The latest price forecasts for HBAR show that a strong rise is at the door if technical indicators develop as expected. The basis of these estimates lies in the DTCC (Depository Trust & Clearing Corporation) platform with HELARA’s HBAR CRIP ETF, with Canary’s XRP ETF and Fidelity’s Solana ETF. This development is seen as an important administrative step for ETF approval.

Hbar technical view

During the spelling, the HBAR is traded at the level of $ 0.2445 and has created a solid support of around $ 0.21. Token, which increased by 1.82 %in the last 24 hours, seems to have emerged from the long -term correction stage. According to Analyst Ekragcrypto, HBAR is moving in a structure similar to the parabolic rise in 2021. Elliott wave analysis and fibonacci levels indicate a fifth wave potential that can extend to $ 3.30.

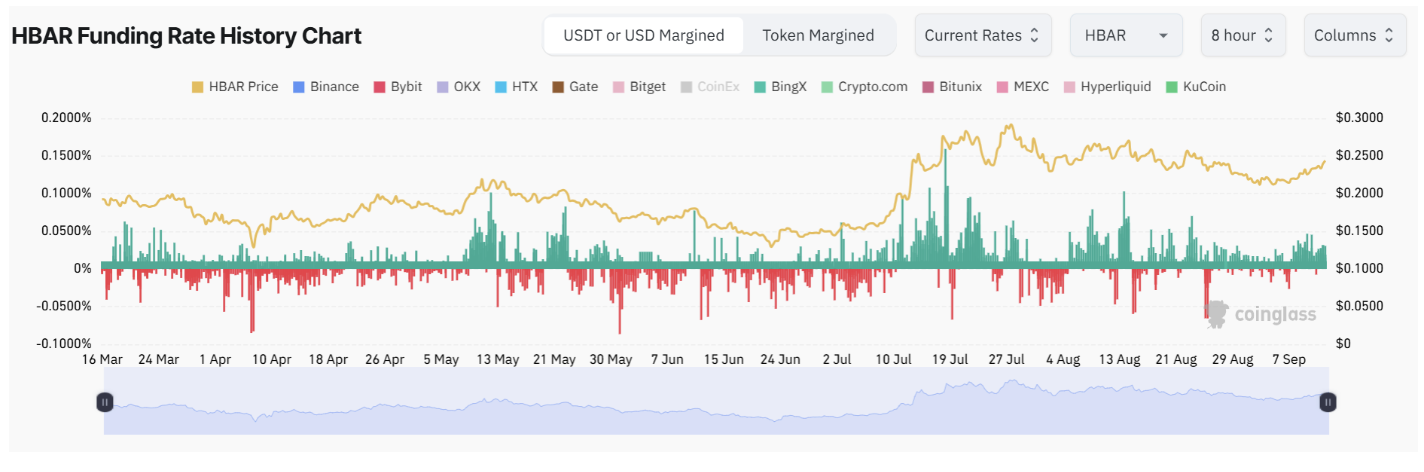

Technically, $ 0,10 and $ 0.12 are expected to increase the price rapidly by overcoming resistance levels. In addition to technical indicators, the funding rates are positive and the high interest interest is still high, shows that traders are expecting rise. In addition, an expert trader, Sjuul, draws attention to the classic “Power of 3” formation and argues that Hbar has entered the expansion stage.

The recording of Canary to DTCC for HBAR ETF is an important preparatory step before the SEC approval. Although the official process has not yet started, this development is considered as an important signal that corporate investor interest has increased and technical and chain indicators for HBAR indicate a strong growth stage.

Effect of ETF news

According to CoinMarketcap data, HBAR gained close to 14 %in the last week and reflected the positive effect of ETF news on investors. In addition, after the steps taken by Blackrock’s ETF lists, the interest that directed to other alternative projects has brought Hedera’s potential to the agenda again. Such news streams that are compatible with technical indicators ensure that price increases are sustainable; Investors are recommended to follow ETF processes and on-ach movements carefully.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.