Dune’s “Latam Crypto 2025” report dated 18 August 2025 in Latin America with wide data sets crypto currencyit reveals that daily finance has become a layer of money. The report shows that use in the region is based on savings, money transfer and expenditure rather than speculation. In the study, the region focused on four titles as exchanges, stablecoins, input-output ramps and payment applications. The findings were compiled from the data sets confirmed by Blockchain data.

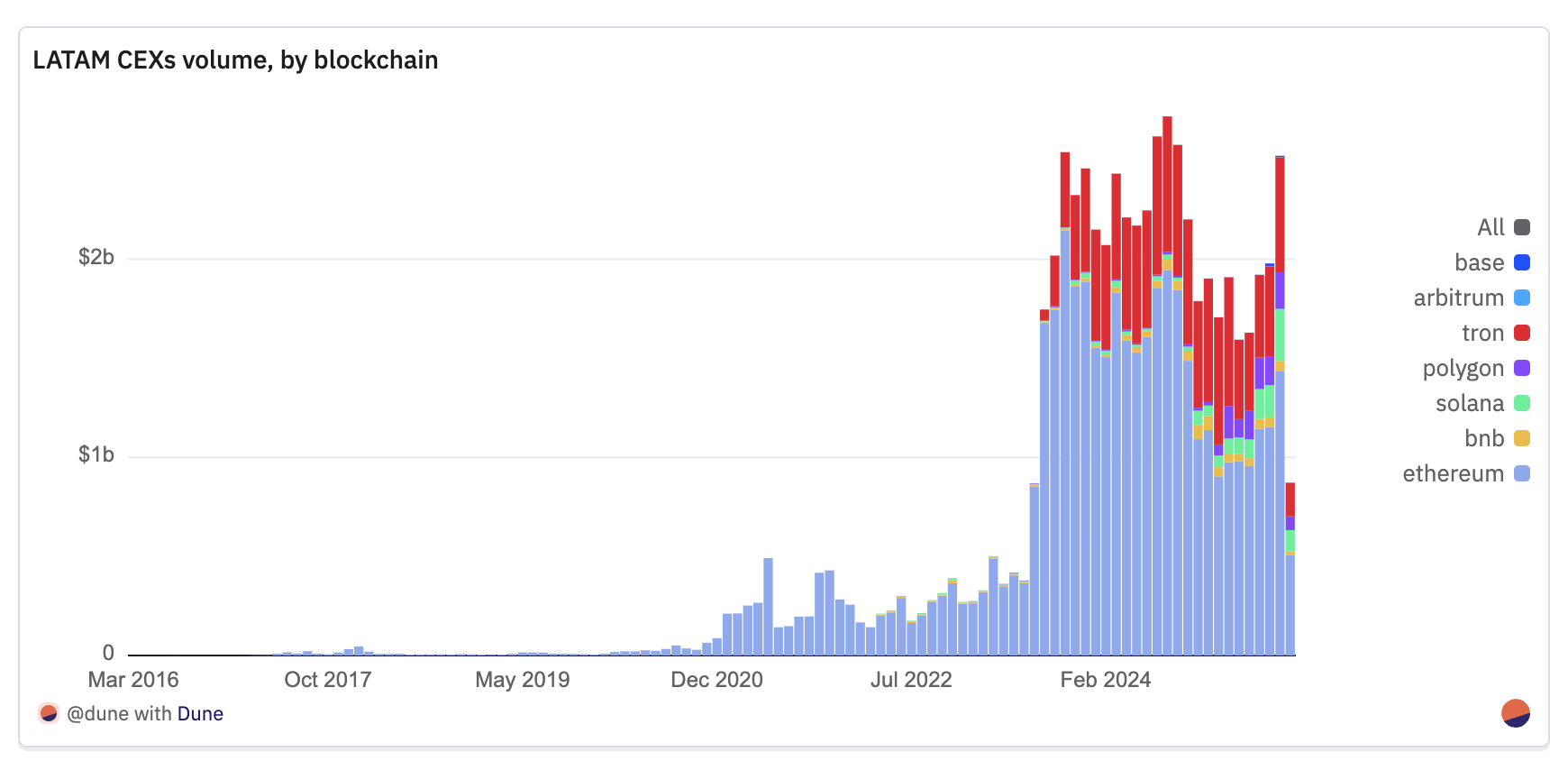

Volume on stock exchanges increased by 9 times

DuneAccording to the Latam Crypto 2025 report, crypto currency exchanges throughout the region came to the fore as the main financial infrastructure. In the period of 2021–2024, annual flows increased by 9 times to 27 billion dollars. The architects of the volume are in high consistent agreements Ethereum (ETH) $4,300.67In low cost USDT payments Tron (TRx), in the growth of individual flows Solana (Left) and Polygon (MATIC) was. The table reflects a wide range of money from cross -border money transfer to individual investors access.

The report is based on verifiable panels and cooperation with projects to read the diverse market dynamics under a single roof. The aim is not to speculative narratives, but to make real uses such as money transfer, salary, savings and payments visible. The report with a four -column frame focuses on common and practical usage areas instead of addressing different countries of the region as a single market.

Dollar -fixed stablecoins are by far ahead

USDT and USDC watched in July 2025 Crypto currency exchangesIt made more than 90 percent of the transaction volume. Along with the dollar -fixed stablecoins, coins fixed to the local currency gained momentum. Brazil Realine indexed stablecoin660 percent increase in the annual basis, the Mexican pesosu -indexed stablecoins were a leap of 1,100 times. While the weight of digital dollar in regional payment habits is maintained, stablecoins fixed to local currencies were rapidly adopted in the domestic market.

Beyond the stock markets On the ground And ZKP2P with protocols like Anchor Suppliers, such as the volume of approximately 60 million dollars by operating crypto currency and local economy without unauthorized, multiple network gateway offers. Picnic, EXA And Blindpay Applications such as stablecoin balance, savings and real world expenses in a single interface by combining crypto currencies closer to banking experience came to the fore.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.