Bitcoin  $122,485.31While overcoming the $ 120,000 threshold, the expectation of rise for October is strengthening. The Bull Theory The team has an area up to $ 143,000 in the month. The foresight of the team means that there may be an increase of approximately 20 percent in the rest of the month. Analysts evaluate that historical data and current technical signals indicate in the same direction and that record levels can be tested in a short time.

$122,485.31While overcoming the $ 120,000 threshold, the expectation of rise for October is strengthening. The Bull Theory The team has an area up to $ 143,000 in the month. The foresight of the team means that there may be an increase of approximately 20 percent in the rest of the month. Analysts evaluate that historical data and current technical signals indicate in the same direction and that record levels can be tested in a short time.

Historical data supports rise

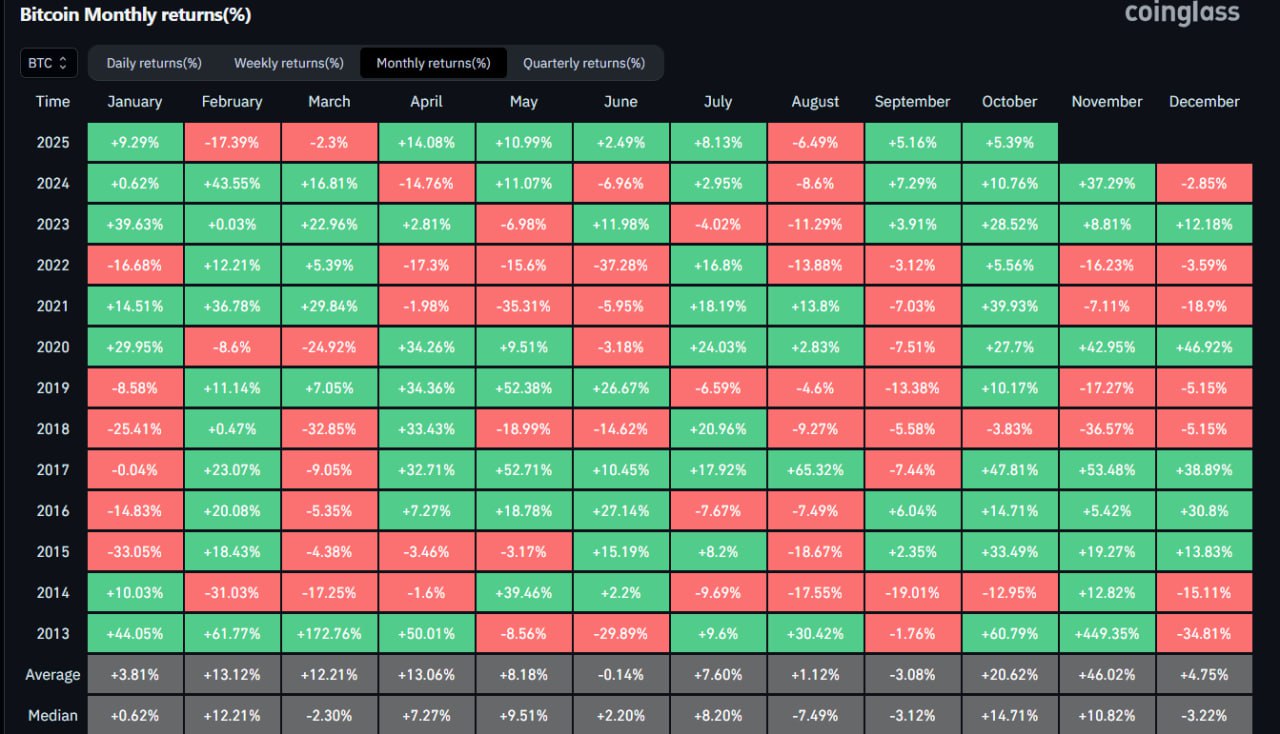

Coinglass according to data October The month stands out with a positive closing in the last 12 years with a positive closing and stands out as a period with a strong place in the investor memory with an average return of 20.62 percent. Negative closures in the past years were recorded as -12.95 percent in 2014 and -3.83 percent in 2018. In the years when September is closed, October is progressing in the same direction. For example, after the 2.35 percent rise in September 2015, 33.49 percent rise in October, 2023 SeptemberAfter a 3.91 percent rise in October, 28.52 percent rise in October stands out.

Repetition of Historical September-October returns Bitcoin’s priceIt points to the potential that could carry it to $ 143.539. Even in the average return of 14.71 percent, new records of around $ 136,000 are likely to be seen.

$ 150,000 scenario in Bitcoin

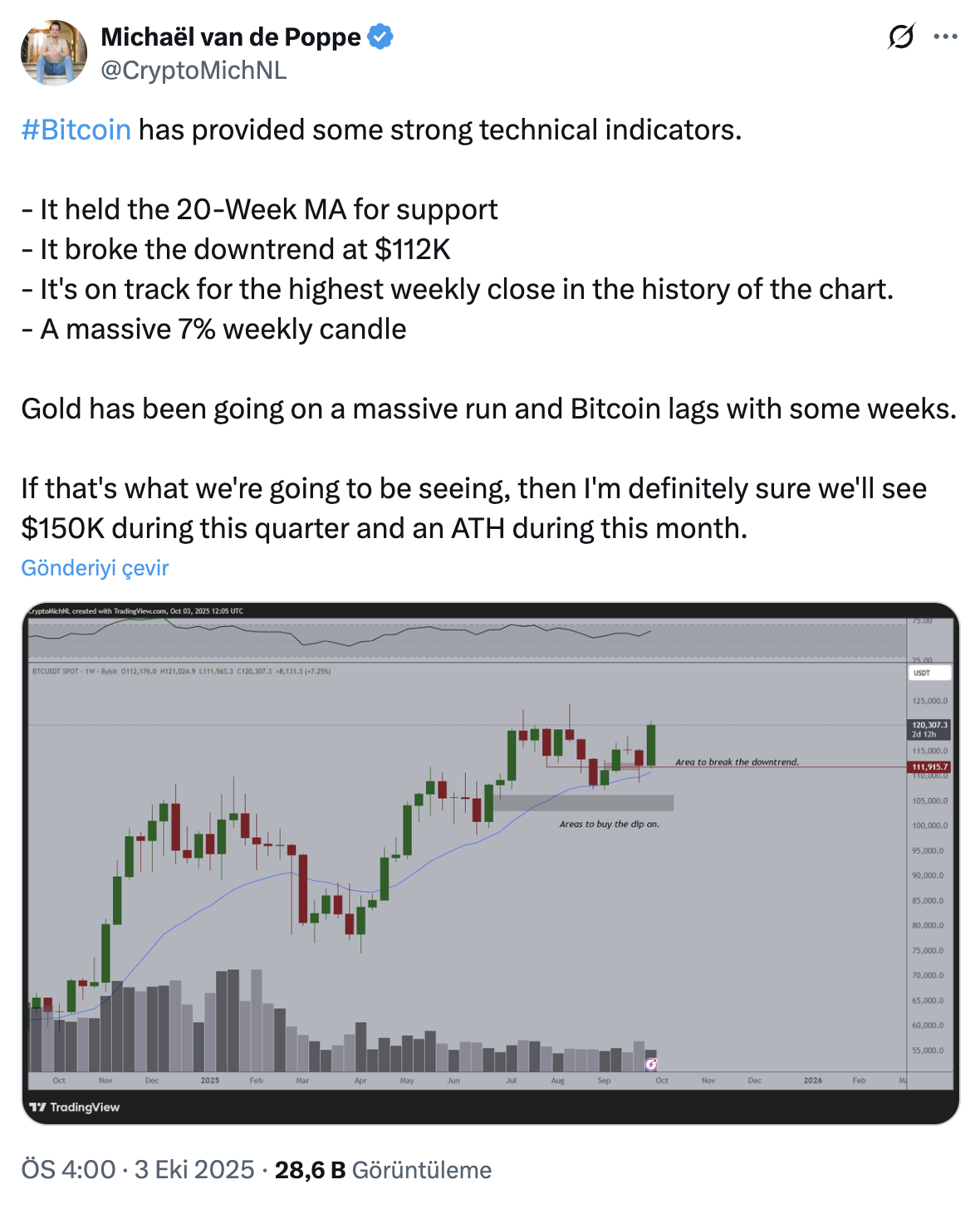

Market expert Michael van also poppeThe support of the 20 -week moving average by support, over 112,000 dollars to overcome the falling trend and preparing for the highest weekly closing of history is in favor of rise. The last week has shown that about 11 percent of the powerful wax momentum confirmed. The rally in precious metals offers a ground that supports the risk appetite through the correlation channel.

In the current table, the analyst emphasized that the price may rise to the target of $ 150,000 in the fourth quarter if the acceleration is preserved. The probability of refreshing records during the month gains strength with the intersection of seasonality and technical breaks, while the volatility is expected to increase after new summits. It stands out as the first indicators to be followed in terms of the direction determination of a weekly closing in the short term and a 20 -week average price behavior.