Ethereum $4,161.19Bitcoin with strong entrances to Spot ETFs and the increasing interest of corporate treasures  $113,239.43He left behind. According to the K33 Research’s research report dated 19 August, the ETH/BTC parity increased above 0.037 and saw the highest level of the year. However, since June 1, ETH gained approximately 70 percent, while BTC remained at 9 percent. In the same period, the Spot Ethereum ETFs in the United States have attracted approximately $ 9.4 billion since June 2, and corporate treasury balances exceeded 2 percent of circulating ETH.

$113,239.43He left behind. According to the K33 Research’s research report dated 19 August, the ETH/BTC parity increased above 0.037 and saw the highest level of the year. However, since June 1, ETH gained approximately 70 percent, while BTC remained at 9 percent. In the same period, the Spot Ethereum ETFs in the United States have attracted approximately $ 9.4 billion since June 2, and corporate treasury balances exceeded 2 percent of circulating ETH.

ETF flows and demand for corporate treasures came to the forefront

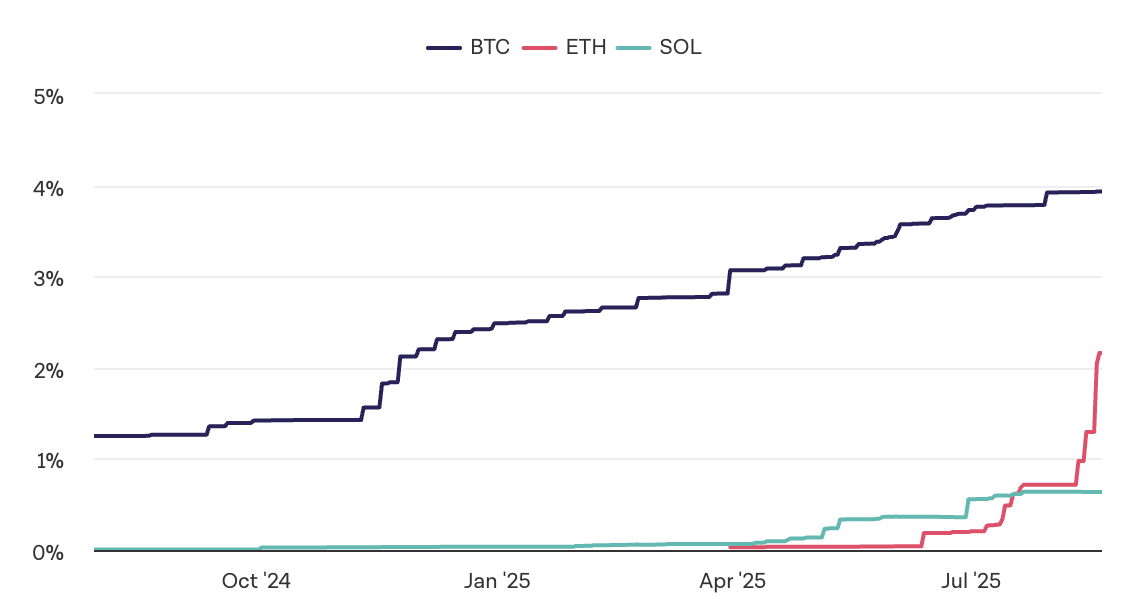

Oslo -based K33The upward attack in Ethereum based the two -channel demand shock. As the first of these channels from 2 June Spot Ethereum ETF‘s 9.4 billion dollars of entry, as the second channel as the corporate crypto currency treasures of the ETH share in two months from 0.2 percent to 2 percent of the climbing. Indeed, Coingecko data shows that the ETFs and corporate treasures have absorbed about 3.7 percent of circulating ETH supply since the beginning of June. EthAlthough the market value of the BTC is about five -fifth, this absorption was decisive in price dynamics.

Price performance also supports the resulting table. ETH has gained approximately 70 percent since June 1, while its value gain in BTC was limited to 9 percent and ETH/BTC parity It reached the highest level of the year by exceeding the 0.037 threshold. K33 stressed that at the center of this separation, ETF demand and ETH added to the balance sheets.

Ethereum appetite with leveraged is also increased. The 2X ETH ETF of Volatilityshares has increased its position of Ethereum equivalent since June 256,000, and as of August 18, about 61 percent of the CME ETH -futures open position (approximately 1.14 million ETH).

The interest in Bitcoin derivatives is reduced: the risk appetite is weakening

Bitcoin On the front, the US Producer Price Index (PPI), which exceeded expectations in the US, was a significant cooling in the derivative markets. The largest when the data is announced crypto currencyThe price of the price fell from about $ 121,000 to $ 117,700 in minutes and the liquidations exceeded $ 1 billion in a few hours.

According to K33, CME Bitcoin futures premiums tested the double households at the summits and stuck at an annual annualization as of Monday at approximately 5.5 percent. The Notional CME open position increased by about 4,800 BTC to 143,000 BTC. The open position value in indefinitely mature transactions was close to 300,000 BTC. One -month option Skew climbed the highest level of the last two years. This balance in the market caused a fragile structure to grow in both directions.

At the end of the second quarter Spot Bitcoin ETFAssets under the management of the price multiplier and re -allocation rose to $ 134.6 billion. With the 13F notifications, corporates announced ETF share worth 33.6 billion dollars. In August, Bitcoin -based investment products remained between the weekly net flows stagnant and slightly negative, while the Ethereum side continued to attract capital. In the last week, the average daily spot volume of Bitcoin in the last week was viewed around $ 59.4 billion in total -term+indefinite transactions at a level of 3.4 billion dollars. On August 14, the spot volume leaped over $ 6 billion. 90 -day correlation with Ethereum remains strong gold And S&P 500 Correlation weakened with.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.