There is no new negative development today, but tomorrow at this time Fed minutes It will be published. Investors who follow up know that we expect a decline for crypto currencies for 3 important reasons. Now there is a BTC that moves to $ 112,500 as a weekly target. What do the analysts say to us?

Will crypto coins fall further?

BTC He will give an important exam at 112,500 dollars and he pulled the daily bottom to $ 112.837 when the article was prepared. While the volumes are relatively weak, we see that buyers lose power. In the future, if we see large outputs in ETFs, this daily candle can bring more sales at the closing.

The minutes will be published hours later, the next day Jackson Hole will start and after that Powell He will make one of the most important speeches of the year about the economy. Therefore, it was not surprising that investors reduce risks day by day, and the decline was expected.

Altcoin Sherpa used the phrase “sucks için for the current situation of BTC.

“Bad news for BTC seems to be awful in the short term.

The good news is, I think we will see a recovery in a relatively short time. I think we will see a reasonable recovery around 112,000 dollars with $ 110,000. ”

Kyle pointed to serious weakening in futures. And 4 items listed.

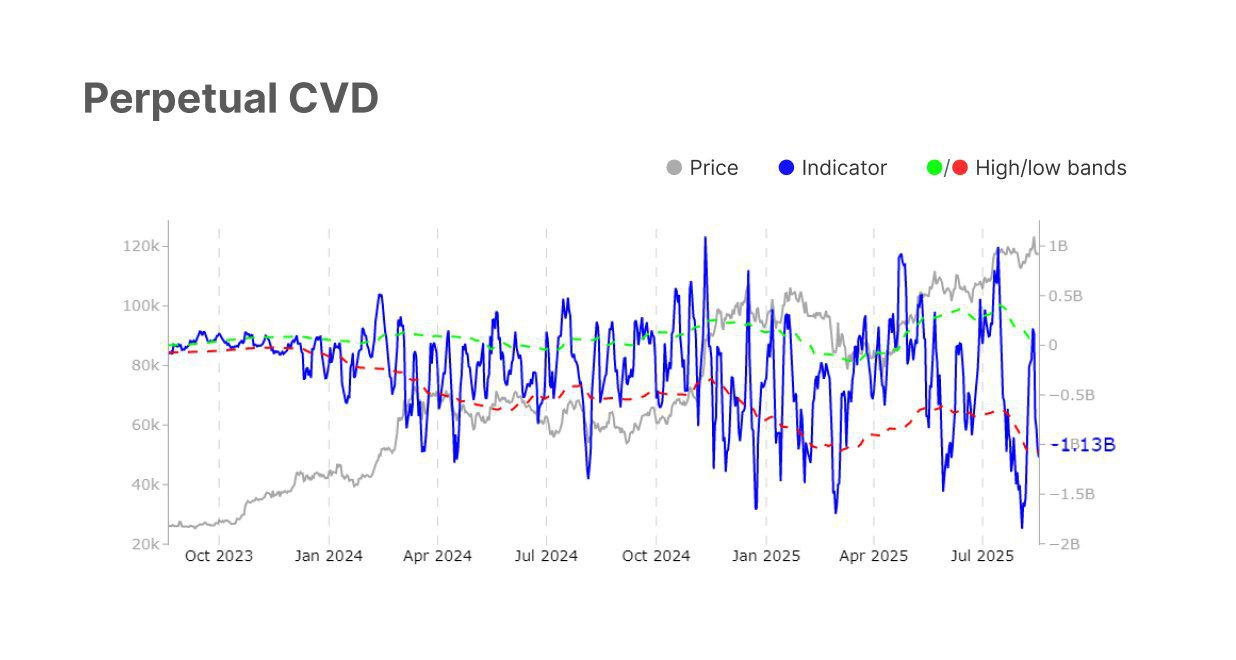

“Perps CVD suddenly hit the bottom.

It fell to 1.13b (691%) and is currently on a low band (-1,08b).

Heavy sales pressure = clearly declining tendency.

Surrender atmosphere everywhere…

However, at these levels, the fatigue of the sellers may not be too far.

Do you think we will recover here or will we continue to bleed? “

ETHBTC estimates

4,150 dollars for ETH was an important level. Ether While continuing the day with a loss exceeding 5 percent, it went down to the lock zone. Alright ETHBTC What is the situation in the parity? It was feared and we saw a decline to 0.036BTC. We wrote that the gradual decline could be extended here while targeting 0.04. Now sales can be accelerated more easily, and under 0.0355btc, subcoins may be lost more.

Mister, who looks at the market in a longer term, says that short -term negativity should not be exaggerated here.

“The ratio between ETH/BTC increased above a 365 -day moving average.

This level historically points to the beginning of ETH’s rise cycles. This time it will not be different. “

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.