Tether, a stablecoin exporter, USDT creator, began negotiations with mining and investment groups to invest capital into different points of the gold supply chain, according to Financial Times. This move aims to further diversify Tether’s portfolio risk.

Tether and Gold move

As stated in the explanations, Tether stated that he investigates capital distribution to various fields in the gold sector, including gold mining, refinery, trade and copyright companies.

The company has accumulated physical gold, which is stored in a safe in Zurich, Switzerland, with a value of $ 8.7 billion. These reserves support Tether Gold (Xaut), the market value of approximately $ 1.4 billion and indexed Stablecoin.

On the other hand, Tether’s heading under expanding the risk profile. Approximately $ 130 billion or 80 %of the $ 162 billion reserves consist of cash, cash similar and short -term deposits, including direct and indirectly $ 127 billion US Treasury bills. According to the audit report in June, the company reported a net profit of 5.7 billion dollars in the first half of 2025.

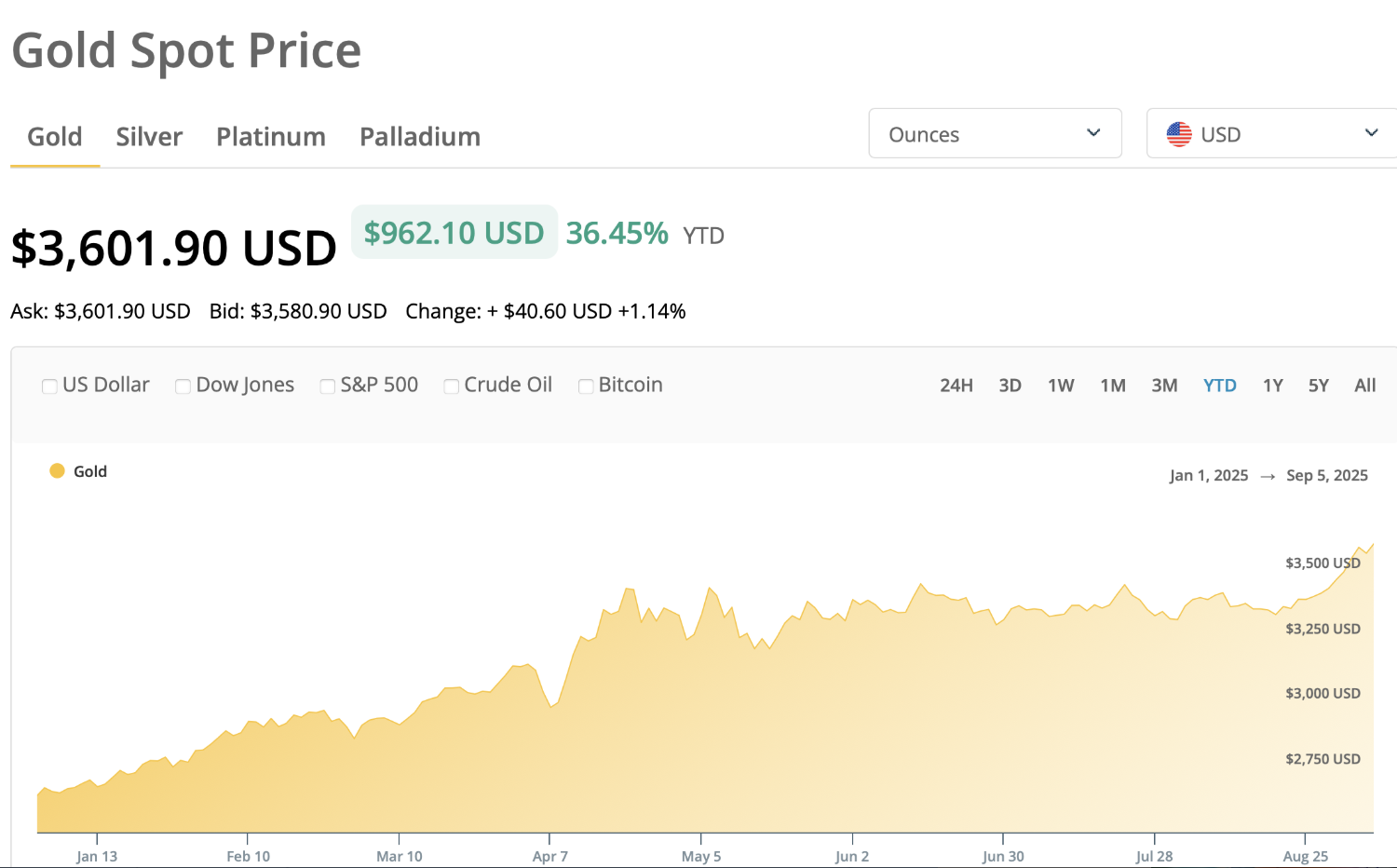

Since the beginning of the New Year, the price of ounce of gold increased to approximately 3,600 dollars at the time of writing and increased by 36.5 %in 2025.

Tether had previously entered the commodity market. In October 2024, some of his wife evaluated the lending to commodity merchants. In November 2024, it was opened to oil trade with a funded crude oil process of $ 45 million.

According to Bloomberg’s Friday, Tether increased his share in the Canadian Golden Copyright Company with a share of $ 100 million. Stabilcoin exporter has 37.8 %of the company, which obtains income flow from gold mining operations.

What does this move mean?

This strategy of Tether clearly shows the tendency to diversify in the crypto currency world and to turn to real world beings. This step reflects the company’s effort to support its portfolio with beings with more robust and different risk profiles, overcoming the traditional reserve model based on the US dollar and short -term borrowing tools.

On the other hand, gold is an entity that historically provides protection against inflation and is seen as a safe port in geopolitical uncertainty periods. Not only Tether offers a stablecoin (Xaut) for the gold price, but also investing in the gold supply chain is an indication of his belief in the value of this commodity. This move has the potential to protect and increase the value of reserves.

In addition, Tether diversifies his reserves and reduces his excessive dependence on US treasury bills. This can help minimize a possible interest rate hike or risks that may arise from fluctuations in the US economy. However, direct investment in the commodity markets brings new risks in itself. Gold mining, refinery and copyright companies may be exposed to operational, geopolitical and environmental risks.

In addition, Tether’s strategy shows that the boundaries between the traditional finance and crypto currency world are becoming increasingly uncertain. Stablecoins are no longer a simple price fixing tool, becoming financial institutions with complex reserve management and investment strategies. This will make transparency and trust in the market even more important. Tether’s regular publishing audit reports is an important step towards consolidating this trust.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.