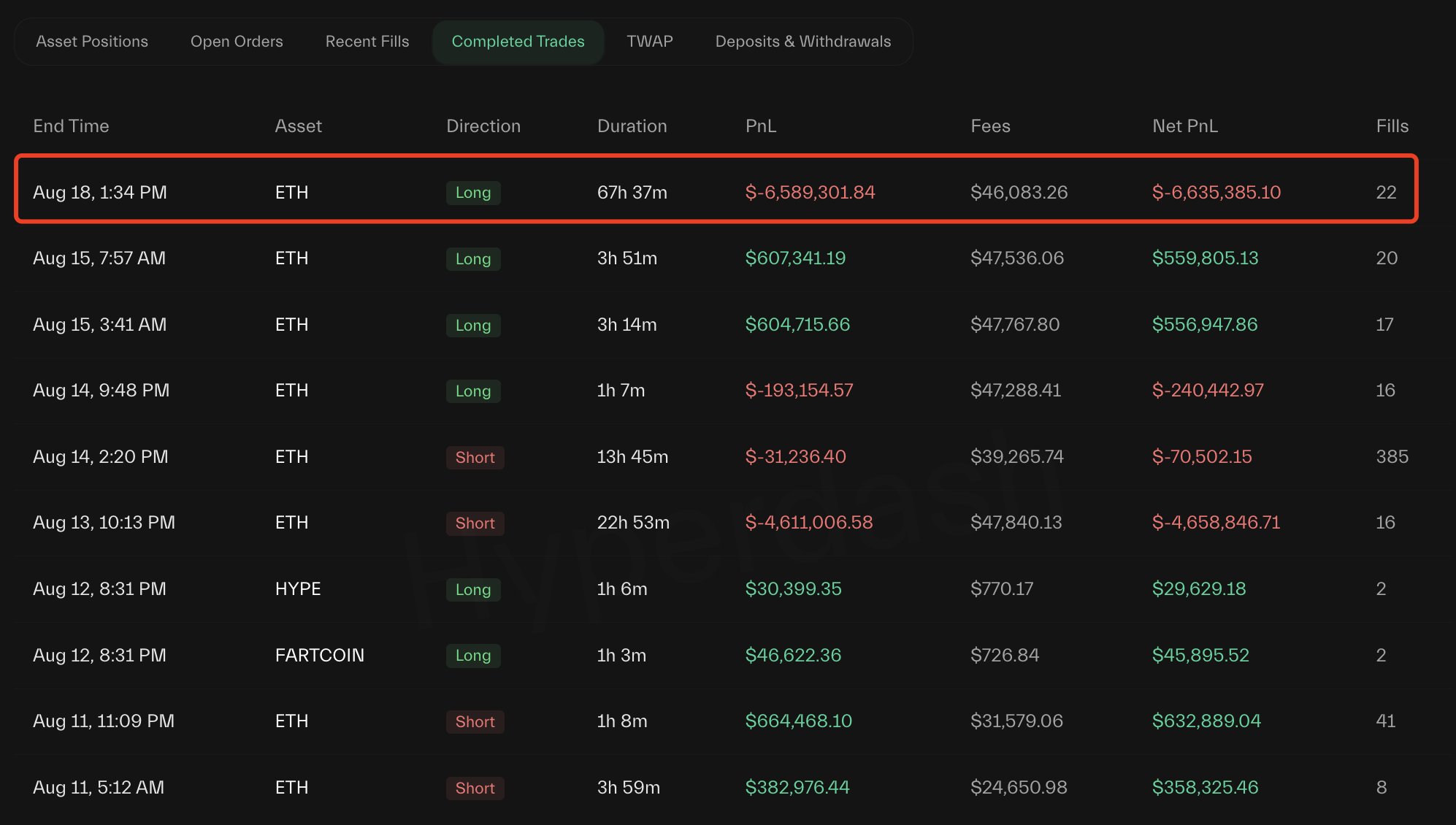

Ethereum $4,266.78Whales may have started to withdraw from leveraged positions in other words. The market reads this as a possible direction change. LookonchainAccording to Blockchain data quoted, a whale that controls the wallet in 0x89 in 0x89 $ 93 million in the near future closed the Long position of 21,683 ETH Long position. The transaction in question wrote about 6.6 million dollars of damage to the whale. After closing the same wallet position, Hyperliquid drew a total of 9.6 million USDC. When the development took place, ETH was moving under the $ 4,500 threshold after the last rise.

Ethereum Balinasu closed the position with damage

According to data flow 0x89… It stands out as one of the wallets known for its activity in the derivative markets. For this reason, the wallet closes the Long position of 21,683 ETH positions and then draws all the USDC balance in Hyperliquid. The data is that this position closure is about 6.6 million dollars. reveals. Even if the damage is written, the position closure reflects a cautious approach that focuses on rapidly reducing the total leverage level used.

Ethafter a strong rally, under the horizontal of $ 4,500 and maintained the course close to the annual peaks, the caution of the big wallets increased. In the past cycles, it was seen that the leveraged derivative positions decreased during periods when prices approached the hill regions. The high funding costs in continuous futures contracts also pave the way for large players to turn to reduce risks. In 0x89… The move of the wallet is a consistent example with this trend.

Possible effects of whale behavior on leverage and liquidity

HyperliquidThe fact that it is a prominent platform for leveraged Ethereum transactions indicates that shooting can have wider effects on sensitivity and liquidity. Removing large balances out of the market may affect the depth of the order books in the short term and open the door to sudden fluctuations in price movements. The fragility of sensitivity becomes more visible, especially when investors using leverage changes.

If similar whale level wallets go to the trail of 0x89, in the derivative markets open position sizeThere may be a significant decrease in the. This has the potential to weaken the leverage effect that feeds the considerable part of the last rally. The acceleration of withdrawal of withdrawals reinforces cautious investor behavior, while the balance between spot and derivative markets can be re -established.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.