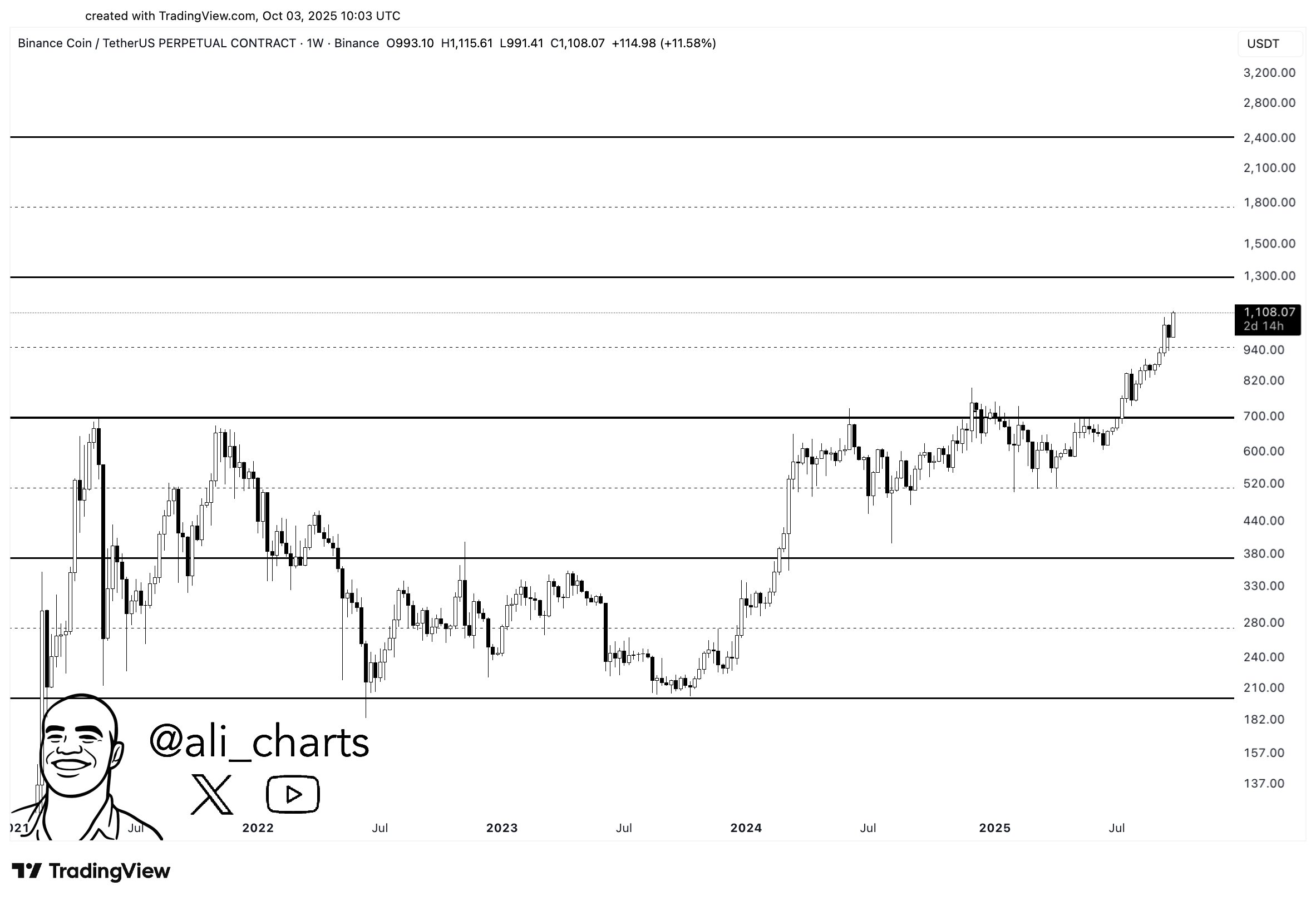

BNB Coin It continues to rise over 20 percent in the weekly time period, with an additional value of 5 percent today, close to the summit of all time of around $ 1,150. Despite the short -term horizontal course throughout the market, the volume increased by 40 percent to 5.85 billion dollars. Coinglass Data show that open positions in derivative markets have increased by 18 percent and exceed 2.5 billion dollars. Analyst Ali Martinez pointed out the target of $ 1,300 for the BNB, while in the third quarter of the year, he drew attention to strong entrances to Binance.

Dynamics that guide the price in BNB

BnbIn the current pricing of the buyer interest, transaction volume and derivative markets Open positionsThe increase in the increase was effective. In the short term, the threshold of psychological resistance around $ 1,200 is followed, while Martinez points out with volume of the trend for the target of $ 1,300. The size of the open positions over $ 2.5 billion on the derivative side indicates that the expectation of rise continues on the leverage.

Martinez, Binance He reported that there was a net entry of $ 14.8 billion for the third quarter. The total of the 10 largest competitors remained at about 94 million dollars. Analyst said that the difference reached 158 times when the comparison was made. Binance’s founding partner and former CEO Changpeng ZhaoThe historical reference to the 2015–2017 cycle has enabled the re -revival of investor confidence. High activity in derivative markets and strong spot entries are critical for the permanence of BNB Coin’s acceleration at the price.

0.05 GWei GAS fee can increase the demand for BNB

On the other hand BNB Chain In the network, the minimum GAS fee was standardized at 0.05 GWei level, and the confirmants and developers rapidly adopted the new footage fee. The transaction fee corresponding to about 0.005 dollars has made Blockchain stand out in terms of cost. While providing faster and more affordable exchange for investors, developers will accelerate product trials with their flexible cost structure.

In the next stage, wallet providers, central stock exchanges and trading platforms are expected to be compatible with 0.05 GWei standard. Compliance throughout the network can indirectly support the demand for BNB by increasing the in -blockchain activity. The low wage approach facilitates the user acquisition of defi protocols, while the potential to reduce the risk of bottleneck during heavy periods.