Last week, employment figures, yesterday PPI and CPI data just announced crypto currencies breathed comfortably. Investors interpreted tariff discussions throughout the year as a sales signal due to the exaggeration of inflationary effects of tariffs. However, although global rates were commissioned in August, there was no incredible increase in inflation.

Crypto coins are rising

For years inflation The Fed employment, which followed a focused policy, did not care about employment and there were time to care about employment. More importantly, we have seen that the tariffs do not cause inflation to the extent that they are feared, and this gives great alarms. Each job report tells us how serious the contraction in employment is.

The Fed, which has increased interest rates since the beginning of 2022 and has started the discounts that it started last year for almost 1 year, has to return to stable interest cuts. There will be no soft landing as expected, but we will not see the huge consequences of tariffs on inflation.

Then FedMarkets need to be prepared for the scenario where the interest rates will steadily reduce interest rates. After a long time, the BTC celebrated the latest data by exceeding $ 114 thousand again and clarifying the Fed’s policy route.

Fed will download interest rates

Although the PPI data came longer last month, Powell He spoke of focusing on loosening in employment and that they should download interest rates. After his explanations, we started to see better data for employment, better data for inflation.

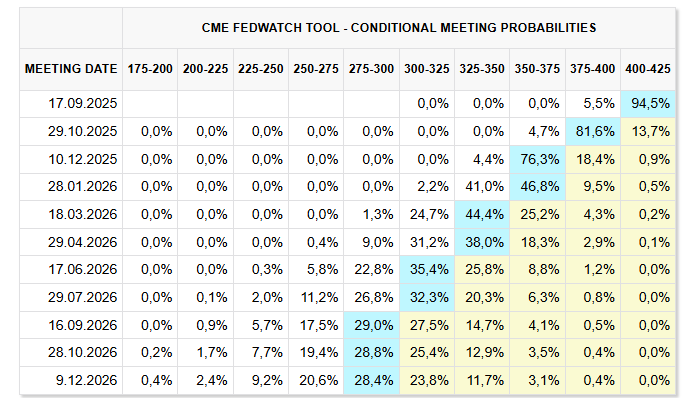

Moreover, the court measure that froze the decision of the Fed member Cook was dismissed yesterday, so we see goodbye to us for a while. 25BP discounts are foreseen for the interest rate decision to be announced after 6 days under the current conditions.

The total discount expectation of 75BP before the end of the year exceeded 80 %, which is much lower in the near future. When this is the case, the fact that Powell is forced to reduce interest rates months before the departure of the institution, and the future of a president who will act parallel with Trump will change projections in favor of risk markets for global policy relaxation.

If the reports that will come in October, November and December are also in this way, crypto currencies will want to run to new summits with each new report. Moreover, reserve moves, Altcoin ETF With its approval, the news flow will also be supported in favor of crypto currency investors.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.