XRPlast week after the withdrawal from $ 3.5 in the last 24 hours after the withdrawal of approximately 4 percent decreased to $ 3.14–3.15. Blackrock’s announcement that there was no Spot ETF plan for XRP has weakened the market perception for Altcoin. In this environment, investors question the “purchase” strategy.

What does the decline in the price of XRP Coin tell?

Popular analyst Credibull Cryptoup to 10 percent weekly withdrawal of withdrawal of the first shared Long position -receiving zone brought back to the ideal entry, he said. According to the analyst, if the current support zone is preserved, the price may turn to the top of the range or to a new summit. Analyst added that sagging in the short term is possible, but the region is attractive for purchase.

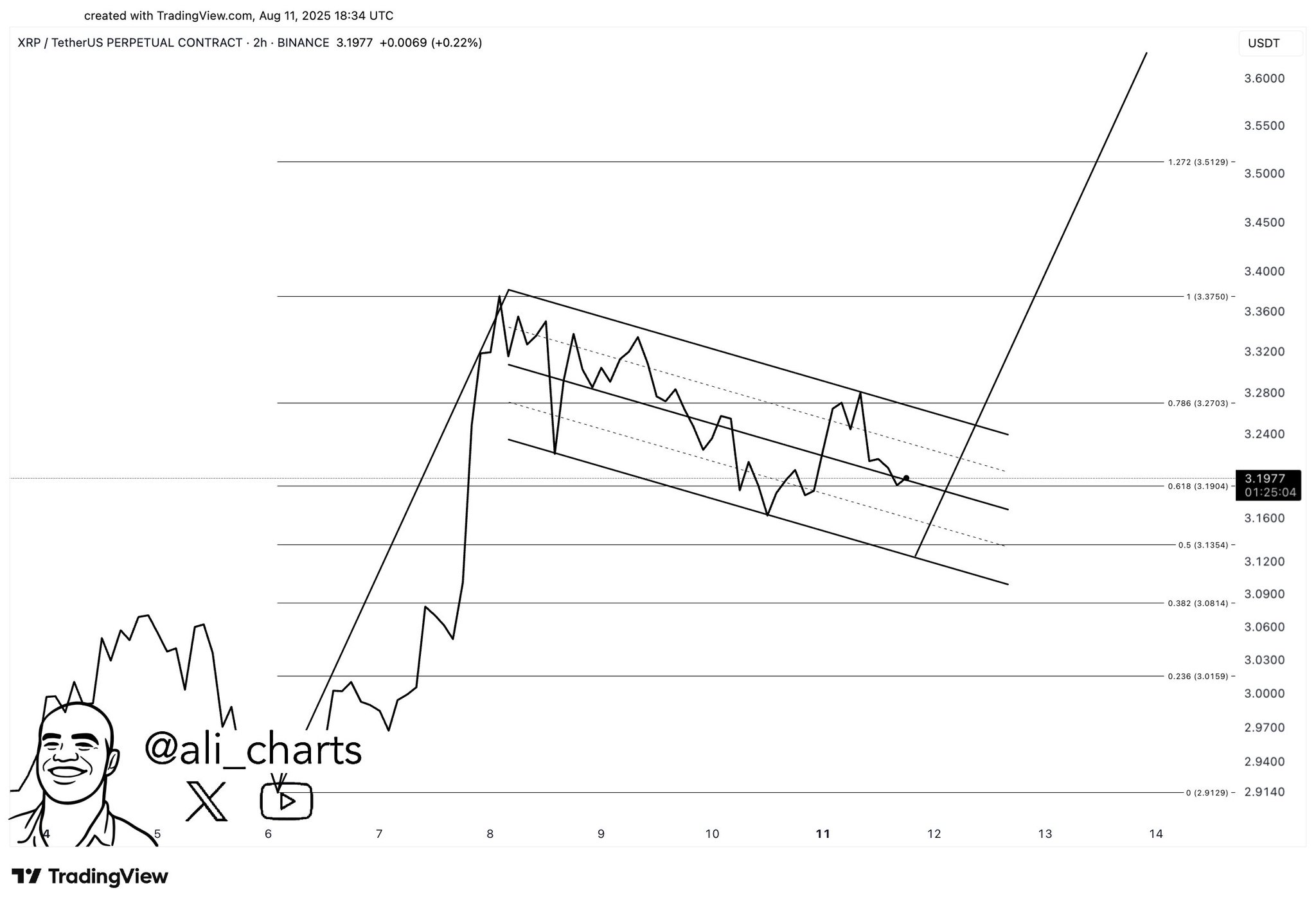

Ali Martinez also pointed out the technical thresholds. According to him, the return of the XRP’s $ 3.27 threshold may pave the way for the $ 3.60 target. Martinez reminded the target of $ 12,60 in the middle-long-term rise scenario based on the breakdown of the multiple triangular formation in November 2024.

On the front of the Blockchain, whale interest continues and 900 million XRPs are collected in the short term. This flow of whale indicates that the demand side is not completely extinguished despite the sales pressure.

Latest situation in case of approval for Spot XRP ETF

SEC’s Ripple last week  $3.15by official closing the case he filed Spot ETF As the rumors of approval for the approval, Blackrock, the world’s largest asset manager, limited expectations to announce that there was no XRP ETF plan. Market estimation platform PolymarketThe probability of approval in the last week is moving between 75–90 percent and is currently pricing at 81 percent. Although the approval rate shows that expectations have not completely eliminated, it reflects the existence of uncertainty.

$3.15by official closing the case he filed Spot ETF As the rumors of approval for the approval, Blackrock, the world’s largest asset manager, limited expectations to announce that there was no XRP ETF plan. Market estimation platform PolymarketThe probability of approval in the last week is moving between 75–90 percent and is currently pricing at 81 percent. Although the approval rate shows that expectations have not completely eliminated, it reflects the existence of uncertainty.

Canary Capital CEO Steven McClurgIn an interview with Paul Barron, Ethereum of possible XRP ETF approval  $4,274.22 He said he believes that he could perform better than his counterparts. As a reason for this belief, return structure, market positioning and community power. McClurg added that the stake feature in Ethereum may limit ETF performance. In the last place, the price remains sensitive to ETF news flow and technical thresholds in the short term.

$4,274.22 He said he believes that he could perform better than his counterparts. As a reason for this belief, return structure, market positioning and community power. McClurg added that the stake feature in Ethereum may limit ETF performance. In the last place, the price remains sensitive to ETF news flow and technical thresholds in the short term.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.