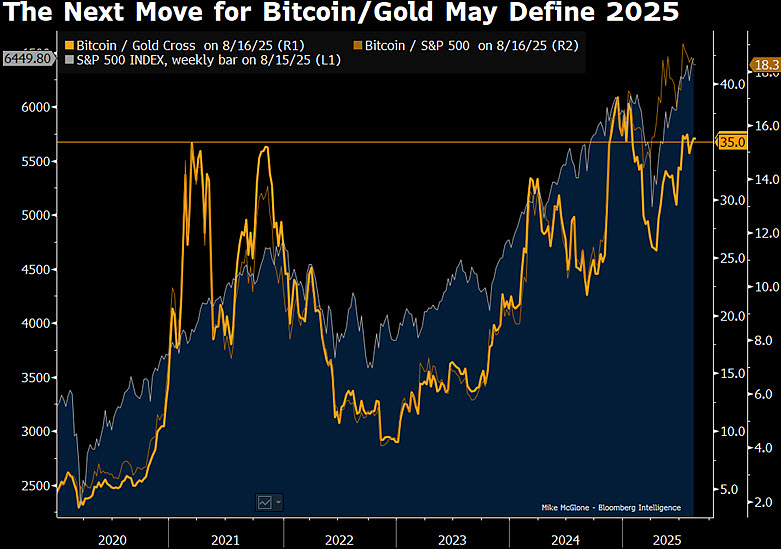

Bloomberg Intelligence’s chief commodity strategist Mike McGloneAccording to Bitcoin $118,396.50It must remain above the 2021 summit against gold to prove that it is an independent asset, which is no longer the last major trade in which speculators pursue. McGlone is now about 35 ounces, this level goldA sagging will be a sign of weakness stated. On August 14, the BTC/XAU parity increased up to 36.9 ounces and partially retreated. In mid -April, 24.7 ounce of the year was recorded.

2021 summit threshold against gold

McGlone sees the meaning of the threshold as an independence test for Bitcoin. If Bitcoin If he clings to this threshold, he can write his own cycle. However, if it falls in the face of gold, it will remain in the shadow of speculators. From the beginning of the year, this painting supports it. Bitcoin is still 0.41 percent behind. Although this difference seems small, it stands out as the detail that damages the claim of independence. On August 14, the summit, which was seen with 36.9 ounces, was recorded on a bit of the threshold as a breathful moment. But in mid -April, the weak zone tested with 24.7 ounces is still fresh in memory.

McGlone has been known for its years of use of a cautious tone about Bitcoin. Strategist before crypto currencyThe price of the price of 10,000 dollars claimed that it came to the agenda. Now he argues that the discourse of independence in Bitcoin will not be convincing in Bitcoin without permanence over 35 ounces.

US bonds can be the next major trade

Strategist, as an address for possible new big trade US treasury bondspointed to. He reminded that bond returns in China relaxed to 1.75 percent and argued that this comparison could make treasury bonds a center of attraction. Because the risk/return balance is more predictable here. McGlone did not hide his personal preference. For now, he explained that he preferred gold instead of “digital gold ..

On the other hand, there are no views against McGlone’s opinion. From Fidelity Jurrien Timmer Before that, in the second half of the year, he predicted that Bitcoin could leave behind. However, this scenario, which Timmer envisaged as the calendar progresses, has not yet been realized.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.