Bitcoin (BTC)  $110,260.54 While consolidated $ 110,000, technical indicators show that asset approaches the end of the current bull cycle.

$110,260.54 While consolidated $ 110,000, technical indicators show that asset approaches the end of the current bull cycle.

Does the bull cycle end?

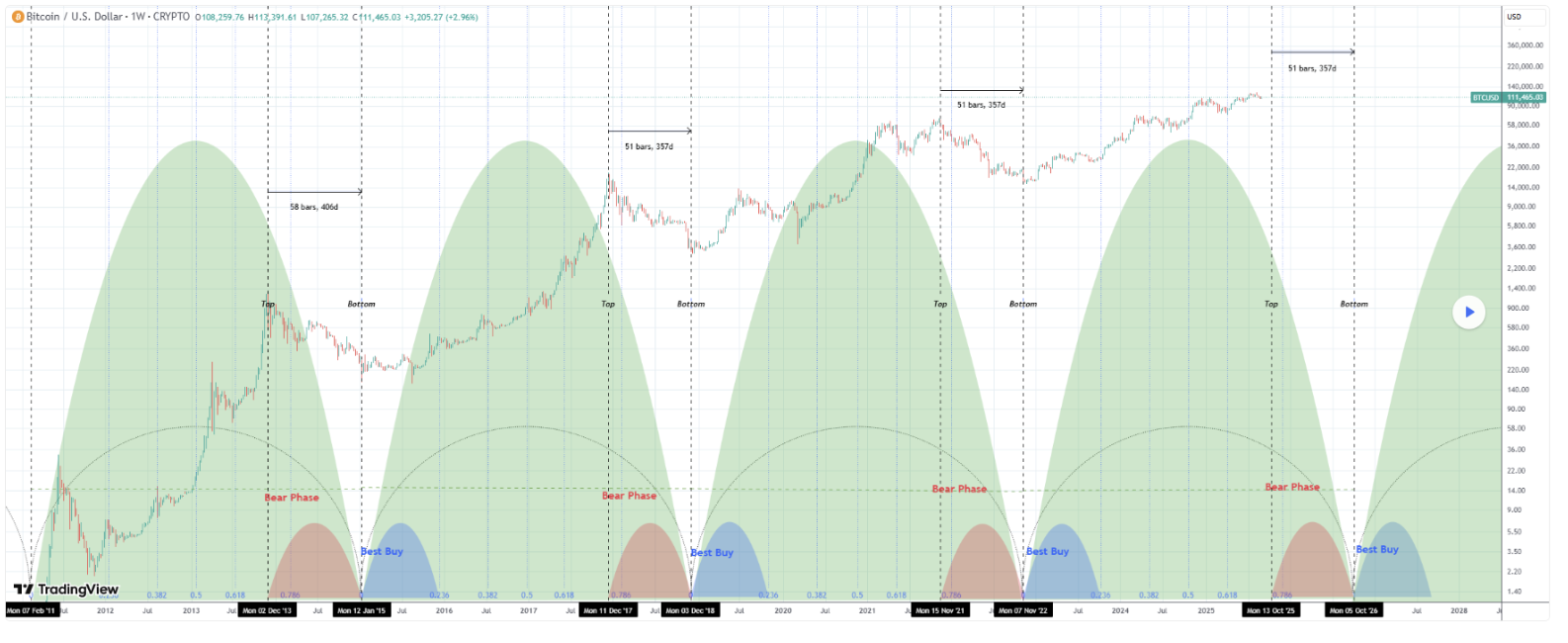

According to a well -known internal analyst Tradingshot, the first crypto currency is approaching a potential market summit at the end of 2025 and will follow an important correction until 2026.

Analyst said in a sharing at TradingView on September 5, saying that historical data follows a repetitive rhythm of Bitcoin’s market structure often consisting of peaks, bear market phases and cycle bottoms. Each “super cycle” tended to reach the summit around the 0.786 Fibonacci time extension before moving to a long -term decrease.

According to the current loop measurements, the next major summit can take place in the week of October 13, 2025. This timing is compatible with the previous loops that peaked shortly before the transition to the bear market phases.

The analysis also argues that the bear phase can begin after December 1, 2025, when the 0.786 Fibonacci sign is reached. If the cycle symmetry persists, the bear market may extend to the bottom of the prescribed super loop on October 5, 2026.

At this point, in the past, the best long -term purchase opportunity is expected to emerge in accordance with the consistent patterns that the loop bottoms provided suitable entry points before the next large rally.

Important price levels to be followed for Bitcoin

On the other hand, over -chain data shared by Ali Martinez emphasized the key metrics to evaluate the health of Bitcoin’s existing bull market.

Historically, when the price falls below the “realized price of short -term investors”, the decline trends begin; Deeper feedback occurs when the ılan The realization of long -term investors landed ”. These levels represent the average cost of recent purchases and long -term investors.

According to Glassnode data, as of September 6, 2025, the price of ği realized price of short -term investors ”seems to be $ 109,400 and ün the real price of long -term investors” appears to be 36.700 dollars.

Bitcoin was traded just below the record levels, while $ 109,400 has become a critical level of support that should be monitored; $ 36,700 remains a deeper structural base, which historically comply with the loop bottoms.

Bitcoin Price Analysis

When this article was written, Bitcoin was traded at $ 110,774; Although it has a decrease of approximately 1.7 %in the last 24 hours, it is still 1.5 %on a weekly basis.

In order for the markets to gain confidence that the rally is sustainable in the coming weeks, Bitcoin needs to maintain a critical level of $ 110,000.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.