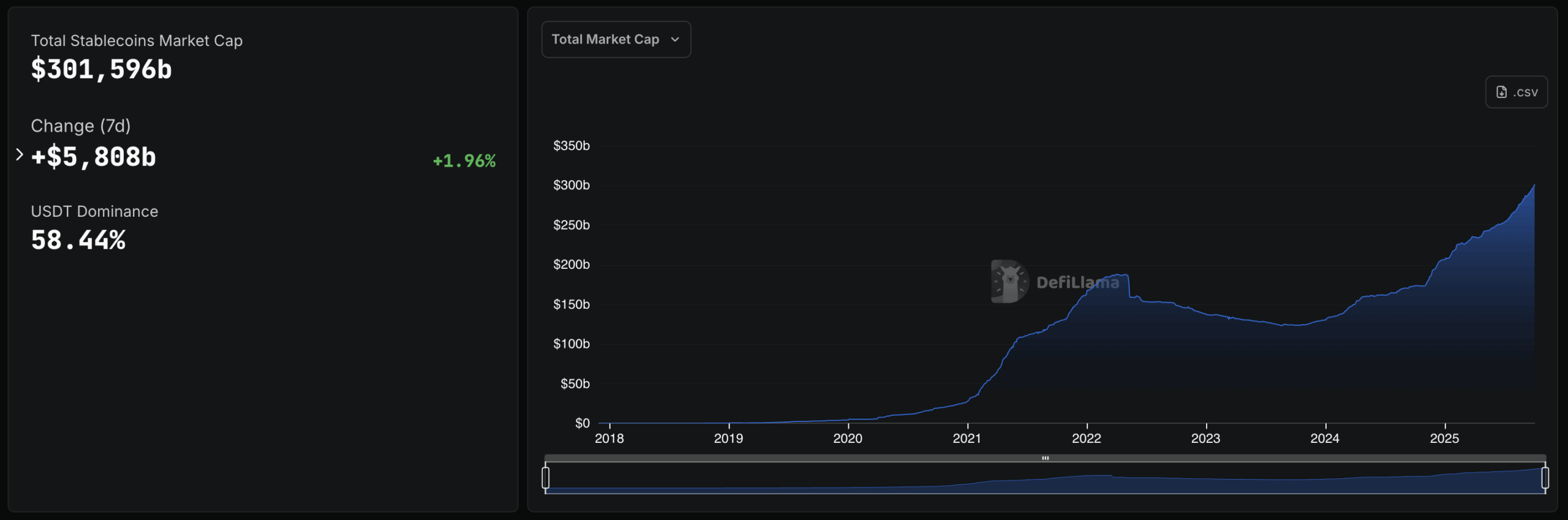

StablecoinThe total market value of the s has exceeded $ 300 billion for the first time. Fashion show According to the data, the total value rose to $ 301 billion. The market value increased by 2 percent in the last week and 6.5 percent in the last 30 days. The record was confirmed by the measurement dated 3 October 2025 and is supported by capital flow with the increase in transaction volumes. Bitcoin with recovery in the crypto money market  $120,326.87 and Ethereum

$120,326.87 and Ethereum  $4,480.54The third quarter of the double -digit rises strengthened the painting.

$4,480.54The third quarter of the double -digit rises strengthened the painting.

Market share of stablecoins

Tether’s USDTIt has strengthened its first place by maintaining a market share of approximately 58 percent with a size of 176.3 billion dollars. A few days ago, the $ 173 billion rose above the threshold. Circle’s USDCIt is secondary with a market share of 24.5 percent with $ 74 billion. Ethena with the first four 14.8 billion dollars USDand with $ 5 billion DAI is completed with.

With the increase in the total market value, the distribution of dominance became more pronounced. While maintaining the difference between USDT and USDC, USDA increases its share step by step. DAI ranks fourth with a more limited share by maintaining the collateral -oriented model. The total growth of 2 percent weekly and 6.5 percent per month shows that the stable demand increase is gradually reflected in the market shares.

Regulatory Framework Increased interest in the market

In the third quarter, approximately 20 percent of the growth regulatory regulator gained momentum with an increase in the clarity. The Genius Law adopted in the USA, indexed to the dollar Stablecoin ExportersNa reserves and regular reporting brought more open rules and opened the door to scalability. The distinction of transparency and audit standards contributes to the growth of storage and intermediary institution infrastructures.

The clarity in the regulations facilitates the adoption of stablecoins in the layer of trade and defi. While the corporate demand channels increase, the adaptation processes on the exporter side accelerate by increasing market funds.