Ripple (XRP)  $3.01 Investors have long been waiting for the approval of the XRP Coin ETF for a long time, but the approval will come in the last quarter. But as he did for Rex-Ossprey Solana, the XRP coin will indirectly list the XRP ETF list. So how is this? It is possible with 33 ACT and 40 ACT difference.

$3.01 Investors have long been waiting for the approval of the XRP Coin ETF for a long time, but the approval will come in the last quarter. But as he did for Rex-Ossprey Solana, the XRP coin will indirectly list the XRP ETF list. So how is this? It is possible with 33 ACT and 40 ACT difference.

XRP Coin ETF listing

Rex-osprey this week XRP Coin EtfHe announced that XRPR will begin to be traded on the stock market. Although Ripple excites its investors, it is not a kind of ETF approval and listing of the kind you understand when you first hear it.

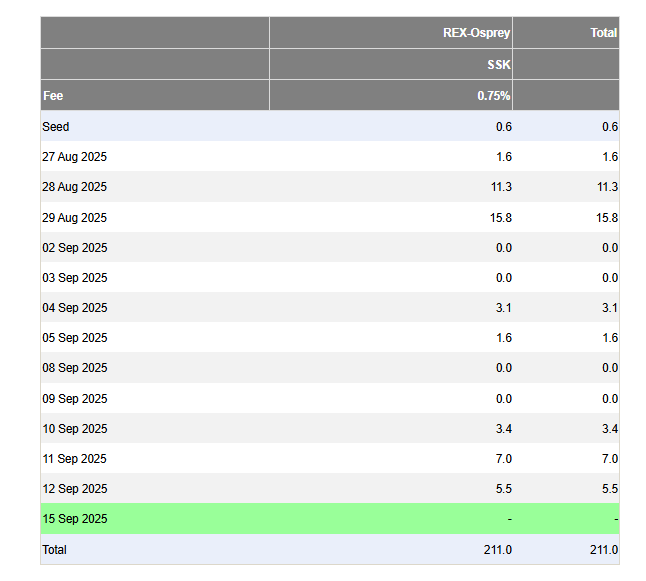

We first saw this for Solana (left) on July 2 in the crypto. SSK coded Staked Solana ETF began to be traded and the background initiated by Rex Shares and Osprey Funds was confusing. The company evaluates an important gap in the law.

ETF and TRÜST What is the difference?

For example, 80 %of the allocation of SSK 50 %Staked Left SolanaHe’s indexing either. 33. The product prepared in accordance with the law does not receive an approval, because there is no objection ”automatically approved and starts to be treated. However, the ETFs prepared under the 40th law must be approved by the SEC. So there is no such thing as a classic ETF approval of the kind we understand here. Both SSK (Solana ETF) XRPR This is what is done with the rex-osprey partnership for (Ripple Etf).

- The law deals with the fund within the scope of a trust. For example, Grayscale Bitcoin, which was launched by Grayscale, was later converted to ETF

$114,567.70 Like Trress. What was this Trress afterwards? 40. ETF approval within the scope of the law and was converted into GBTC. ETF was.

$114,567.70 Like Trress. What was this Trress afterwards? 40. ETF approval within the scope of the law and was converted into GBTC. ETF was.

Rex-osprey What is done by SEC’s direct permission is to create a product that can be listed as long as it does not object ”. Then, it may not be within the scope of the 40th law under the names of SSK or XRPR (but the excitement of the expected approvals in the last quarter) to market it.

Everything is clear and clear. The “ETF Approval” announcements consist of the approval of the Trivers with ETF is actually the transformation of the differences of the 40 and 33th law into marketing strategy.

Although this PR BRIEF IN THE BECAUSE IN THE BECAUSE TRÜLANA TRÜSS, SSK, as you can see above, is experiencing similar entrances with normal crypto Tars. In summary, Spot ETF (40 ACT) is a packaged (33 ACT) product.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.