The only important thing for market value is not the only important thing for the smart contract platforms. Today we will compare the on-Chain data. For a stable price increase, metrics such as total locked value in the network and the number of active users need to grow stable. Well, we only focus on the graphics ETH, left and Avax What is the latest situation on this front?

Ethereum (ETH)

After Friday’s development Eth New has reached the record levels of all time. However, since the ETF flow remained weak, we could not see new records at the weekend. Despite the broken record in the price, TVL still has not returned to the summit in the $ 105 billion region and lingers at $ 97.6 billion. Although the recovery is good, the growth in the network needs to continue. Nevertheless, it is nice to have exceeded TVL in the old Ath era.

Fee revenue is $ 1.27 million and 24 -hour inputs have a net input of over $ 200 million. The dex transaction volume has weakened compared to Friday and fell to $ 4.5 billion below. Lido, the biggest protocols in the network in terms of TVL size, Aave and eigenlayer.

Although the active addresses were over 530 thousand, the 575K summit of August 6 could not be returned. A Ethereum that normalizes the numbers he saw as AC in the past  $4,784.95 there is. In other words, the increase in the price is supported by on-ach data and the rally seems likely to continue.

$4,784.95 there is. In other words, the increase in the price is supported by on-ach data and the rally seems likely to continue.

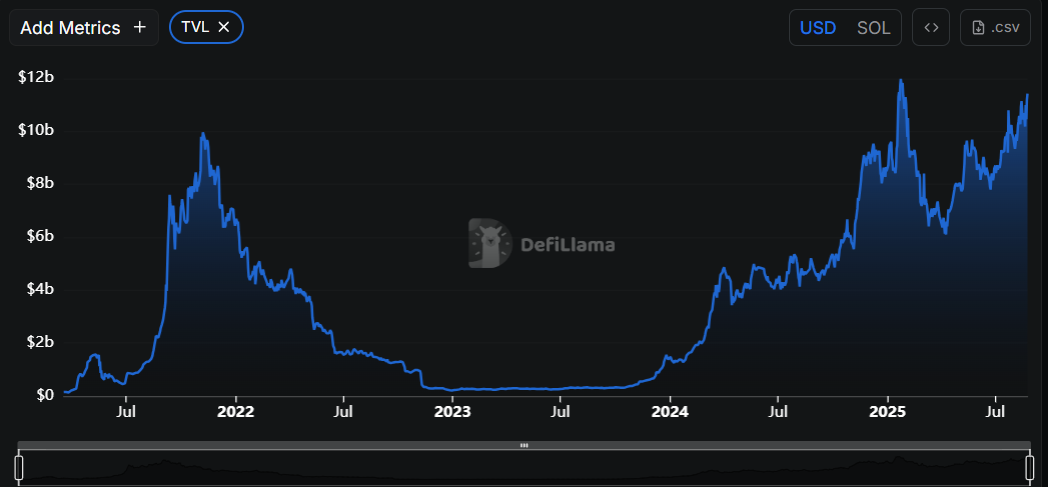

Solana (left)

Declining up to 268 million dollars Solana (LEFT) TVL (Total locked value in the network) is almost a cycle from death. Ftx Although he linger for a long time after his collapse, his breath was reborn from his ashes, and today he is going to the days he will target $ 300 again with the price of over $ 208. TVL exceeded $ 11.4 billion, but it did not return to the record at the beginning of January.

On those days breast coin Considering his frenzy and his dullness today, the fading seems to have survived the foam in TV. Fee income is close to Ethereum and the volume of dex is at 4 billion dollars. Considering the volume of dex exceeding $ 7 billion on August 14, the demand has the potential to revive here as of tomorrow.

Active users are over 2.3 million. EthereumIt’s more than solana is a much cheaper and faster network. Moreover, most crypto currency investors want to give money to transactions below a few cents. Nevertheless, the number of active addresses has declined compared to the Hype period in January. Although TVL has become intact, there is a folding of 6.12 million active user records. We can interpret it potentially for the possible hype atmosphere and the new left rally.

The most important part of TVL on the Solana network comes Kamino, Jito, Jupiter, Sanctum, Raydium (respectively).

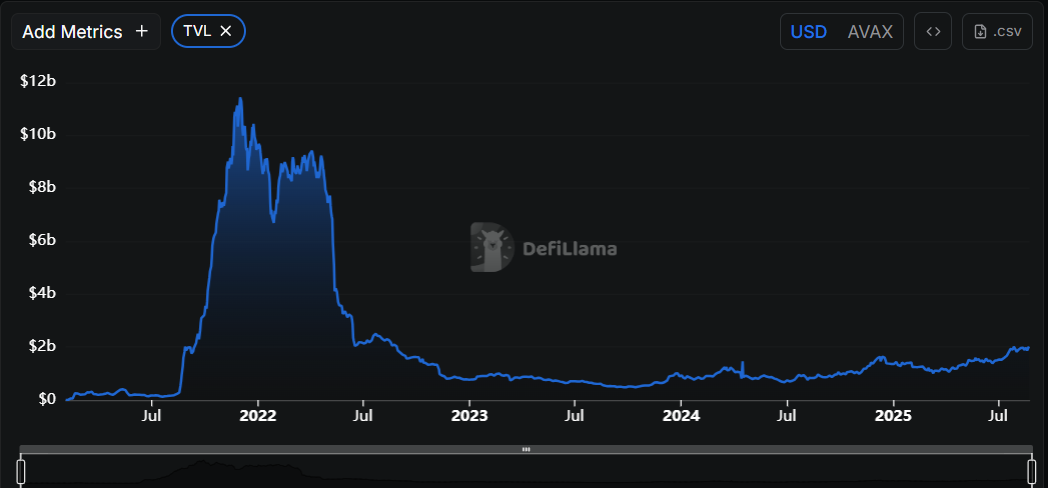

Avalanche (Avax)

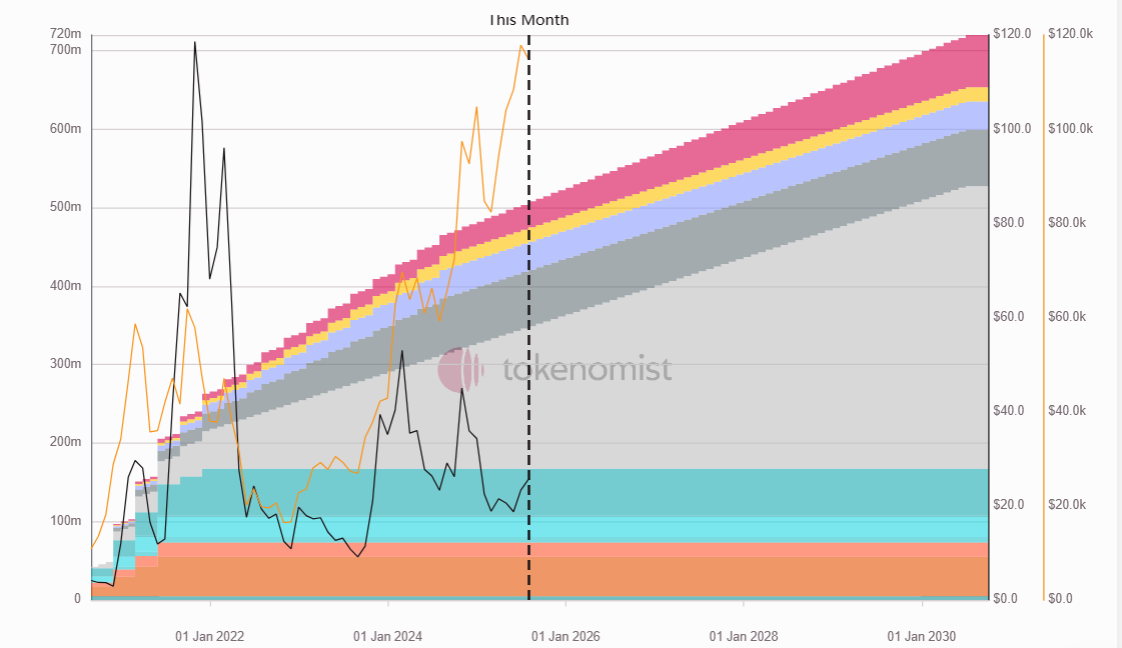

Avax Why doesn’t it rise? Why does Avax act like nothing happened? Is Avax died, is it over? If you look at the graph below, you will understand better what happened to Avax. The left CoIN rapidly jumped to the limit of $ 300 because a very active network, the community is strong, the total locked value on the network as the price increased.

Avalanche  $25.60 TVL is still similar to the bear markets graphics, and with a tvl of 2 billion dollars, it sucks. At the end of 2021, the threshold of 10 billion dollars was exceeded, but after years, the Avalanche network could not return.

$25.60 TVL is still similar to the bear markets graphics, and with a tvl of 2 billion dollars, it sucks. At the end of 2021, the threshold of 10 billion dollars was exceeded, but after years, the Avalanche network could not return.

Network Fee income is in a funny figure like 29 thousand dollars, the transactions can not say cheap solana network is also very cheap but the difference between million dollars and a few thousand dollars is clear. Active addresses are only 40 thousand. Net entrances are limited to $ 6 million. Of course, under these circumstances, AVAX “rightly” will perform worse performance in spot markets.

The important detail here is that the Avalanche network cannot produce remarkable products within its ecosystem. Nearly 500 protocols constitute a 2 billion dollar TVL TVL, most of these protocols operate at at least 3-4 networks. In other words, the protocols added support for Avalanche, Tvl A network they create. It is not known how long this will take.

Since 2022 there was a detail that I drew attention to Avax.

The graph above was the declaration of the known, ie a slightly softer inflation after the rise of vertical supply. In 2021, AVAX 65 dollars and BTC 41,588 dollars, but only opened supply is only 234 million. End of 2022 Price 17.35 dollars supply 318 million, 2024 price price $ 35 E supply 415 million. And today the supply is 508 million and the price is 25.6 dollars. In other words, the supply, which was the price of 65 dollars in 2021, has 2 times the supply, and due to the annual double -digit inflation, Avalanche began to attract such attention, especially after FTX collapse. We will see what the results of this in the long run.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.