifiers will facilitate the scaling of Layer-2s by reducing the data load, which will reduce costs and increase corporate charm. In the same context, as well as corporate actors (ETFs and crypto currency treasure companies) accumulated and stake, the warning that investors who do not stak may face the risk of losing return. Bitcoin in September Table  $122,485.31 positive, Ethereum‘s limited negative performance was noted.

$122,485.31 positive, Ethereum‘s limited negative performance was noted.

Eyes at Fusaka update in Ethereum

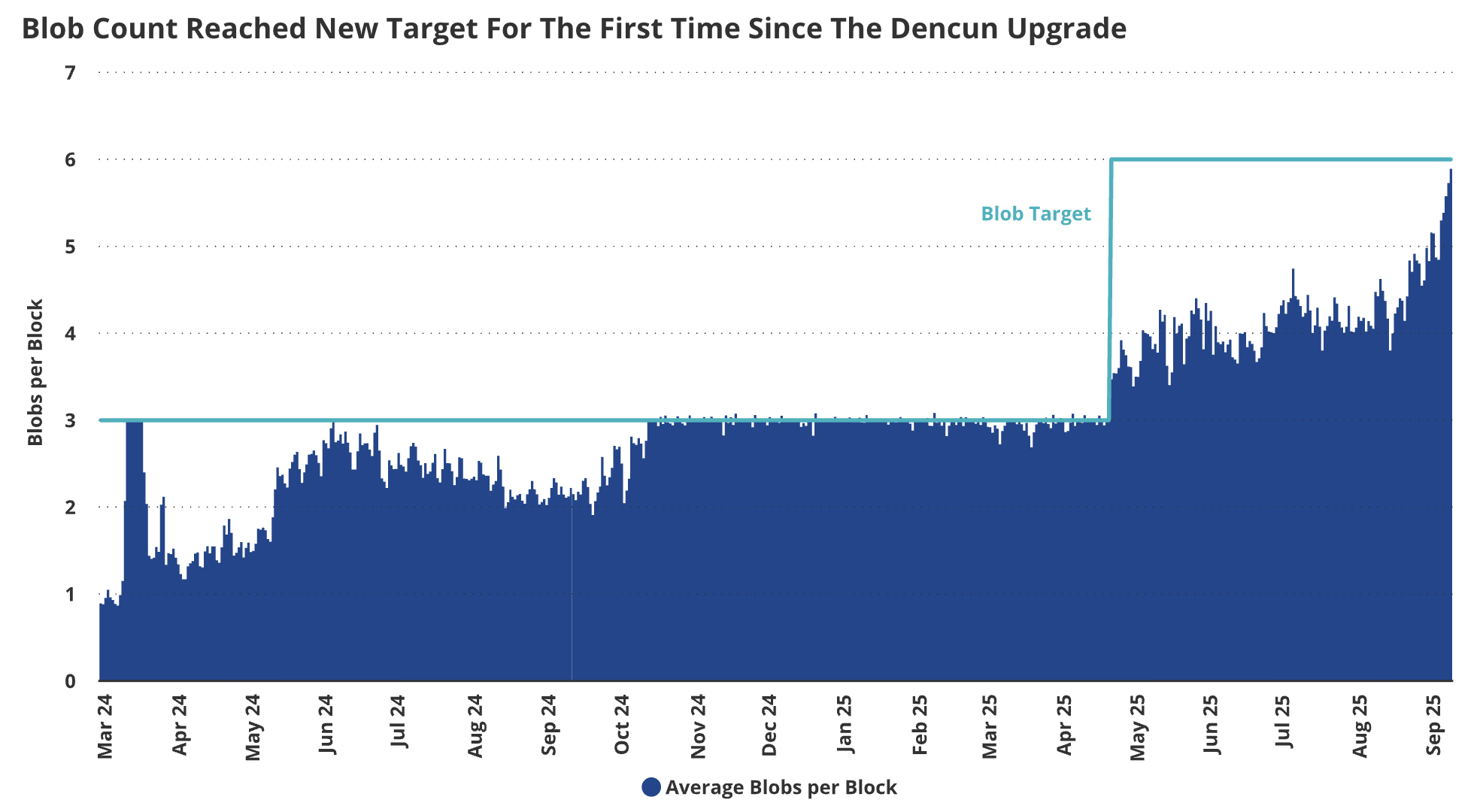

Ethereum networkPeer Data Availability Sampling (Peerdas), one of the basic innovations of the Fusaka update, which is expected to be available in December, is to reduce tape width and storage pressure by allowing confirmants to verify the Layer-2 BLOB data without downloading. Developer roadmap capacity increases with gradual only BLOB parameter (BPO) fork’s progress of the update indicates that it is almost precise to be presented on the main network in December. With the update Layer-2While the data area is increased for s, the cost of end -user transactions will decrease.

According to Vaneck’s assessment, this capacity increase does not return Layer-2 wage burns to old levels, but it may strengthen the monetary asset position at the center of Ethereum’s growing scale ecosystem. With the success of the test network stages (including Houlesky), the technical risks to the transition to the main network decreased. This is Fusaka updateHe says he can come out on the planned date.

In the September report, Vaneck emphasized that corporate demand is strengthened through crypto currency treasure companies and ETP/ETF, and that the ETH positions are gradually turning to long -term storage and Stinging. This dynamic stake increases the risk of investors to be behind the network export/award flow. The company relies on the volatility -based financing model crypto currency He pointed out that the sustainability of treasury companies is sensitive to market volatility.

23 of the 35 crypto money depreciated

On the other hand, Vaneck reported that the 23 major crypto currency was a decrease in the Vaneck report, Bitcoin’s month was plus, and Ethereum closed the minor. 53 percent of the winning subcoins of September Mantle (MNT), with a 24 percent rise Avalanche  $30.66 (AVAX) and 16 percent rise Bnb was. The losers of the month decreased by 19 percent Polygon (Pol), with a 17 percent decline Arbitrum (ARB) and 14 percent decrease Toncoin (Ton) was.

$30.66 (AVAX) and 16 percent rise Bnb was. The losers of the month decreased by 19 percent Polygon (Pol), with a 17 percent decline Arbitrum (ARB) and 14 percent decrease Toncoin (Ton) was.