King crypto currency The unit did not make a good start in September, but the whole of the data for the month is preparing the ground for recovery today. Since investors have justified reasons to be cautious, we have seen that volumes have fallen. So what is targeted for crypto coins on the way to the end of September?

Crypto coins September forecasts

First of all, it will come after the PPI data in yesterday’s evaluations ETF We mentioned that the figures are extremely important. It was exactly as targeted, and in September, BTC ETFs first saw over $ 400 million for the first time. Yesterday weighted Blackrock and a net entrance of $ 741.5 million, including Fidelity ETFs.

Ethereum  $4,414.47 The ETH inputs on the façade also normalized, and ETFs, who have seen a net output many times during the month, experienced a net entry of $ 171.5 million yesterday. The September 11 data, which is expected to arrive at the closing of the daily candle, is hoped that it will be stronger because today’s CPI data came exactly as expected. The fact that there was no bad surprise has reinforced concerns about tariffs.

$4,414.47 The ETH inputs on the façade also normalized, and ETFs, who have seen a net output many times during the month, experienced a net entry of $ 171.5 million yesterday. The September 11 data, which is expected to arrive at the closing of the daily candle, is hoped that it will be stronger because today’s CPI data came exactly as expected. The fact that there was no bad surprise has reinforced concerns about tariffs.

Bitcoin  $0.000017 It will not be surprising that the levels of 116,000 and $ 118,000 are tested while proceeding to the FED meeting. If the FED does not make open interpretations for inflation at the meeting and is focused on the major risks of employment in employment, the title of the historical decline of September may also turn into an exception this year.

$0.000017 It will not be surprising that the levels of 116,000 and $ 118,000 are tested while proceeding to the FED meeting. If the FED does not make open interpretations for inflation at the meeting and is focused on the major risks of employment in employment, the title of the historical decline of September may also turn into an exception this year.

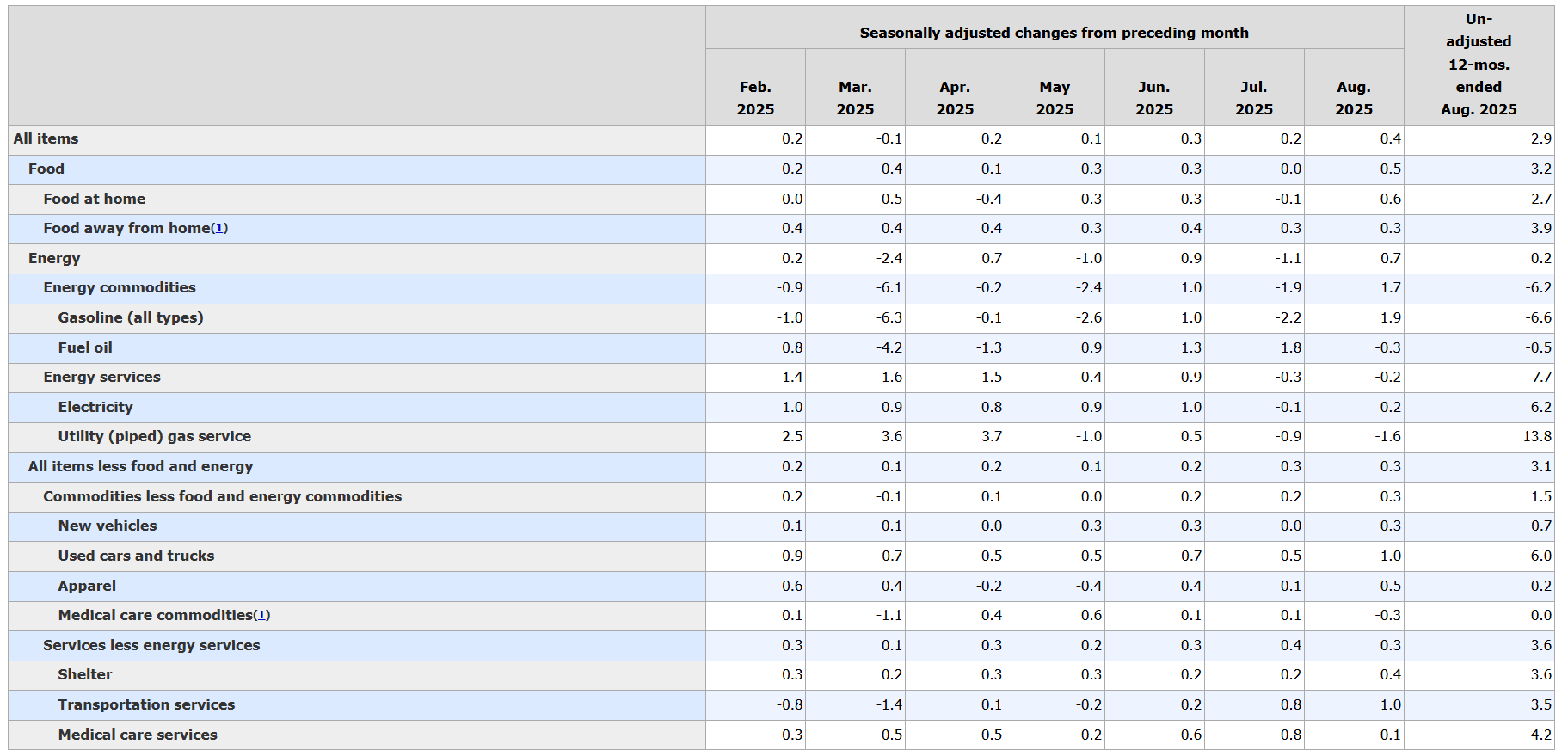

US inflation

The increase in July was 2.7 %, and today’s inflation data showed that inflation increased by 2.9 %in August in the 12 -month period. Well Fed‘s soft landing, stable decrease in inflation, the scenario of the shelf. Although the highest annual inflation figure has been seen since the beginning of 2025, the markets welcomed the latest figures since it was priced with the assumption of triggering the worse of tariffs for a long time.

The first data remaining in the shadow today was the first unemployment salary applications. Since October 2021, such high levels have not been seen. Moreover last week’s EMPLOYMENT FIGURES And when we combine this week’s nearly 1 million BLS revision with this, the sound of the alarm in the labor force rises further.

Giant US retailers such as Walmart, Target and Best Buy are already known to reflect customs duty increases in prices. Moreover, they will continue. However, the first measurements show that this does not have significant consequences in inflation. In addition, some Fed members reiterated the opinion that the impact of customs duties on inflation would be one -time.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.