Bitcoin  $110,652.65(BTC) stuck at 110,000 dollars and Ethereum

$110,652.65(BTC) stuck at 110,000 dollars and Ethereum  $4,375.29After the new records of the (ETH) broke into consolidation, solana (left) has become the most remarkable player in the crypto market recently.

$4,375.29After the new records of the (ETH) broke into consolidation, solana (left) has become the most remarkable player in the crypto market recently.

Corporate investors are turning to crypto currencies in the second category

Solana, which was traded around $ 211 on Monday, has an increase of 33 %compared to the low levels at the beginning of August and became one of the best performance assets of the Coindesk 20 Index in the last month. In the same period, it gained 34 %against Bitcoin and 14 %against ETH since mid -August.

According to analysts, this rise is an indication that investors are turning to a wider range of subcoin. Sergei Kerv, the Risk Unit Manager of Youoveler, said, “The period of redistribution of the profit among crypto currency holders”, and that the liquidity has shifted from Bitcoin to the second category tokens and that there was a significant increase in capital flow to Solana. Due to the fact that corporate investors are in search of large and liquid projects, this flow may be long -term, and Together with XRP, Solana showed Solana among the “next interesting market ideas”.

Dorman: Solana can repeat ETH’s rise strategy

Arca’s chief investment official Jeff Dorman argues that Solana could mimic the rise of Ether’s rise in this year. Reminding that Ether has made a rally of approximately 200 %since April, Dorman, in his new report, seems ready to repeat the same strategy in the coming months, Dor he wrote.

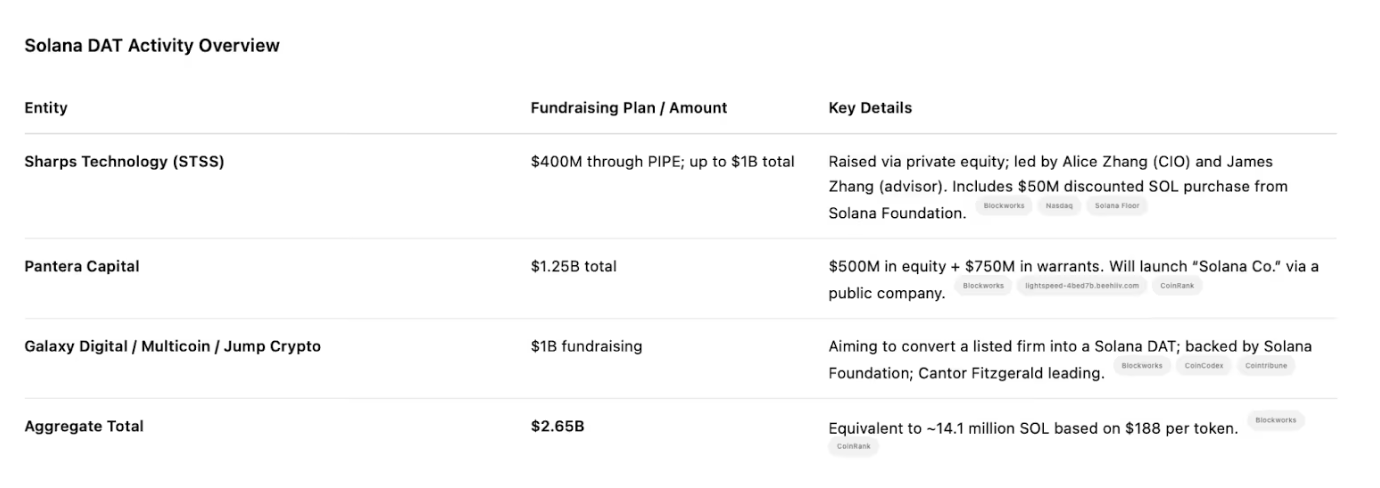

Stating that the first Solana ETF listed in the US in July is based on futures, Dorman said that some asset managers such as Vaneck and Fidelity have applied for Spot Solana ETFs and that the decisions were expected towards the end of this year. He also added that the DAT, which is at least three solenda -oriented funds, can channel Solana up to $ 2.65 billion next month.

The fact that Solana’s market value is about one -fifth of Ether means that the price against these flows may be even more sensitive. Dorman, “Currently solana the most obvious ‘long’ position,” he asked the following question: “ETH’s price, almost 200 %of the new demand of approximately $ 20 billion, almost 200 %, solana’ya 2.5 billion dollars or more new demands do you think what will happen?”

Recent news also contributes to Solana’s acceleration. Galaxy Digital, the Holding Digital Asset Holding in Nasdaq, made his shares token on solana. In addition, the process rate and certainty is expected to increase with the approval of the Alpenglow upgrade.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.