In the USA Spot Bitcoin  $118,702.92 ETF‘s last day of October 2025, the last trading day was a total of $ 675.8 million entrance. Blackrock with 405.5 million dollars in the entrances ishares bitcoin trustII (IBIT). While the total net entries to IBIT rose to $ 61.37 billion, the size of the ETF increased to 90.7 billion dollars under the management of the ET 20 ETF according to managed assets ”list. Bitcoin on the price front of the same day with a 4 percent rise of 119 thousand dollars tested.

$118,702.92 ETF‘s last day of October 2025, the last trading day was a total of $ 675.8 million entrance. Blackrock with 405.5 million dollars in the entrances ishares bitcoin trustII (IBIT). While the total net entries to IBIT rose to $ 61.37 billion, the size of the ETF increased to 90.7 billion dollars under the management of the ET 20 ETF according to managed assets ”list. Bitcoin on the price front of the same day with a 4 percent rise of 119 thousand dollars tested.

Historical Entrance League Rise in IBIT

Persian According to the data, the US Spot Bitcoin ETFs in the United States attracted the strongest daily net entrance after 10 September on October 1. IBITHe became the leader of the day with a net entry of 405.5 million dollars. Flows on the Wall Street side Crypto Money MarketIt indicates that access to access through ETFs as arranged products continues.

IBIT increased the existence size to 90.7 billion dollars. ETF marketHe wrote his name to the top 20. Bloomberg ETF analyst Eric BalchunasETF has provided 175 percent return since the launch in January 2024. According to the analyst, an additional assets of approximately $ 50 billion are required for entry to the top 10. It is possible to approach this goal if the tempo of the last 12 months repeats. Reminding that other major ETFs also grow rapidly, Balchunas pointed to December 2026 as an expectation for the calendar.

ETF support brought 4 percent leap in Bitcoin’s price

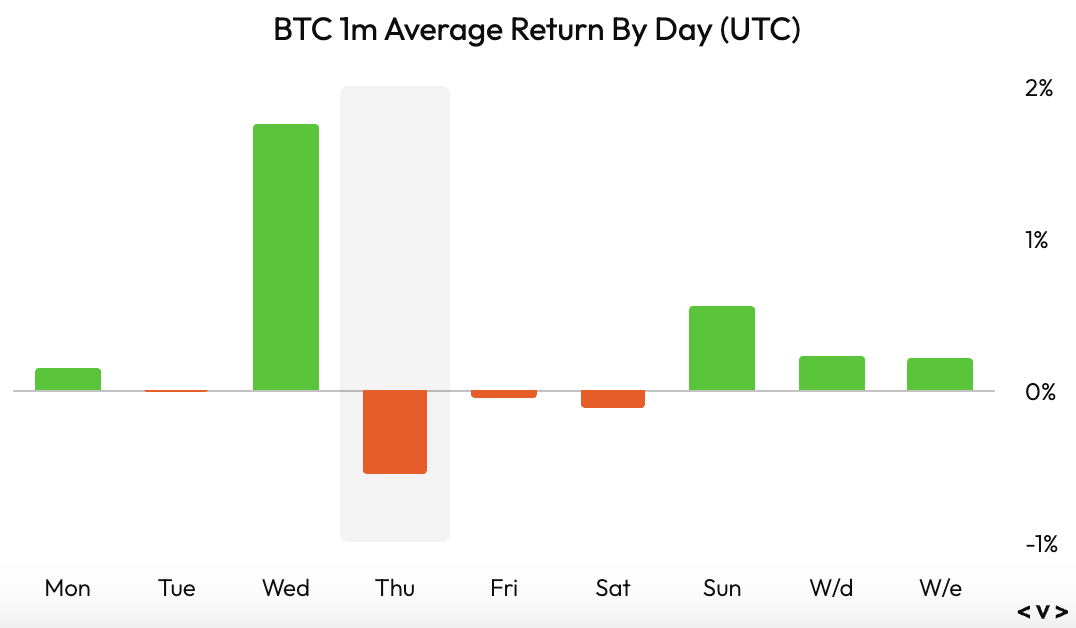

On Wednesday, October 1, Bitcoin exceeded $ 119,000 with a 4 percent rise. Spot ETF The strong entry in the wing increased the risk appetite and allowed the price to approach the resistance zones in a short time. Data Provider in Particularly Processing Days Velothe most powerful average performance in the last year on Wednesday, and the weakest performance on Thursday shows that. In other words, the current trading day can be mainly horizontal or negative.

For now, eyes have been turned to the permanence of high frequency entrances and the speed of increasing IBIT’s market share. IBIT’s approach to the largest 10 ETF list depending on the managed asset size can create a reference point for Bitcoin allocation in corporate portfolios. At the same time, the growth tendency in competing ETFs may be a secondary catalyst that increases competition and liquidity depth throughout the market.