According to the latest report published by Coinbase Instituteal, a “full -scale” Altcoin season seems possible. This expectation of Coinbase’s professional platform for corporate investors is about 75 percent of Altcoins Bitcoin $120,894.38‘i (BTC) indicates that he can leave behind. The US Federal Reserve (FED) is expected to make an interest rate reduction of 25 basis points in September, while in Polymarket, this probability is prospected at 75 percent. Bitcoin’s market domination decreased to 59.39 percent, while the ETH/BTC parity saw the last peak of the year with its 0.039 level on August 14th.

According to Coinbase, the Altcoin season is approaching

In the report full -scale in the market altcoin The season may be at the door. This means that the majority of Altcoins will prevent Bitcoin in terms of performance.

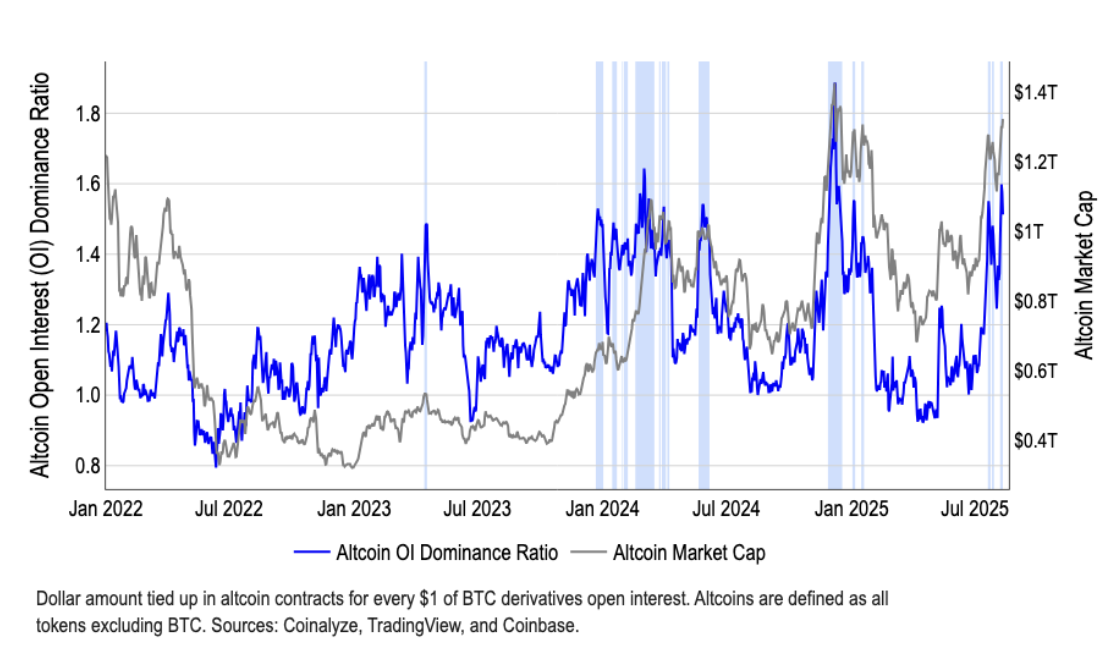

In this context, recently BitcoinMarket domination has been weakened in a remarkable way since June, a 10.21 percent decrease in the market dominance has decreased to 59.39 percent. The data supports the table, which points to a full -scale strengthening in the Altcoin market against Bitcoin.

One of the prominent indicators on the Altcoin front ETH/BTC parity. The parity, which reached 0.039 on August 14, saw the highest level of the year. For the parity, this threshold stands out as a numerical reflection of relative acceleration in the subcoin market.

Fed interest rate reduction and possible scenarios for Bitcoin

Currently, the markets are waiting for an interest rate reduction of 25 basis points at the FOMC meeting in September. Polymarket participants pricit the possibility of realization of this step by 75 percent. The assumption that the possible discount in comments can create a “local hill için for Bitcoin stands out.

Coinbase does not agree with this view. According to the report, a significant part of the individual capital is still waiting for the market and a possible interest rate reduction can be released. Because interest rate reductionN Bitcoin is not possible to be considered as an automatic peak mark and the shape of the money flow for a potential hill will be decisive.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.