ETH price today reflects a market at a pivotal moment, as it retests a key support area, after retracing from the ATH marked in August. With exchange balances plunging to multi-year lows and stablecoin liquidity surging, conditions appear set for reduced selling pressure and the potential for sharp upward moves. Current dynamics suggest ETH crypto may be entering a supply-driven rally phase and this key area could be that revolutionary support.

Exchange Outflows Signal Declining Supply

Recent CryptoQuant data highlights that Ethereum’s 30-day SMA netflow has reached its highest withdrawal levels since late 2023.

Such outflows typically are a big picture often utilized by smart money because this time in ETH, it’s a signal that the investor preference for self-custody or DeFi use cases has elevated, rather than active selling. This decline in exchange liquidity directly reduces short-term supply, setting the stage for potential ETH price gains.

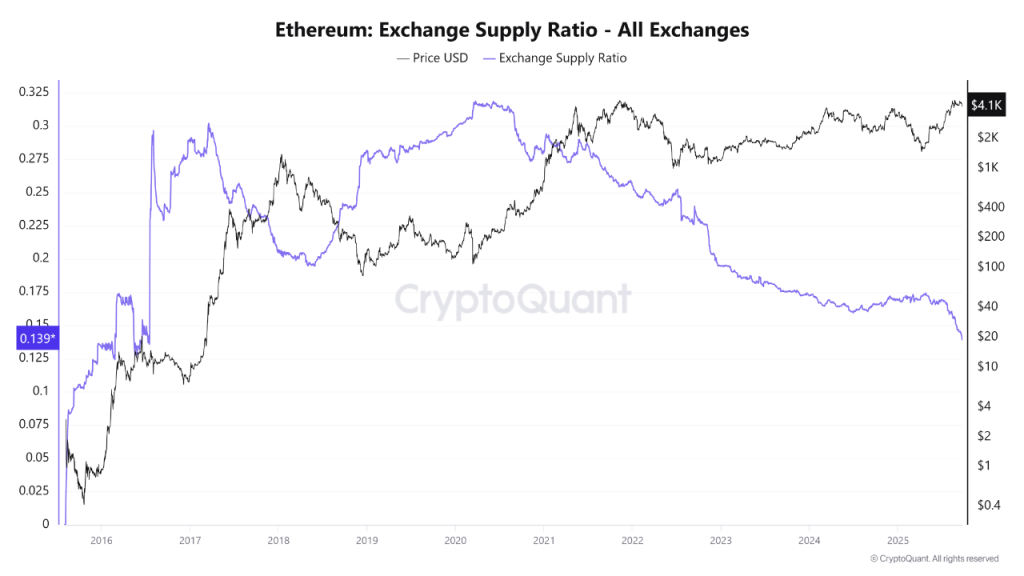

Looking at the Ethereum price chart historically, exchange supply ratios (ESR) tell a consistent story. It revealed that between the years 2016 and 2020, ESR rose steadily and was volatile, which fueled selling pressure despite price rallies.

The height of this was further evidenced during the 2020-2021 bull cycle, as ESR peaked near 0.30. At this time, the exchange reflects strong liquidity and frequent profit-taking near market tops were seen during that period.

Since 2022, the trend of ESR has shifted, with it entering a sharp downtrend, now standing near 0.139. This reveals extremely low coins are held on centralized exchanges. When supply is constrained like this, ETH price prediction models often tilt bullish, as any surge in demand can create a sharp supply shock.

Currently, the ETH price USD hovers near $4,100. With selling pressure at minimal levels and price at key support area, market watchers view this setup as favorable for new highs in 2025.

This ETH price forecast points to a scenario where reduced exchange liquidity can amplify upward momentum in the short to medium term.

Stablecoin Liquidity Adds to Market Strength

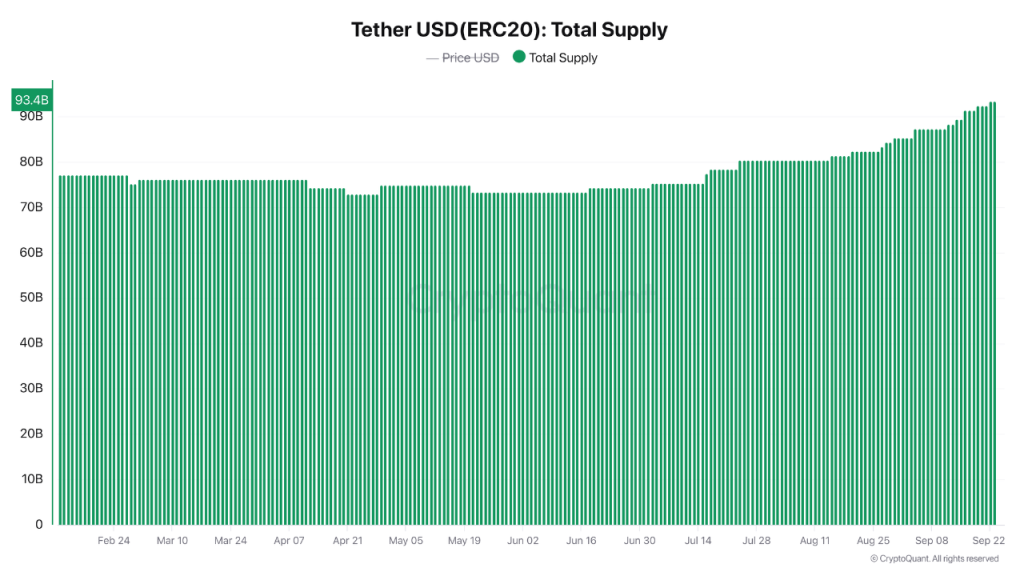

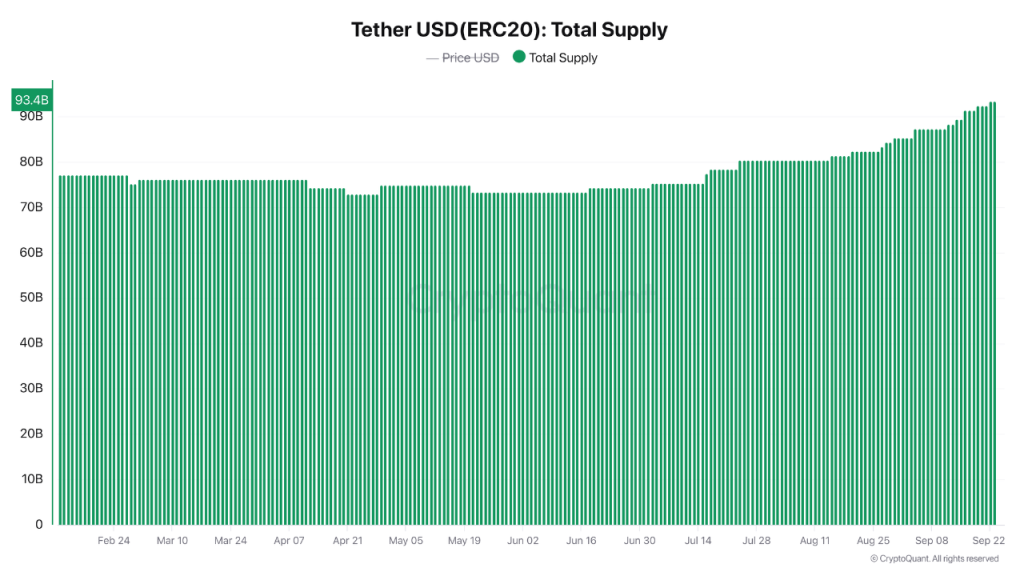

Adding another layer to Ethereum’s bullish setup, the supply of ERC-20 USDT recently hit an all-time high of $93.4 billion. This milestone highlights fresh capital inflows into the crypto ecosystem.

Generally, whenever Stablecoins like Tether are heavily stocked, they serve as a key “dry powder,” or we can use the liquidity that can quickly rotate into ETH crypto and other assets.

Such large-scale inflows have historically coincided with higher trading volumes and improved depth across DeFi platforms.

Combined with falling ESR, this surge in stablecoin supply strengthens the ETH price forecast by suggesting that liquidity is primed to fuel market rallies once demand accelerates.