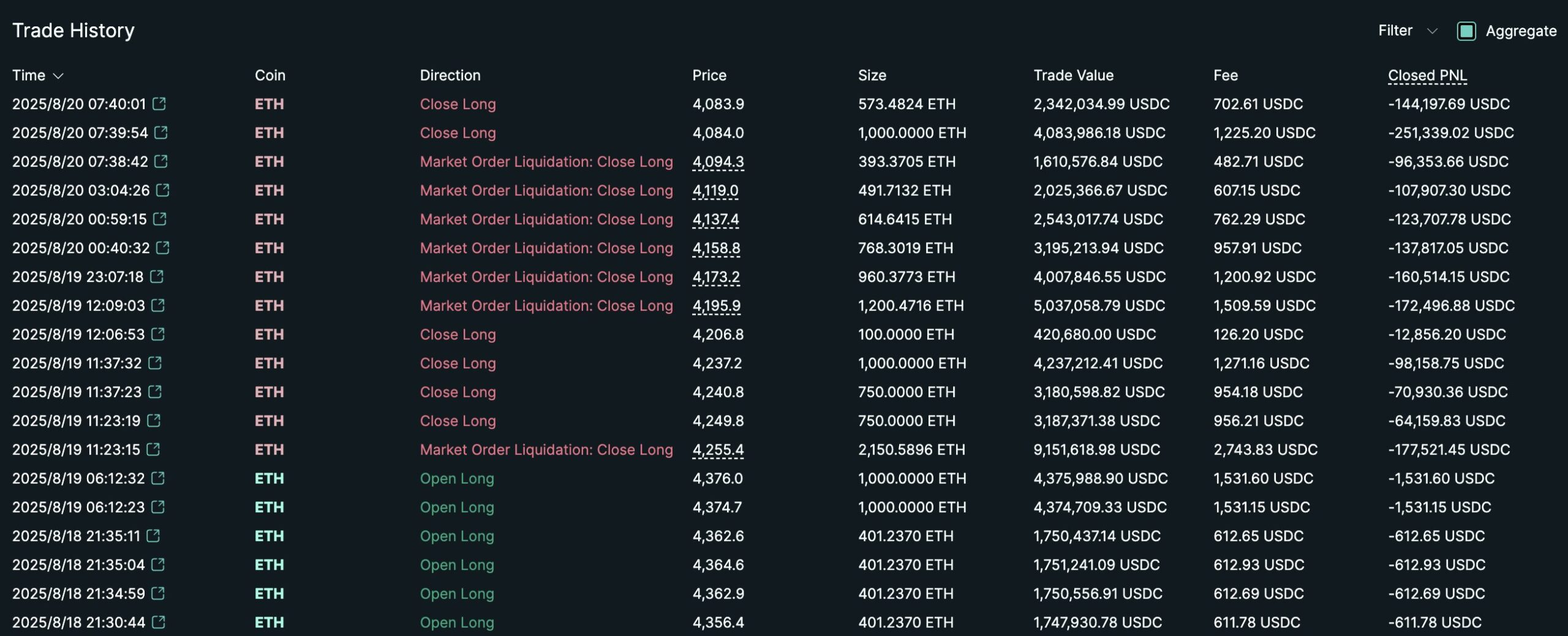

Ethereum $4,300.67An anonymous investor who folded his reserve by opening a long position also lost almost everything with the market correction. The investor reached 43 million dollars in months and agreed to close all the long positions in Ethereum on August 18th and earned $ 6.9 million. Then the investor, who opened a long position again, lost his last harsh withdrawal earnings. Currently, the current value of the investor is at 771 thousand dollars.

43 million dollars of victory has been replaced by destruction

Anonymous crypto currency The investor carried $ 125,000 in a short period of four months to $ 29.6 million with his courage. He constantly reinstated his earnings and created a gigantic ETH position of about $ 303 million. At the summit, the cumulative gain reached $ 43 million and became a performance of the market.

However, his earnings began to melt rapidly. On August 18th EthThe net earnings entering the safe with all the Long positions were $ 6.9 million. Although this figure remained far below the summit, it corresponded to a 55 -storey gain compared to the beginning. The fragile balance in the investor’s reserve became more weakened with market volatility.

LookonchainAccording to the latest data shared by the investor did not stop here. Long position in Ethereum re -opened and lost a significant part of his earnings in the last decline. The account value decreased to 771 thousand dollars. Despite his heavy losses, the investor is still 5 times plus.

The price fell 16 percent after the last rally

Ethereum made a significant 49 percent movement in July. Strong ETF With the entrances and increasing corporate adoption support, acceleration was preserved in August. At the beginning of the month, the price increased to $ 4,791 and approached the historical summit. Although the appetite of the bulls may seem high, the question of sustainability has become increasingly evident.

As a matter of fact, Rally lost acceleration in a short time. On Wednesday, $ 4,064, the lowest level in the day. This level is 16 percent below the last hill. The last retreat triggered chain dissolution in leveraged positions and reminded the bill of high -risk investment strategies.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.