Bitcoin (BTC) Following the latest US data, he reclaimed 117 thousand dollars and expected six employment figures increased appetite. Crypto currency Investors made a good start to October. If we see figures below consensus forecasts on Friday, this crypto will prepare the ground for larger October summits. So what are the analysts’ gold, XRP, Dge and market estimates?

Crypto Money Bull Markets

The US closure is not expected to last too much, but the news of the closure increased the appetite in the crypto. Moreover today’s data interest rate reduction As for his favor, we saw that the appetite increased even more. Today, there was a Senate interview for crypto money taxation and the agenda is intense.

Columbus discussed the appetite of the bears with appetite for six $ 100,000 and said;

“Bears were screaming 100 thousand gold. Just for macroeconomic reasons? Big mistake. Yes, ultimately there will be a collapse. But the graphics are not when it appears. Always depending on the graphics. As soon as we start to lose important levels, the others are still throwing the rise screams and I will sell everything.

To be open. Bitcoin If he doesn’t get back POC and is harshly rejected and he’s losing 112,000 levels again, not just because of a small deviation, then it’s okay, the graphic tells us to wait for a lower level. But right now? In the morning I wanted BTC to break the level of 114 thousand and broke it. Next is Poc. It can take some time. “

XRP, Doge and Gold

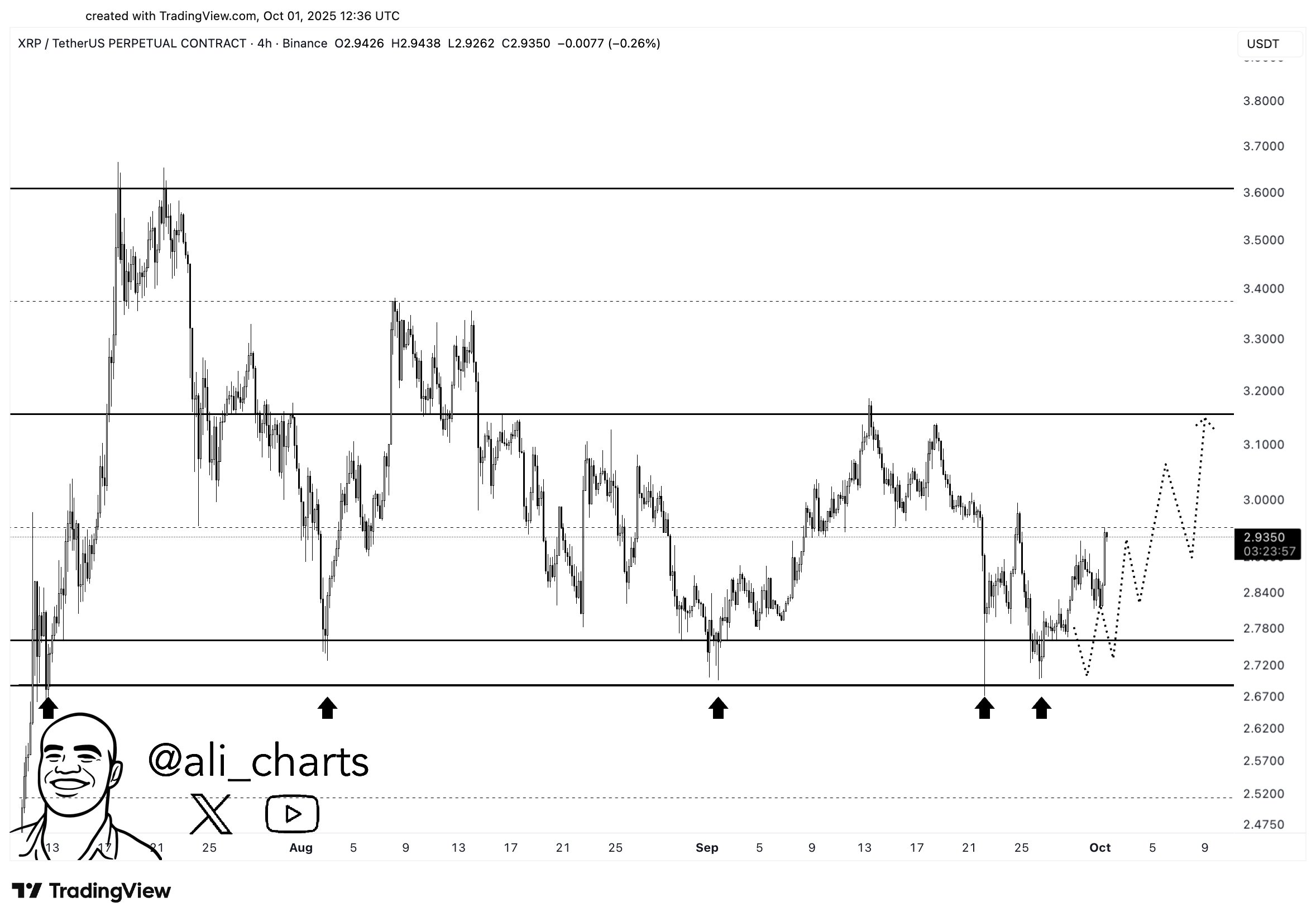

XRP Coin Price Ripple (XRP) is one of the crypto currencies that are expected to approval ETF on the border of $ 3 and next week. Ali Martinez expects 3 to $ 3.15 goals to be overcome soon as the support level is preserved. The analyst’s focus for a while is at $ 3.6 and if the planting is completed as expected in the optimistic scenario XRP Coin It can see a new peak of 4 dollars or more.

Mags Dog He wrote that the target of $ 1 again was graphically programmed. This week there will be an important milestone for Doge, and even in 2021, it is not impossible to reach there before the end of this year.

Michael Poppe warned the gold receivables.

“While an average of 6-8 %on an annual basis, it increased by 47 %this year. It is a very unusual situation and I think we will see an important correction. This will be the month or in the future of the year?

There is a strong rise graph, but it is not the best time to buy this asset. ”