With the start of the new week Bitcoin $118,396.50 With a decrease of 2 percent, it went down to $ 115,000. The largest crypto currency was recorded in the DIP with 115,046 dollars in the day. Ethereum  $4,560.64 and decreased by 3.33 percent to 4.272 dollars. Following the highest level of all time seen on Wednesday with approximately $ 124,350, the main factor in Bitcoin was inflation data that exceeded expectations in the USA. CoinMarketcap’s “Crypto fear and greedThe ”index is at the level of 56, ie in the neutral area.

$4,560.64 and decreased by 3.33 percent to 4.272 dollars. Following the highest level of all time seen on Wednesday with approximately $ 124,350, the main factor in Bitcoin was inflation data that exceeded expectations in the USA. CoinMarketcap’s “Crypto fear and greedThe ”index is at the level of 56, ie in the neutral area.

Inflation surprise shook the risk appetite

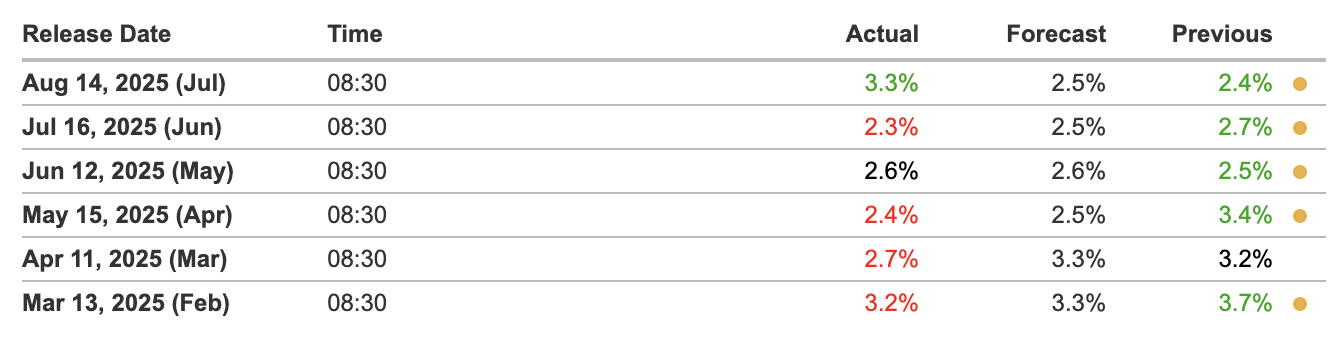

Kronos Research CIO Vincent LiuHe said that the decline stems from the strengthening of cautious perception due to high inflation data than expected. July Producer Price Index‘s (PPI) annually increased by 3.3 percent, the CPI, which was soft than expected before, cut the rally triggered. Fed interest rate reduction expectations weakened, dollar strengthened, escape from risk came to the fore. Analysts emphasize that the hope of interest rate cuts in September is filed.

According to Liu, investors are both macro and crypto currency A clearer signal is waiting for it. Will be announced on August 21st in the agenda of the week Unemployment Salary Applications It has data. Data is decisive for the short -term direction.

Another title that weakens trust is US Treasury Minister Scott Bessent‘s strategic reserve that Bitcoin will not be purchased, and the fact that the achievements will be preserved. The Minister said that budget neutral options will be evaluated to enlarge the reserve. This approach showed that the possibility of a state -based demand in Bitcoin is not on the table for now.

BTC Markets Analyst Rachael LucasSpot ETFs streams, not escape, not the relocation signal, he said. On Friday, Grayscale and Ark Invest’s Bitcoin ETFs were released, while Blackrock’s IBIT product continued to withdraw a net input. According to Sosovalue data, Spot Ethereum ETFs have similar orientation. Lucas said that investors are consolidated in lower costly products and that corporate interest continues.

Lock Support Levels in Bitcoin: 115,000 and 112,500 dollars

On the technical side, Lucas highlighted 115,000 and $ 112,500 as a key support. He stressed that under these levels, permanent breakage may increase risks towards $ 110,000.

The Jackson Hole symposium is pointed out as the next powerful trigger in the crypto money market. FED President Jerome PowellPigeon tone messages will be given by the risk appetite can increase the risk appetite. According to Lucas, ongoing ETF inputs and corporate fund flow continues to create a ground below the pricing.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.