Since mid-2024, a growing number of public companies have started holding XRP as part of their treasury strategies. While Bitcoin and Ethereum dominated headlines in the past, big names like Japan’s SBI Holdings and smaller U.S. tech companies are starting to hold some of their cash in XRP because of how quickly it settles transactions.

Several listed companies across the U.S., Asia-Pacific, and Canada have either disclosed XRP holdings or announced plans to accumulate the asset. This report by CoinPedia highlights which companies are investing in XRP, why they see value in its fast cross-border payments, and what their financial reports suggest about the rising trend of public companies holding XRP.

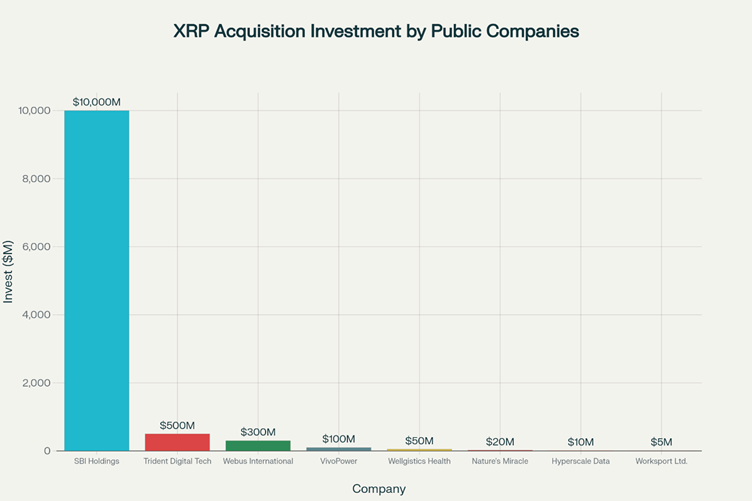

Top Public Companies Holding XRP

1. SBI Holdings

XRP Allocation: ~¥1.6 trillion (≈ USD $10 billion, estimated)

A long-time Ripple partner, SBI is by far the largest institutional holder of XRP. SBI uses XRP in internal treasury operations and is boosting Japan’s crypto ETF applications. Recent information shows that SBI’s investment in Ripple and its XRP holdings are worth about ¥1.6 trillion ($10 billion), which is more than the company’s total market value of ¥1.2 trillion.

This surprising situation has led some experts to compare SBI Holdings’ approach to XRP with how MicroStrategy has been aggressively buying Bitcoin (BTC).

The GAM Global Special Situations Fund is now pushing SBI Holdings to make its XRP investment strategy more official and structured, similar to MicroStrategy’s clear plan for investing in Bitcoin. At the moment, there is no official record of this investment on the company’s balance sheet.’

2. Trident Digital Tech Holdings (NASDAQ: TDTH)

XRP Allocation: Up to $500 million

Trident Digital Tech Holdings Ltd (NASDAQ: TDTH), a Singapore-based leader in tech optimization and Web 3.0 services, announced plans to raise $500 million to build one of the first large-scale corporate XRP treasuries. Chaince Securities will serve as a strategic advisor.

The initiative includes acquiring XRP as a long-term reserve, deploying staking for yield, and engaging deeply with the Ripple ecosystem.

The project, announced in June 2025, is one of the most ambitious corporate crypto plans globally. If regulators give the green light, the treasury launch is planned for the second half of 2025. Trident will keep investors informed with regular updates on progress and how it’s being managed.

3. Webus International (NASDAQ: WETO)

XRP Allocation: Mandated cap of $300 million

Webus International Limited (NASDAQ: WETO), a global provider of AI-powered premium chauffeur services, announced it has secured funding to support its XRP-focused financial plans in key international markets.

On July 1, Webus revealed it had signed a conditional Securities Purchase Agreement with Ripple Strategy Holdings. This agreement gives Webus access to a senior equity line of credit of up to $100 million, which it can draw from over a 24-month period in amounts ranging from $250,000 to $3 million—pending regulatory and underwriting approvals.

Webus has also signed an agreement with SEC-registered Samara Alpha Management to explore digital asset treasury operations, with a cap of up to $300 million. Focused on potential XRP management, the phased deal will only start once funds are moved into custody wallets. No assets have been invested yet.

4. VivoPower International PLC (NASDAQ: VVPR)

XRP Allocation: $100 million already raised

After raising over $120 million in private funding—led by Saudi royalty—VivoPower has pivoted into digital assets. It has deployed $100 million in XRP, partnered with Flare Network for yield generation, and uses Ripple’s RLUSD as its stablecoin reserve.

5. Wellgistics Health Inc. (NASDAQ: WGRX)

XRP Allocation: $50 million (via equity line of credit)

Wellgistics plans to use XRP for real-time payments across its pharmacy network and as a collateral asset for financing. It’s the first U.S. healthcare firm to integrate XRP directly into operations.

6. Nature’s Miracle Holding Inc. (OTCQB: NMHI)

XRP Allocation: Up to $20 million

Nature’s Miracle Holding Inc. (OTCQB: NMHI), a tech company specializing in vertical farming solutions, announced it will allocate up to $20 million toward XRP, using proceeds from an SEC-approved equity raise. XRP will serve as a long-term reserve asset in the company’s newly unveiled treasury strategy.

This marks Nature’s Miracle as one of the first publicly traded, non-financial firms to adopt XRP for treasury purposes. In addition, the company is eyeing opportunities to stake XRP and deepen its participation in the Ripple ecosystem.

CEO James Li noted XRP’s efficiency in global payments as a major factor behind the move.

7. Hyperscale Data Inc. (NYSE American: GPUS)

XRP Allocation: $10 million (initial commitment)

Hyperscale Data Inc. (NYSE American: GPUS) confirmed that its planned $10 million XRP investment will stay on its balance sheet, even after its subsidiary Ault Capital Group (ACG) spins off, currently expected by December 31, 2025.

Starting August 12, 2025, Hyperscale will release weekly XRP updates. The company is also considering a 36-month lockup and may grow its XRP holdings beyond $10 million, depending on market and funding conditions. It sees XRP as a strong asset for cross-border payments and future financial systems.

8. Worksport Ltd. (NASDAQ: WKSP)

XRP Allocation: Up to $5 million

Worksport Ltd. (NASDAQ: WKSP), a U.S. clean energy and automotive tech firm, has taken its first step into crypto by making a six-figure investment in XRP as part of its new treasury plan.

Back in December 2024, the company announced it would begin putting some of its extra cash (up to $5 million) into digital assets—starting with XRP and Bitcoin. Beyond investing, the company also wants to accept XRP as a payment option on its e-commerce platform.

XRP Holdings: Company by Company Analysis

Companies That Have Actually Invested in XRP

| Company | Investment Date | Amount | Status | Performance | Details |

| VivoPower International (NASDAQ: VVPR) | June 2, 2025 | $100 million (via BitGo OTC desk) | Executed | 25.50% | First large-scale XRP purchase; partnered with Flare for yield. |

| Worksport Ltd. (NASDAQ: WKSP) | January 29, 2025 | Six-figure (undisclosed), part of $5M plan | Executed | 20.40% | Early XRP/BTC buy; plans to accept XRP on e-commerce platform. |

| Hyperscale Data (NYSE American: GPUS) | July 28, 2025 (ongoing) | $10 million plan | Executing | 25.50% | Weekly reports begin Aug 12; exploring 36-month lockup. |

Companies That Have Announced Plans (Not Yet Invested)

| Company | Announcement Date | Planned Amount | Status | Potential Performance | Details |

| Trident Digital Tech (NASDAQ: TDTH) | June 12, 2025 | $500 million | Planned – H2 2025 rollout | 34.10% | Largest XRP treasury plan so far. |

| Wellgistics Health (NASDAQ: WGRX) | May 8, 2025 | $50 million | Planned – equity approved | 31.10% | Long-term XRP reserve strategy. |

| Webus International (NASDAQ: WETO) | July 1, 2025 | $100 million | Planned – funding secured | 25.50% | Equity line in place; purchases not confirmed. |

| Nature’s Miracle Holding (OTCQB: NMHI) | July 23, 2025 | $20 million | Planned – financing raised | -7.80% | Announced during the XRP price peak. |

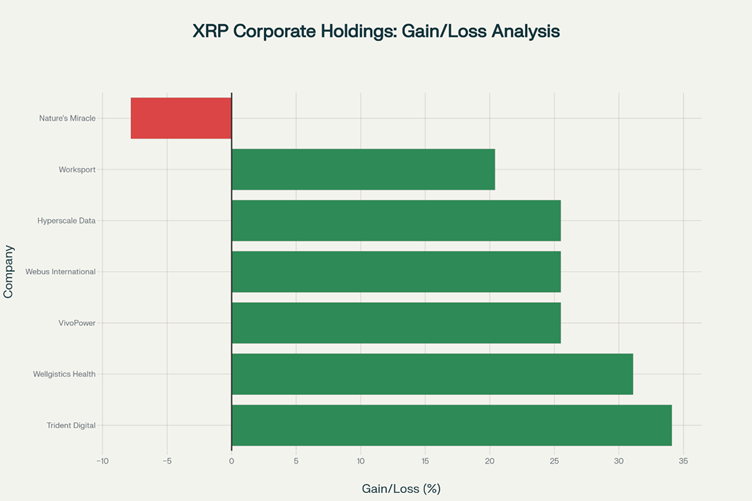

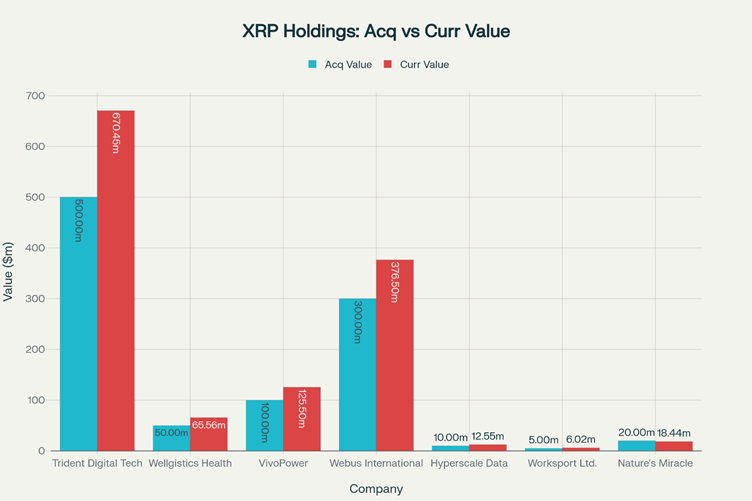

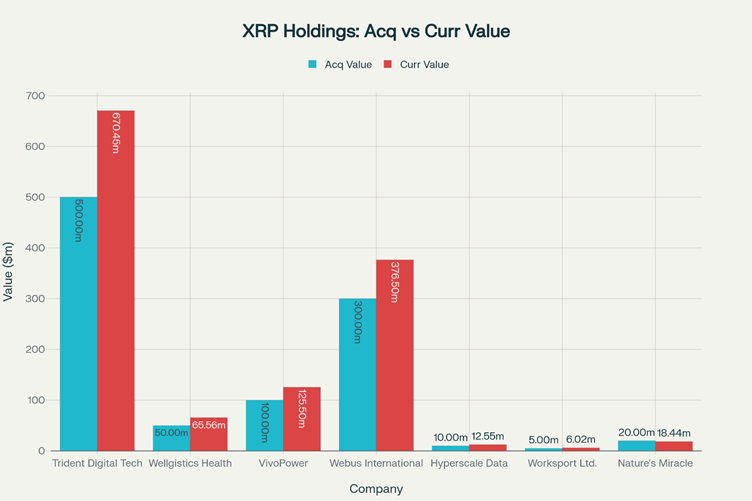

Hypothetical Gain/Loss Statement

This section explores the potential gains or losses public companies would have realized if they had fully invested in XRP on the same day they announced their treasury strategies. While several firms have not yet executed their plans, analyzing the price of XRP on those announcement dates compared to its current market value offers insight into how timing impacts investment performance.

| Company | Acquisition Value ($) | Current Value ($) | Unrealized Gain/Loss ($) | Gain/Loss (%) |

| Trident Digital Tech (TDTH) | 50,00,00,000 | 67,04,50,000 | 17,04,50,000 | 34.10% |

| Wellgistics Health (WGRX) | 5,00,00,000 | 6,55,60,000 | 1,55,60,000 | 31.10% |

| VivoPower (VVPR) | 10,00,00,000 | 12,55,00,000 | 2,55,00,000 | 25.50% |

| Webus International (WETO) | 30,00,00,000 | 37,65,00,000 | 7,65,00,000 | 25.50% |

| Hyperscale Data (GPUS) | 1,00,00,000 | 1,25,50,000 | 25,50,000 | 25.50% |

| Worksport Ltd. (WKSP) | 50,00,000 | 60,20,000 | 10,20,000 | 20.40% |

| Nature’s Miracle (NMHI) | 2,00,00,000 | 1,84,40,000 | -15,60,000 | -7.80% |

Conclusion: Most companies show double-digit unrealized gains, while only one (Nature’s Miracle) shows a loss due to late entry at a higher XRP price. (Assumption)

What If Ripple Labs Treated XRP as a Treasury Asset?

Ripple Labs isn’t a public company in the traditional sense, but it holds a massive amount of XRP, about 40.7 billion tokens, or 41% of the total supply.

Here’s what that could mean:

- Market Influence: With Ripple holding such a large share of XRP, officially treating it as a long-term reserve could significantly reduce available supply, potentially driving prices higher.

- Institutional Signal: If Ripple takes this step, it might encourage other corporations and financial institutions to follow suit.

While Ripple currently uses XRP primarily for utility and liquidity purposes, there’s growing hype around what could happen if Ripple decided to formally adopt a treasury strategy, similar to how MicroStrategy handles Bitcoin.

Why Are Companies Choosing XRP?

In just a few months, corporate interest in altcoin treasuries has exploded. Between early 2025 and July, investments in non-Ethereum altcoins, including XRP, have surged from $200 million to over $11 billion. So what’s driving this sudden momentum, and why is XRP becoming a popular choice?

Since April 2025, around 60 public companies have started integrating crypto into their treasury strategies. While Bitcoin and Ethereum still lead, more firms are branching out, adding XRP to their portfolios as they look to diversify.

Companies turning to XRP point to several advantages:

- Low-cost, fast settlement for cross-border payments

- Global liquidity and strong infrastructure through RippleNet

- Additional utility: Some firms plan to lend or use XRP in yield-generating strategies—something you can’t do with traditional reserves like fiat or gold.

Unlike Ethereum, the XRP Ledger doesn’t support built-in staking, since it doesn’t use proof-of-stake. However, companies can still earn returns using off-chain options:

- Institutional lending programs

- Liquidity provision on exchanges

- DeFi platforms like Flare, which allow XRP to be wrapped and used in smart contracts

These third-party solutions enable companies to generate passive income from their XRP holdings, adding another road of appeal for treasury use.

Conclusion

The Digital Asset Market CLARITY Act plays a solid role in defining the future of XRP by providing a clearer legal distinction between digital securities and commodities. With its focus on network utility and decentralization, the Act supports the case for XRP to be treated as a digital commodity.

This clearer classification removes much of the regulatory uncertainty that has long surrounded XRP. As a result, companies can more confidently incorporate XRP into their treasury strategies and payment systems, knowing they are operating within a defined legal framework.

From agtech and biotech to data and energy firms, these eight companies represent the early adopters of XRP in their financial strategies.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Companies choose XRP for fast cross-border payments, low fees, and utility in yield generation through off-chain staking and DeFi platforms.

Most corporate XRP investments show 20-34% unrealized gains, except Nature’s Miracle (-7.8%) which bought near July’s price peak.

Yes, through institutional lending (VivoPower), Flare Network staking, or DeFi integrations despite XRPL’s non-PoS design.

Japan’s SBI Holdings is the largest institutional holder of XRP, with an estimated allocation of approximately $10 billion. Its strategy is being compared to MicroStrategy’s aggressive Bitcoin purchases.

The Act’s commodity classification reduces regulatory uncertainty, encouraging more firms to adopt XRP for payments and reserves.

Yes, XRP remains a promising 2025 investment due to strong fundamentals, stablecoin use, and potential ETF listings.