Bitcoin $118,440.21 As he started the new week, he crossed the threshold of $ 122 thousand. Ethereum  $4,215.81 4 thousand 300 dollars. Many Altcoin rises to 5 percent or more. Behind the increase in mobility in the market, especially in the 401 (K) plans of US President Donald Trump, the decree that opened crypto money and the continuation of institutional demand continues. Head of Signalplus Insights Augustine fan“401 (K) portfolios of the recovery in the market crypto currency and the inclusion of private capital reflecting the effect of the titles strengthened by the call.

$4,215.81 4 thousand 300 dollars. Many Altcoin rises to 5 percent or more. Behind the increase in mobility in the market, especially in the 401 (K) plans of US President Donald Trump, the decree that opened crypto money and the continuation of institutional demand continues. Head of Signalplus Insights Augustine fan“401 (K) portfolios of the recovery in the market crypto currency and the inclusion of private capital reflecting the effect of the titles strengthened by the call.

The impact of the 401 (K) decision in Bitcoin and crypto currencies is noticeable

Trump, with the decree signed on Thursday, to the Ministry of Labor 401 (K) Pension PlansHe instructed to evaluate crypto currency, private capital and other alternative assets. According to Fan, millions of Americans retirement accountThis class of assets, which has access to Na, can potentially create a significant purchase demand. The perception in the market shows that headlines are directly reflected in pricing.

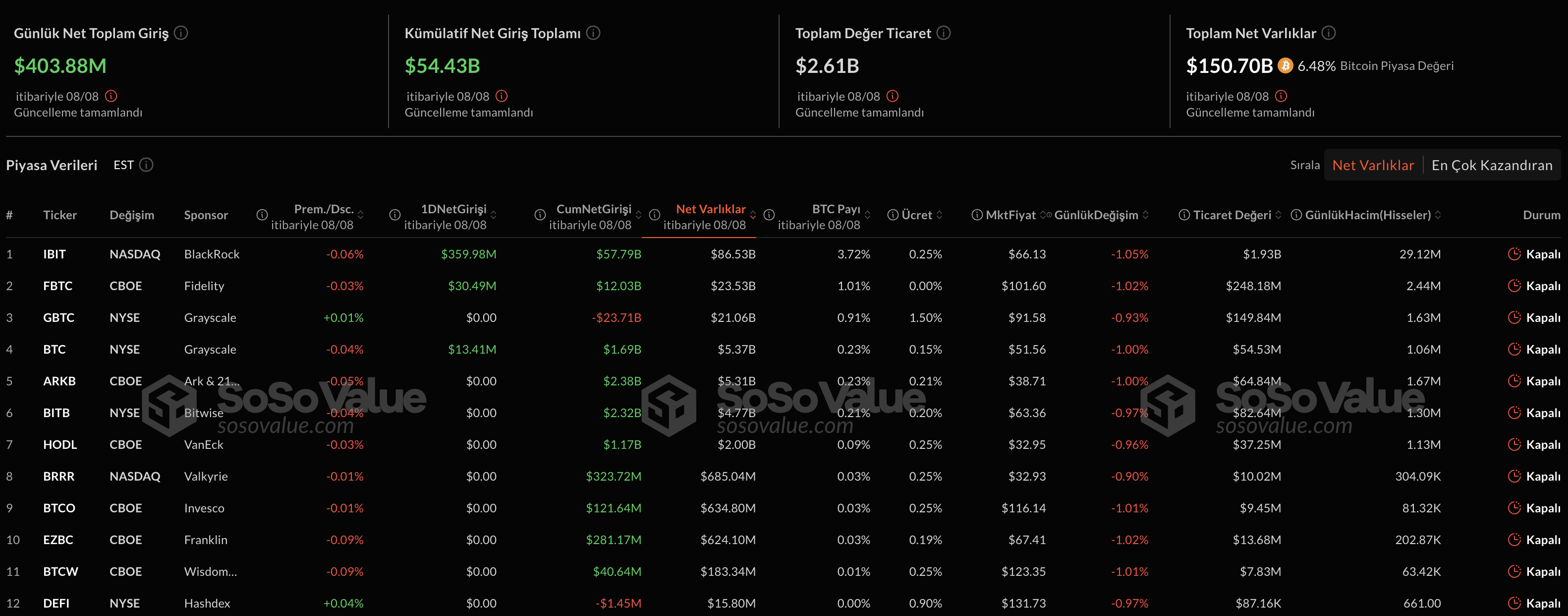

On Bitcoin Front According to Sosovalue’s data Spot ETF‘s weekly with a net entrance of 253 million dollars on a weekly basis, despite the consolidation after all last month’s summit, he kept the demand alive. Corporate balance sheet-criminal purchases continue to be the main theme.

Presto Research Analyst Min jungAt the weekend, Sharplink Gaming stressed the impact of large wallets by pointing to the unofficial 52 thousand 809 ETH purchases. On the macro front, the cautious posture stands out because the CPI and the PPI data on Tuesday will be announced. FED President Jerome Powell He stated that the September interest rate reduction decision in the last FOMC depends on the data flow. CME Fedwatch currently shows 88.4 percent of the possibility of a 25 basis of phase discount on September 17th.

Ethereum is running to record

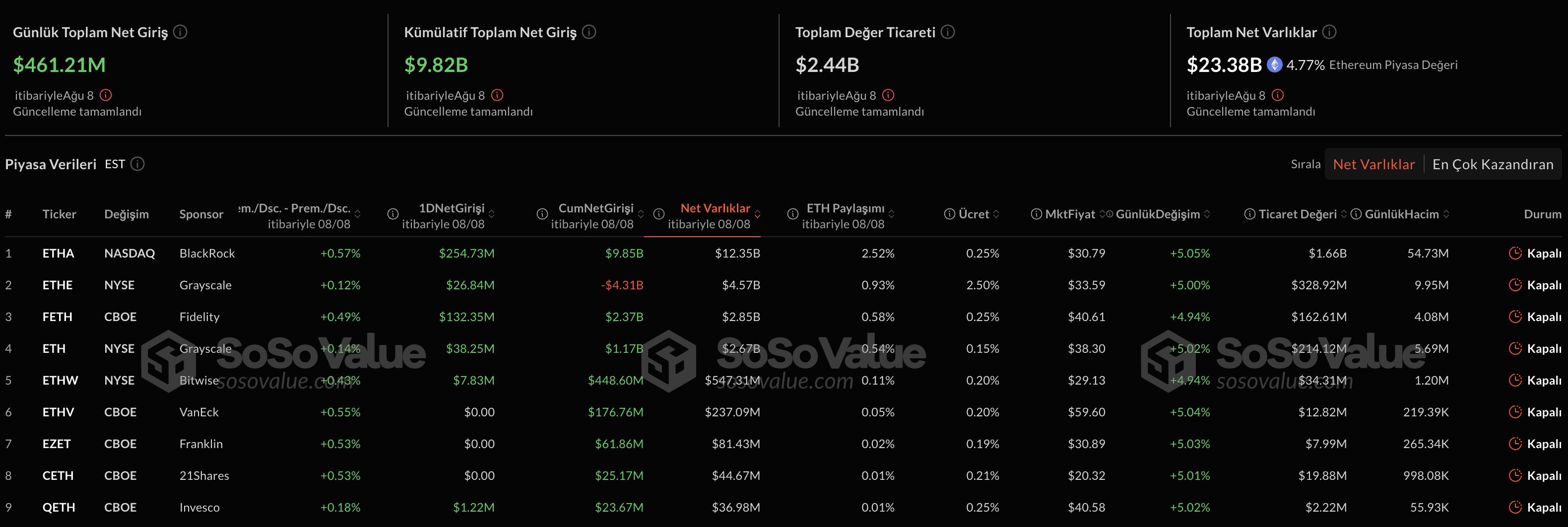

EthereumSeeing the highest level since December 2021 over 4 thousand 300 dollars and 4 thousand 878 dollars recorded in the record of about 10 percent distance. According to Sosovalue data, Spot Ethereum ETFs with 461 million dollars per week He left behind and supported the acceleration of the rise.

According to Coings In the last 24 hours, there was a Long and Short liquid of over $ 350 million. 215 million dollars of the amount comes from Short liquidations. The wide -scale short liquids in the derivative markets also support the rise. BTC Markets Analyst Rachael Lucasthat the momentum, entrances and headlines support ETH and Vitalic BotterHe said the threshold for his reserve was overcome again.

The short -term performance difference is connected to whether corporate entries will continue. EthAs we approach the summit, price behavior is sensitive to the continuity of fund flows and news flow to ETFs. The equation followed by investors is “acceleration, entrance to ETFs and policy headlines”.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.