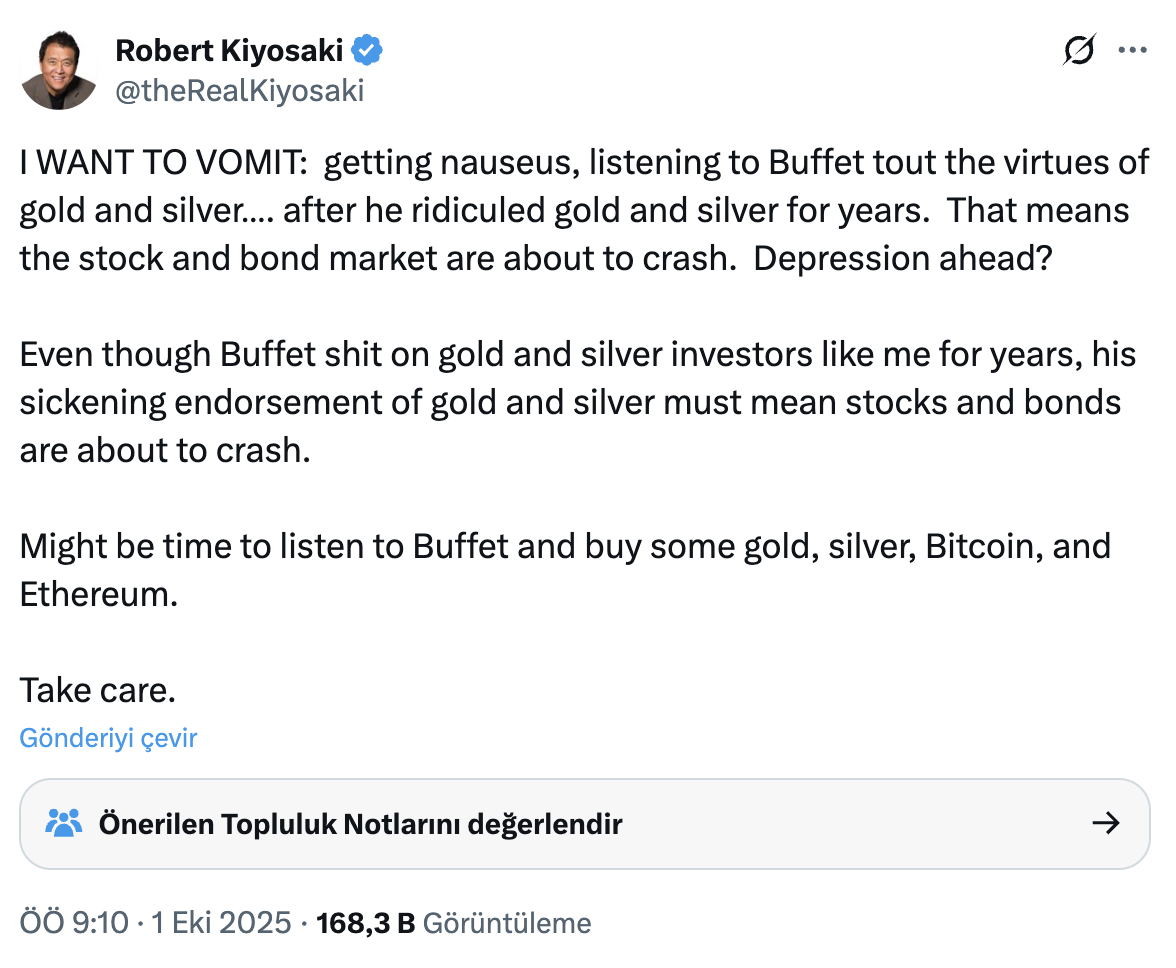

Robert KiyosakiWarren Buffett’s messages focused on precious metals, referring to investors to buy Bitcoin, Ethereum, Gold and Silver. Famous writer X In his latest sharing from his account, he drew attention to the possibility of collapse with harsh fluctuation in the stocks and bond markets. Pointing to the change in the approach of the founder of Berkshire Hathaway, Kiyosaki suggested that the portfolios be re -balanced for risk protection.

Kiyosaki’s Message: Bitcoin, turn to gold and silver

Kiyosaki for a long time BitcoinIt is known for its positive approach and describes the logic of design as a pure genius. The latest sharing implied that the perception of fragility in traditional markets has strengthened, and that the orientation of alternative beings can accelerate. According to the author’s assessment, the investor side is in the face of a potential share and bond sales wave. BTC, Ethcan position gold and silver as a protective basket. The focus of the Kiyosaki message includes the expectation that price volatility may increase and liquidity can flow to better quality guarantees.

The opinion also intersects with the narrative of “erosion in reputation of reputable money” of market commentators. Some analysts return to valuable metals, not only metals, but also their supply crypto currencyHe states that the gate can open the door. In such a scenario, investor behavior may tend to reduce cash positions and shift them to global risk protection assets. The gradual increase in portfolio distributions can create additional security values against high volatility in the dollar index.

Buffett factor about precious metals

While Buffett has been criticizing gold as an inefficient being for years, Barrick GoldApproximately $ 500 million was announced. In the first half of the year, the rise valuations, which reached 45-50 percent band in gold and silver, caused the values to be discussed again. It strengthened the perception of extremism and high selectivity requirements in prudent posture pricing on the Berkshire side.

Berkshire’s record cash stock, which increased to 344-348 billion dollars in the first half of the year, made a significant leap at 2024 $ 167 billion. Central banks’ record -speed gold purchases also support the narrative. The markets will follow to what extent giant cash can be shifted to valuable metals or cash alternative protection tools. In terms of the next step, investors can change the risk management by following the continuity of corporate entrances to Central Bank purchasing trend and crypto currencies.