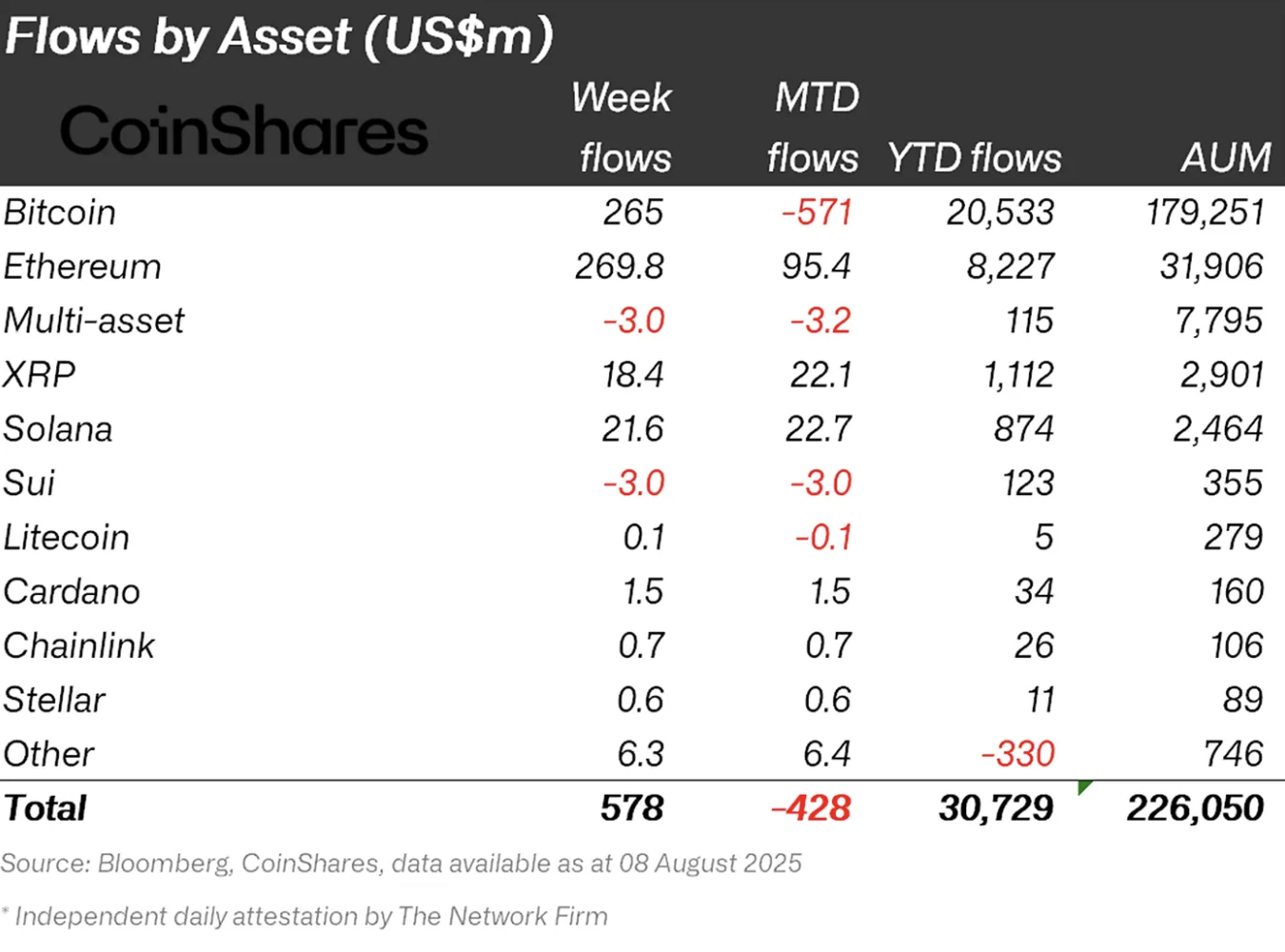

Global according to Coinshares’ data Crypto Money Based Investment ProductsWhat last week was a net entry of $ 572 million again. This was recorded as important recovery following the first weekly exits recorded for the first time after about four months. Products of asset managers such as Blackrock, Bitwise, Fidelity, Grayscale, Proshares and 21shares came to the fore in the entrances. Coinshares Research Head James Butterfillat the beginning of last week with the growth concerns of weak US employment data, 1 billion dollars output, in the second half of the week 401 (K) retirement plans to allow crypto currency will be allowed by the government announced that the government announcement was 1.57 billion.

Regional distribution of weekly fund flows

Coinshares According to the report published today Hard outputs in the first part of last week’s first part was replaced by strong entrances. Butterfill for this reason 401 (K) plans in the USA crypto currencyHe showed the government statement to include. On the other hand, at the beginning of the week, the triggering factor was the growth concerns created by weak US employment data.

Regional distribution USA608 million dollars from Canada16.5 million dollars and Australia7.9 million dollars from a net entry from 7.9 million. Europe remained weak. Germany, Swedish And SwitzerlandA total of $ 54.3 million was a net output. Thus, while the direction returned to a global scale, continental Europe continued to remain cautious.

Bitcoin recovered while Ethereum stands out

Ethereum $4,212.94 Based investment products led the market with a net introduction of 268 million dollars with the effect of ETH Coin’s $ 4,000 threshold for the first time in eight months later. Since the beginning of the year, the entrances have increased to a record level with 8.2 billion dollars, while managed assets reached the highest level of all time with $ 32.6 billion. In this item, the lion’s share of Spot Ethereum ETFs in the United States. The investment products in question have entered 326.6 million dollars and were balanced with exit in other countries.

$[mcrypto coin=”BTC” currency=”USD”] and the latest situation in subcoins

$[mcrypto coin=”BTC” currency=”USD”] and the latest situation in subcoinsBitcoin The two -week net output series ended on the side and the investment products were 260 million entrances. Short -Bitcoin products were 4 million dollars. Spot Bitcoin ETFs in the United States made up $ 253.2 million of this total. On the Altcoin Front Solana 21.8 million, XRP 18.4 million, Near 10.1 million, Litecoin  $127.54 100 thousand dollars, CARDANO

$127.54 100 thousand dollars, CARDANO  $0.796008 1.5 million dollars, Chainlink

$0.796008 1.5 million dollars, Chainlink  $21.46 700 thousand dollars and Stellar

$21.46 700 thousand dollars and Stellar  $0.448282600 thousand dollars in the entrance. Sue -based investment products were $ 3 million output.

$0.448282600 thousand dollars in the entrance. Sue -based investment products were $ 3 million output.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.