Bitcoin (BTC) $113,239.43 price It fell to $ 112,566 in the last 24 hours and now finds buyers at $ 113,500. ETF flow stopped on the BTC front, even yesterday, we saw what exceeding half a billion dollars. Following a $ 812 million output on the first day of August, yesterday’s sales were the largest of the month. What is even more frightening is that ETH outputs exceed $ 400 million. So what are the current estimates of crypto money analysts?

Bitcoin drop

ETF What their exits say to us is the fact that even more professional investors avoid risk. Since the end of July, we have been talking about the reflections of tariffs on inflation. BTC And Eth While the total output is based on 1 billion dollars in a single day, it is not difficult to understand the anorexia in the spot markets.

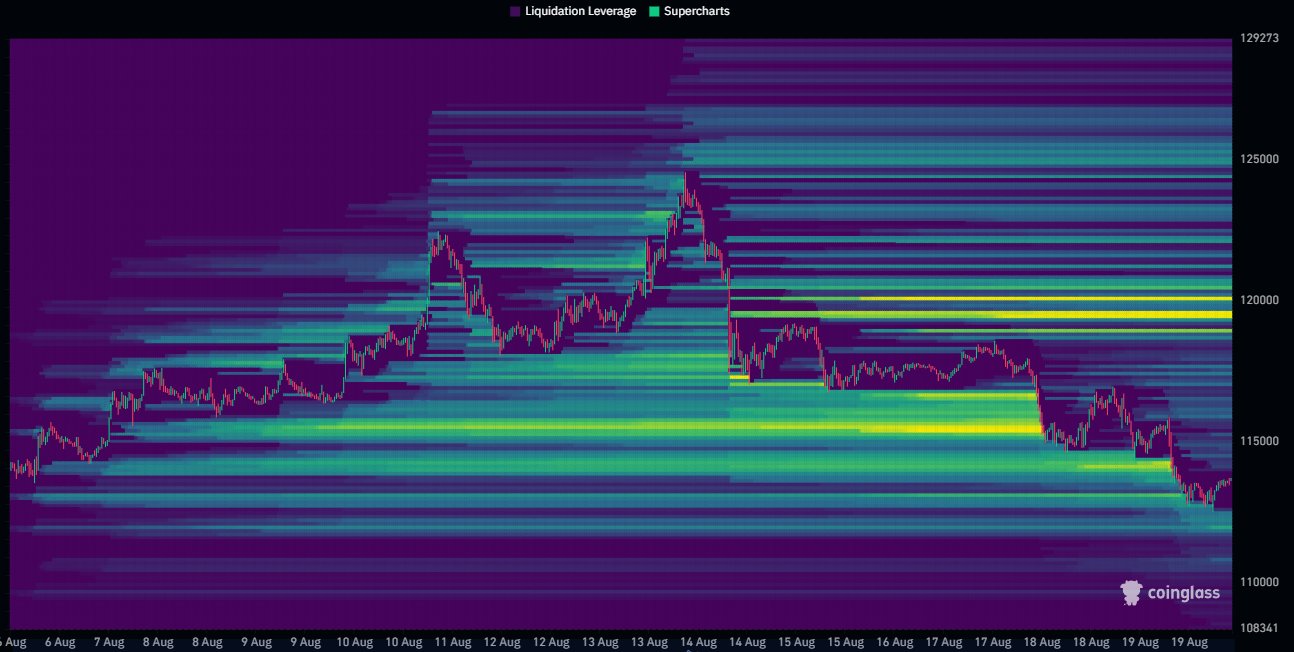

Altcoin Sherpa Ploting Analyst talks about BTC that it may be risky to get a short position. Waiting for the 117 thousand dollars test in the short term, the name warned investors by sharing the above graph.

“BTC, unless you scalping, I think it is not right to open a short position at the current levels.

The Daancrypto focused on liquidity shared the heat map above. BTC, which remained in the same range for the last 6 weeks, receives liquidity from both sides, while the analyst draws particular attention to the levels of 120 thousand and 112 thousand dollars.

“Pay attention to these areas, because when the price approaches these levels, they usually serve as local reverse turning zones and/or magnets.” – Daancrypto

Now BTC It is drawn to 112 thousand dollars, but $ 112,500 support for now is solid. If we see more hawk tons of details about the effect of tariffs on the interest route in the Fed minutes later, this may cause a break down.

Corporate Demand and Ethereum

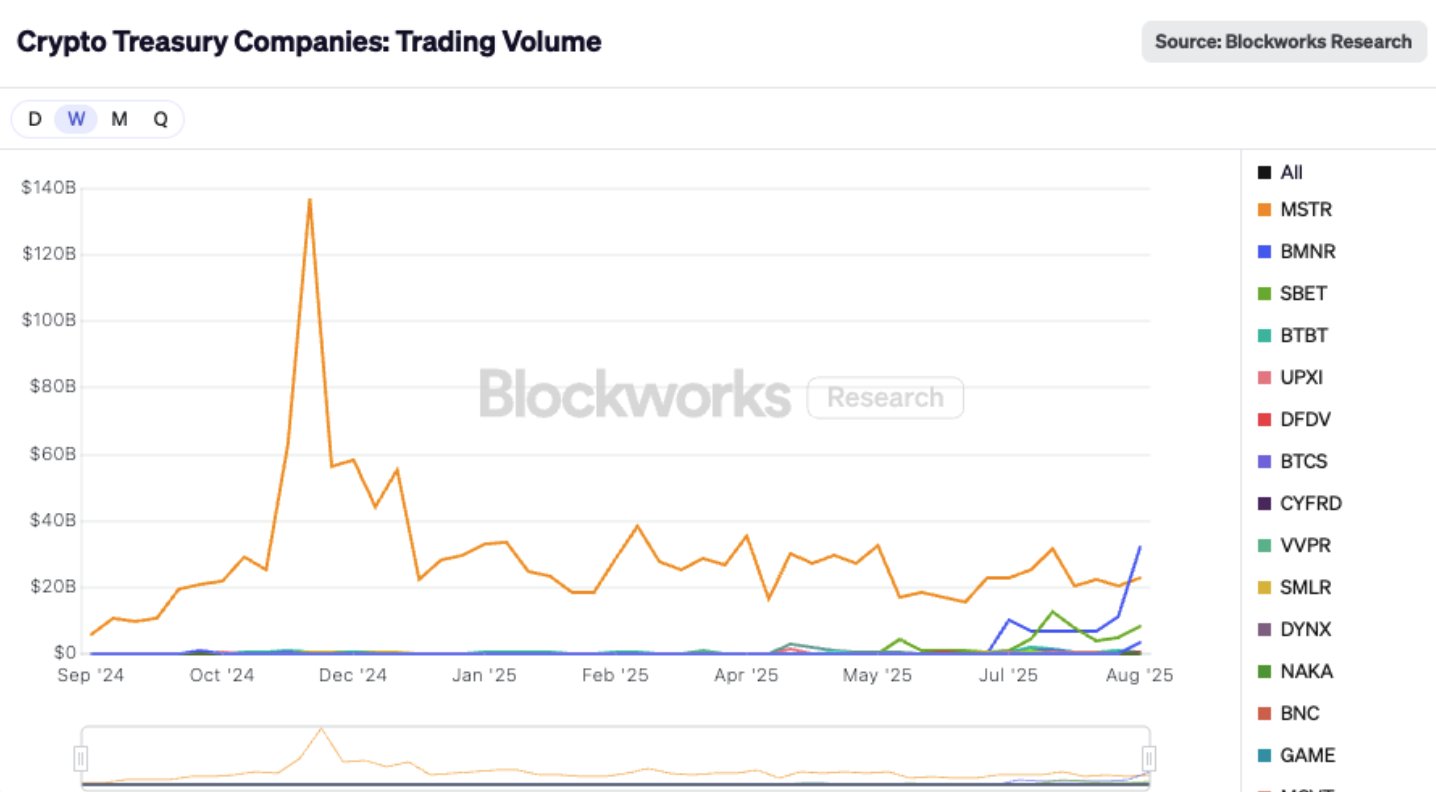

ETH ETF Although he sees large outputs on his channel, the demand of the Treasury companies writes a very different story. LAST ATH trial 2 companies 30 billion dollars Eth It was triggered by explaining the goal of receiving. Moreover, there is no sign that these companies have given up their decisions. Miles Deutscher compared the BTC/ETH with the following graph, and said it was remarkable.

“This is a crazy graph. ETH, Treasury company exceeds the BTC in the transaction volume. Frankly, when I look at this graph, I think that ETH should still go a lot according to BTC and there is a much less saturated process volume.”

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.