In this cycle, unlike other cycles, we are experiencing a period in which corporate actors are intensely included in the game. We have a new investor segment, where previous 4-year cycles are now structurally changing structurally and many signals caused by many signals, which are less affected by FUDs, making appetite and large volume purchases. So, what is the Corporate Crypto Cake Request?

Corporate Crypto Money Report

Coinshares monitor and report the situation of corporate investors’ interest in crypto currencies in ETF, ETP, Trresses. Today we will discuss the important details in this report. We will also take a look at the status of reserve companies and other big news.

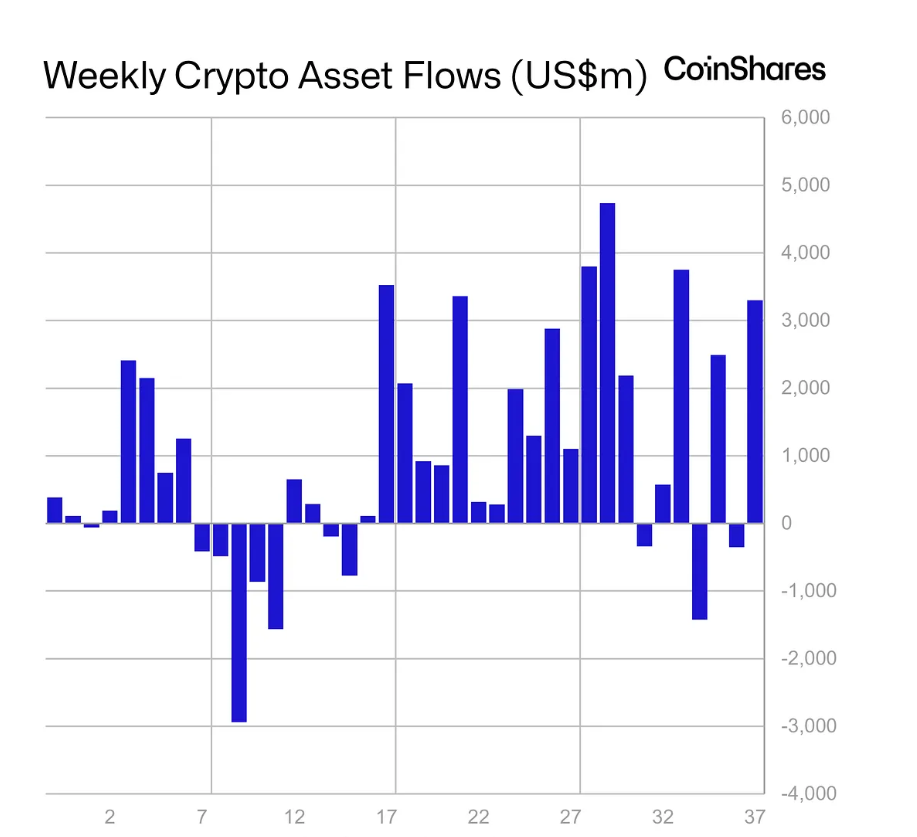

In the week we left behind, investor sensitivity was significantly recovered and we saw a net introduction of 3.3 billion dollars. Both Eth Sales for BTC reversed.

Crypto currency The total value of investment products (AUM) approached the record level of August and rose to $ 239 billion again. This shows that the rise trend continues to be almost neutralized from the August summit. This is a very important detail when moving to the last quarter.

The USA is the most intense demand zone with a net entry of $ 3.2 billion. We saw $ 160 million in Germany last week. Switzerland was third with $ 92 million. BTC 2.4 billion dollars, ETH 646 million dollars in a net entering the third largest entry with 145 million dollars Solana (LEFT).

I can summarize the reasons for the change of sensitivity as follows;

- The fact that employment figures are much weaker than expected.

- Postponement of secondary sanctions for Russia.

- In the case of the Fed member Cook, the court decided to dismiss the Fed’s independence discussions.

- 75BP interest rate reduction expectation for 2025.

- The increase in the tariff in inflation does not even approach the fear.

- The inclusion of new crypto currency reserve companies in the game and the increase in purchases of existing companies.

- The declaration of will for SEC and CFTC’s joint crypto regulations.

- Bo Hines joined Tether and Ursat’s Genıus is compatible with USDT presented to the US market by Tether as an alternative.

XRP Coin 32.5 million dollars, water has entered a net entered 14 million dollars.

Bitcoin, Ethereum, Solana Reserves

We talked about why the public companies create crypto money reserves. They achieve their goals, share prices are increasing and so they can borrow more and enlarge their reserves. This trend will become more and more exciting.

Ethereum Reserve

Tom Lee was headed by $ 9.75 billion in Ether reserves of Ether reserves. The total asset was based on 2.15 million ETH. After the update on September 8, the company bought an 82,233 ETH of $ 370 million today. Lee explained his motivation as follows;

“Ethereum

$4,505.75We continue to believe that it will be one of the largest macro investments in the next 10-15 years. The transition of Wall Street and artificial intelligence to Blockchain will lead to a greater transformation in today’s financial system. And most of this takes place in Ethereum. ” – Tom Lee

71 different companies have a strategic Ethereum reserve of the structure, which hold a total of 22.52 billion dollars of ETH. The reserves based on 5 million are on an important threshold. ETH ETF reserve exceeded 6.6 million ether. The first place is the second, the Sharplink 837 thousand ETH and The Ether Machine reserves are the third largest reserve with half a million BTC.

Bitcoin Reserve

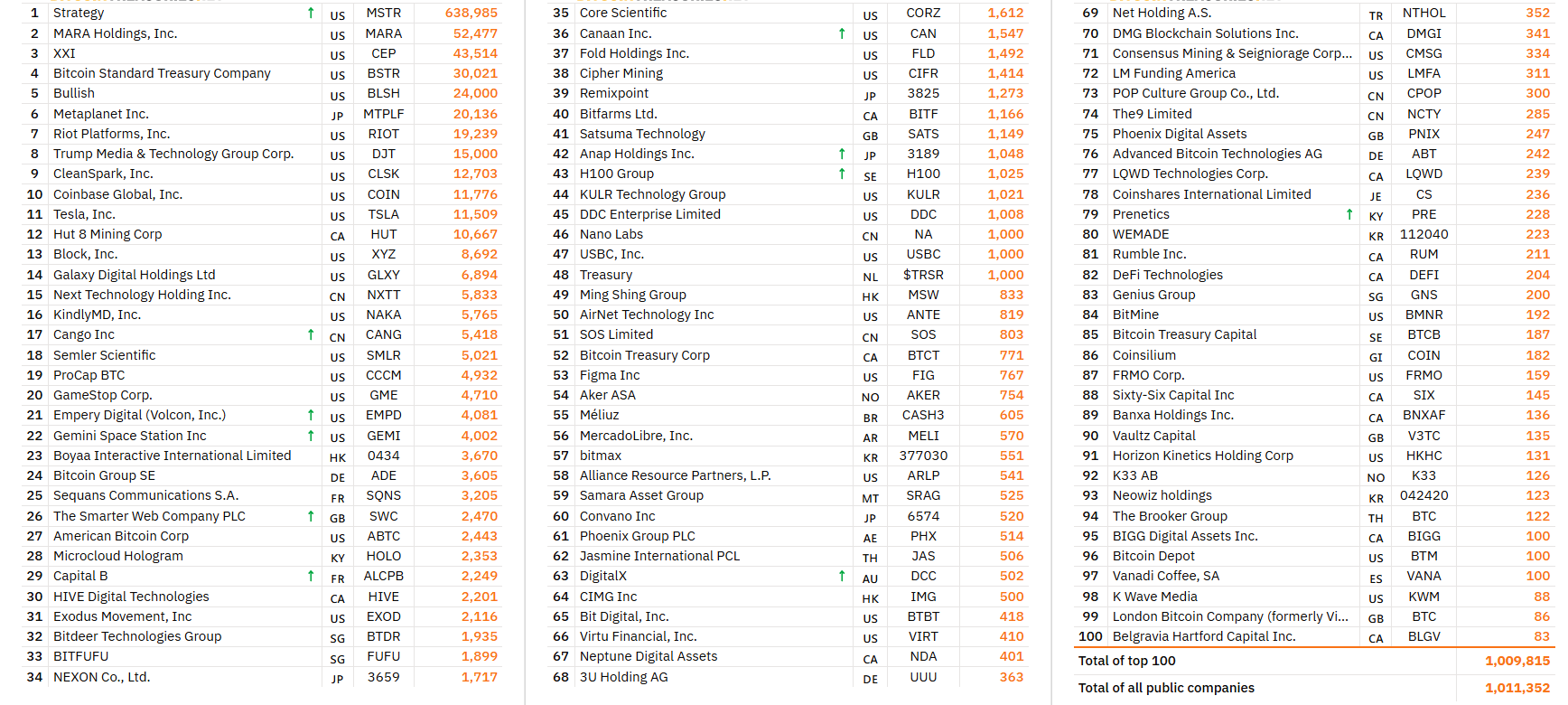

MSTR announced today the new BTC purchase. The company’s total BTC Reserve It was based on 638,985 BTC. Mara Holdings in the second place holds 52.477 BTC. The top five companies have reached 1 million 11 thousand BTC, which is held by the US company and 100 largest BTC reserve companies. These are open companies.

The amount of BTC in ETF and funds reached 1,473 million. Considering that each BTC is 115 thousand dollars, we will better understand how big it is. US -based 66 public companies, 29 private companies, 16 ETF already holds BTC. Canada ranks second with 43 different companies, ETF and so on. The list continues with England, Japan and Hong Kong.

You see the situation of the 100 largest companies above.

Solana reserve

The biggest interest is in Solana as Altcoin after Ethereum. The size of the reserves here was based on $ 2.73 billion. Moreover, Multicoin announced today that it has received 6,822 million $ 1.58 billion left coins. It was the purchase date described today compared to the reserve size.

Helius continues to collect funds and he is preparing for a huge purchase. Today, he announced that he found half a billion dollars of funds from two separate companies. When this fund reaches the figure it targets, it will announce a billion dollar left purchase. This kind of announcements come for different subcoins, so I recommend you to keep yourself up to date all the time. For example, if X is a major reserve announcement for a Altcoin, it will trigger large price movements. CryptoAppsy I think is a good news application, summarizes, satisfactory details in the developments you are curious about, and so on. Cryptoappsy When you click on the link, you will go directly to the application store.

Solana (left) reserve The first 5 of the largest companies are;

- Sharps 2,14 million left

- Defi Development 2,028 million left

- Upexi 2 million left

- Forward 1,450 million left

- Galaxy Digital 1,350 million left

A total of 17 different companies follow this strategy for Sol Coin.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.