With the start of September Bitcoin (BTC)  $116,046.09 There was a remarkable increase in miner transfers. In particular, more than 56,000 BTC transfer to Binance has raised the possibility of sales pressure. However, the chain data shows that there is cooling after this high flow. This suggests that miners now evaluate Coins with OTC transactions or HODL strategy instead of selling their coins directly. This change of behavior helps to absorb supply without pressure in the market, reducing downward risks on the price.

$116,046.09 There was a remarkable increase in miner transfers. In particular, more than 56,000 BTC transfer to Binance has raised the possibility of sales pressure. However, the chain data shows that there is cooling after this high flow. This suggests that miners now evaluate Coins with OTC transactions or HODL strategy instead of selling their coins directly. This change of behavior helps to absorb supply without pressure in the market, reducing downward risks on the price.

View in BTC

According to instant data, Bitcoin is traded for about $ 115,000. He jumped up from the demand zone of around 110,000 dollars and gave a strong support signal. The RSI indicator is at 56 level; This shows that the market carries a healthy acceleration and is far from the extreme purchase zone. If the bulls can clearly exceed $ 123,000, the price seems to be able to target $ 140,000. However, if this resistance cannot be broken, the market may return to horizontal movements. For this reason, the protection of the support zone between the $ 110,000-112,000 is of great importance.

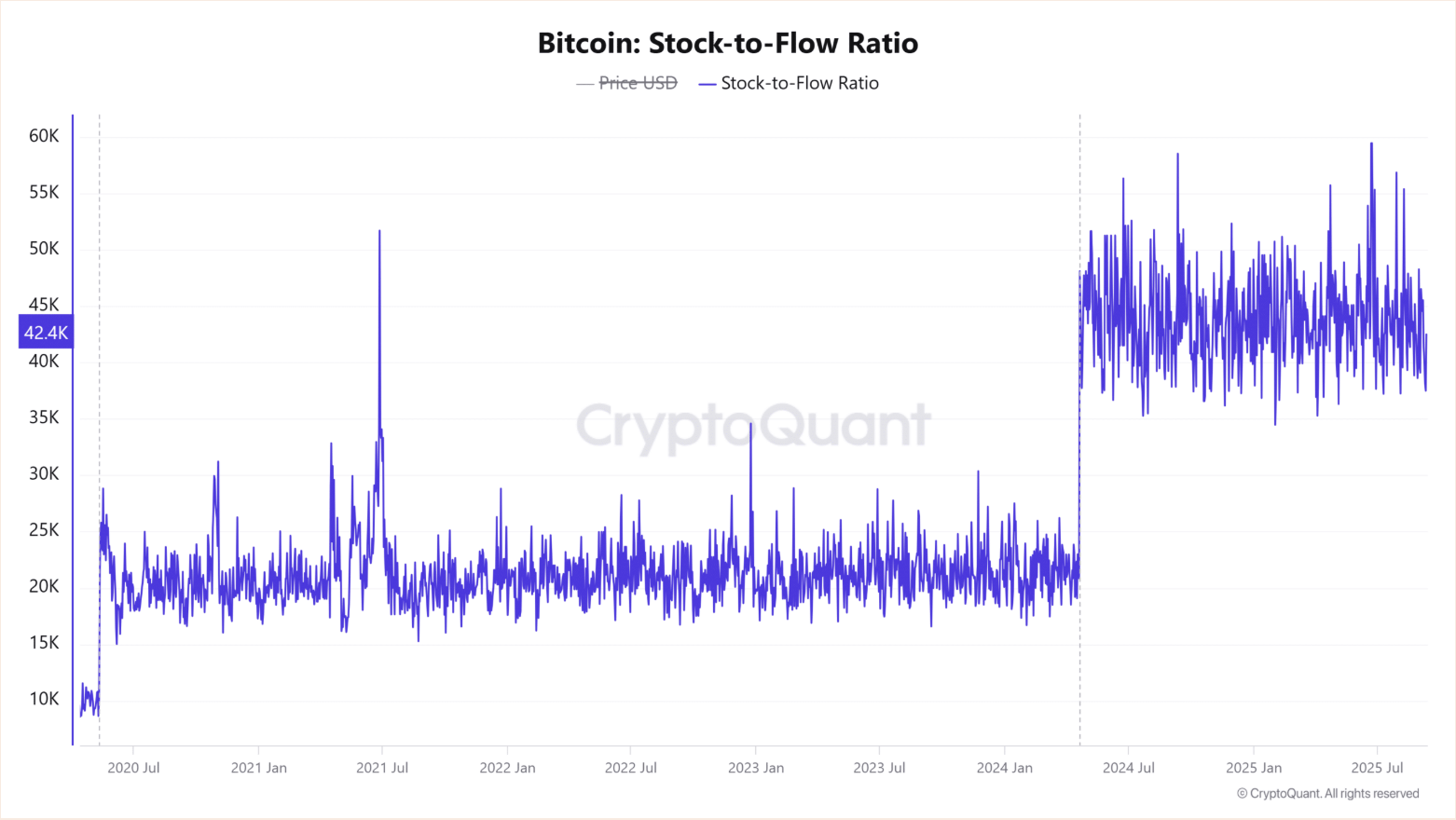

Bitcoin’s Stock-to-Flow (S2F) ratio, which measures the scarcity of supply, increased by 11 %to 708,000. This shows that the circulating supply has become increasingly limited compared to the new BTC production. Historically, such rises coincide with the periods when Bitcoin gained strong value. The increase in the S2F ratio can support the price increase by making it easier to absorb supply with decreasing mining currents. However, if the signal of famine weakens weakens, the confidence of the bulls may be broken.

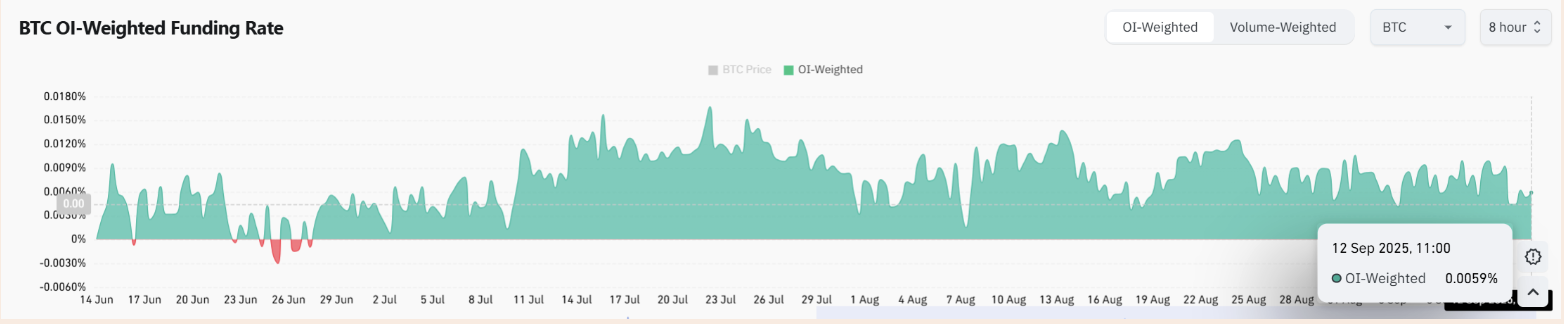

In the futures market, BTC’s open position -weighted funding rate is positive with 0.0059 %. Although this indicates that long (long) positions are still dominant, the funding rates are lower than the previous peaks. Since excessive funding rates are usually a harbinger of harsh corrections, the current moderate medium offers a more favorable ground for spot purchases to direct the market.

Resistance and support are important

Bitcoin’s strong support of around $ 110,000 reveals that corporate investors see these levels as an opportunity to purchase these levels when evaluated with the latest ETF inputs. In particular, the fact that miners reduce sales pressure and strengthen the indicators of supply famine strengthens the foundations of the market. However, the acceleration may be limited unless the resistance of $ 123,000 is not exceeded. For this reason, investors need to closely follow the critical resistance and support levels.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.