Bitcoin price Re -reached $ 118 thousand dollars and some in subcoins The weather changed rapidly. While Dogge gets back $ 0.24, we cannot fully see the excitement of the upcoming ETF in the graph, even though the left coin rises. 2 different analysts shared the current market assessment for Ethereum and there are important details here for the future of Altcoins.

Ethereum (ETH)

Ether started the week with a strong ETF entrance and today’s ADP data PCE and united and strengthened the expectation of interest rates exceeded $ 4,300. Although the pioneering data signal in employment, ADP confirmed that the situation in the labor markets was not so good.

This week, we drew attention to the recovery that could be experienced in the ETHBTC parity. The analyst named Daancrypto pseudonym drew attention to the same point.

“EthAfter making an increase of 150 %from low levels against BTC, the last 40 days have been watching a stagnant course and the weakness in the subcoin market has immediately felt immediately. While most Altcoin returns what they have earned in previous months, market sensitivity is rapidly deteriorating.

We all want the Altcoins to perform well, but it is good for BTC to re -absorb some bids and liquidity when the market tries to get out of the current stagnation/consolidation period.

ETH/BTC He’s almost not attracting anyone here, and I just would like to see that it just rises above 0.041 or re -testing the 0.032 level. No matter what Eth does, it will still show the overall power of Altcoins against BTC and the BTC dominance trend. So continue to follow this couple occasionally. ”

There is no need to darken the neck in subcoins because of the important level is preserved. Moreover, ETH has seen more than $ 400 million net ETF input yesterday, so the professional investor still looks sure of the rise.

Mousache above Ether He underlined the distinct of the rise structure by sharing the graph and wrote that the coming weeks would be breathtaking.

Bitcoin (BTC)

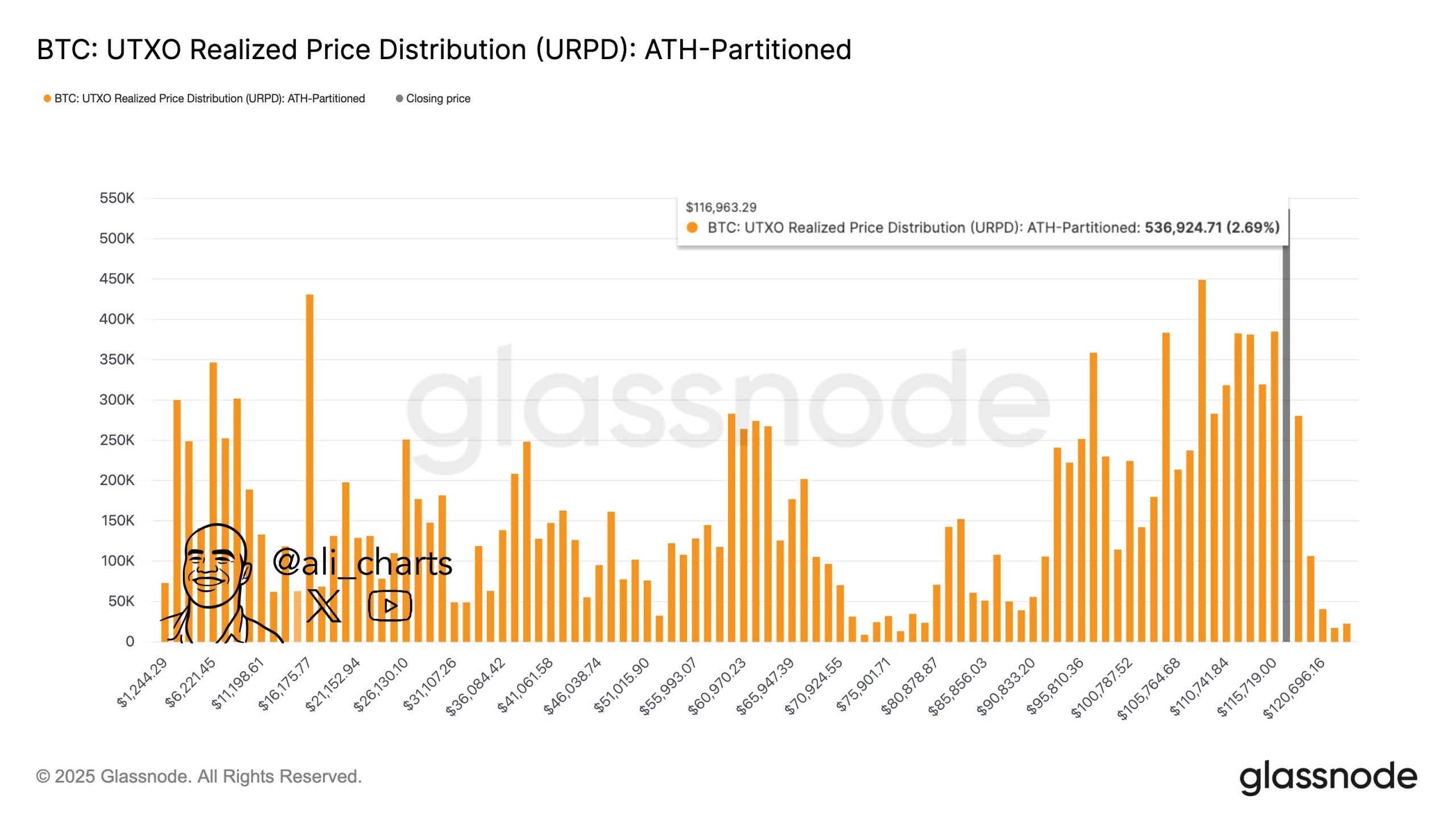

Closing over 117,500 dollars BTC‘s needs to protect 118 thousand dollars and if we see a decline, $ 112,500 will be the lock support point. In October, the historically rise period and the only concern interest rate cuts were likely to be interrupted, for now, which has been on the shelf. What is expected in the normal October scenario, where tension with Russia does not increase, is greater peaks. Ali Martinez said in terms of the density of 117 thousand dollars in terms of the intensity of the closing on it, he said.

If BTC can continue to close over 117 thousand dollars, it would be good.