Ethereum recently $4,266.78 Strong funds observed in ETFs draw attention. Especially in July, ETH -based funds came to the fore with their performance, while the interest of corporate investors increased the mobility in this field. Sernaye entrances in the last six weeks seem to have left behind the previous twelve -month period.

Ethereum ETF

Ethereum ETFs in July, albeit for a short time Bitcoin  $115,054.16 Passed in front of based products. According to analysts, this has increased the institutional interest in Ethereum. In this process, where investors’ support for ETH is intensified, EThereum ETFs became more visible in various market areas.

$115,054.16 Passed in front of based products. According to analysts, this has increased the institutional interest in Ethereum. In this process, where investors’ support for ETH is intensified, EThereum ETFs became more visible in various market areas.

The big investments made by Bitmine company were one of the important factors that started this momentum. Analysts say that one -year entrance has been realized in the last six weeks in the market, which has remained inactive for a long time.

Balomberg ETF analyst Eric Balchunas said, “Ether ETFs saw the fund entry of the year every six weeks. After a long silence, there was a sudden movement.

Demand is strong, fear weak

The fact that the amount of ETH that Bitmine holds reached $ 6.6 billion increased the interest of corporate capital to Ether. Many analysts say that the major purchases of the company encourage major investors to receive ETH.

“The last rise in Ethereum triggered the profit realization. However, in spite of fluctuations, institutional entries to ETFs continue. This makes the basic demand stronger compared to past cycles.” – Jamie Elkaleh

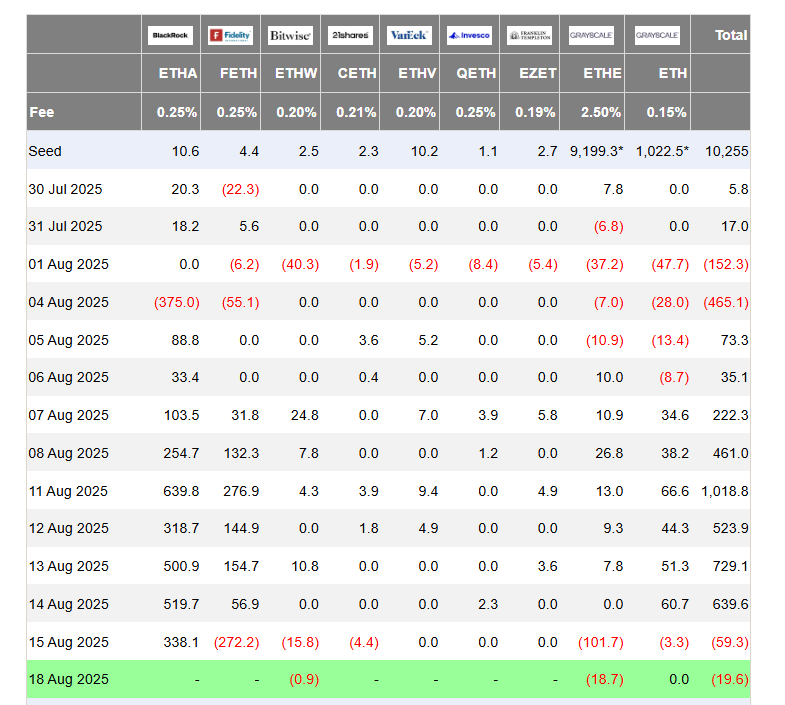

As of August 7, there was a serious mobility in Ethereum ETFs. Inputs exceeding $ 200 million opened door to daily entrances up to 1 billion 18 million dollars. ETH ETFs, which entered a record on August 11, entered 639 million dollars on August 14, completed the last day of the net entrance series. On Friday, August 15, we saw a net output of $ 59 million with concerns triggered by PPI data. Today, only Bitwise and Grayscale’s ETF data has come to the total net output for $ 19.6 million for now.

It remains unclear whether the rapid growth observed in Ethereum ETFs continues. Despite the short -term market mobility, the stable demand of ETH ETFs may protect the spot price if institutional entries continue. Investors are hopeful because we have not yet seen the same escape after hundreds of millions of dollars.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.