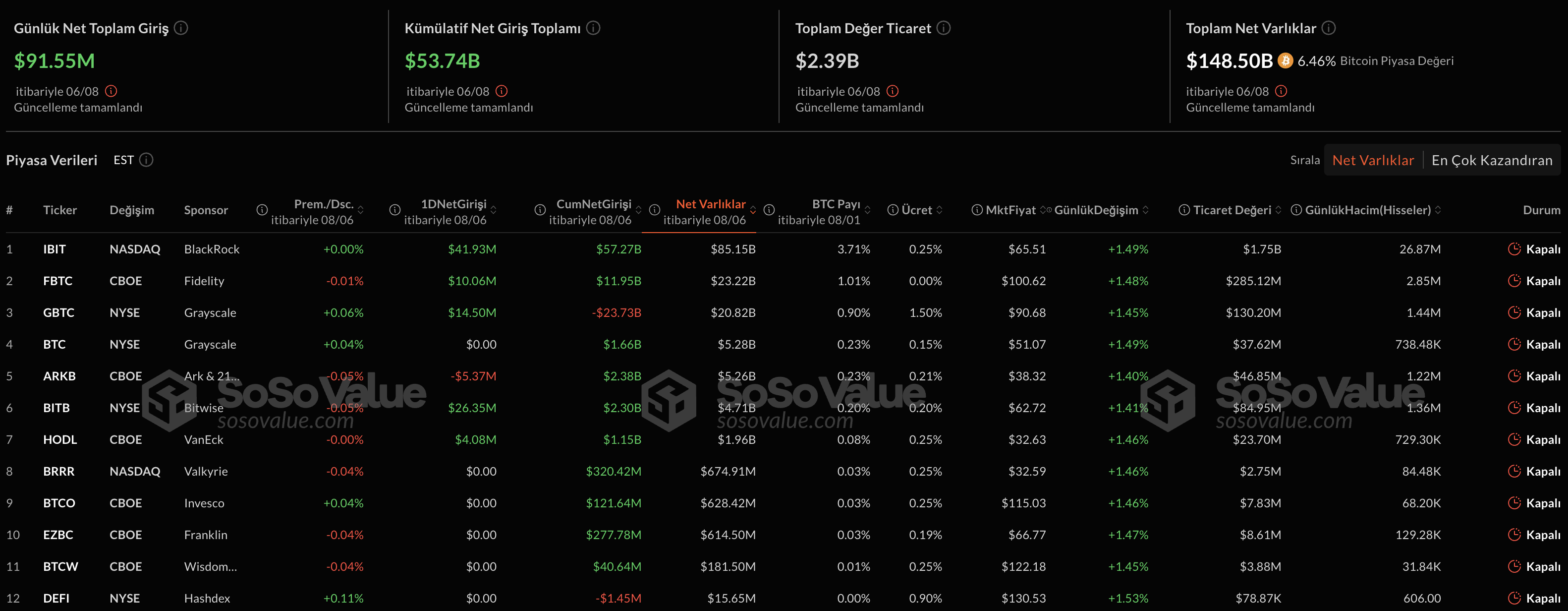

In the USA Spot Bitcoin $114,317.13 ETF‘s four -day $ 1.45 billion output series on Wednesday, August 6 with a net introduction of $ 91.5 million. Sosovalue’s data With a 42 million dollar contribution, Blackrock shows that Ishares Bitcoin Trust (IBIT) leads entrances. Bitwise’s BITB 26.35 million, Grayscale’s GBTC $ 14.5 million, while Fidelity and Vaneck funds returned to the positife. The only ETF ARK & 21shares was the ARD, which was moving in the opposite direction to the series, and $ 5.37 million was recorded.

Capital flow started again to Spot Bitcoin ETFs

Bitcoin Although most of the entrances to the ETFs came from Blackrock, Bitwise and Grayscale, the total figure was able to compensate only the small part of the assets coming out of ETFs in the last week. Still LvRG Director Nick Ruck“Returning to a net entrance shows that investor insecurity is limited and that the current price consolidation encourages corporate buyers,” he said.

Experts ETF flows US central bankHe emphasizes that the (FED) has become a critical indicator that measures the risk appetite with expectations of monetary policy. Investors reflect the expectations of Bitcoin’s long -term adoption by taking short -term volatility to their portfolios. This gives ETF movements a strategic signal value.

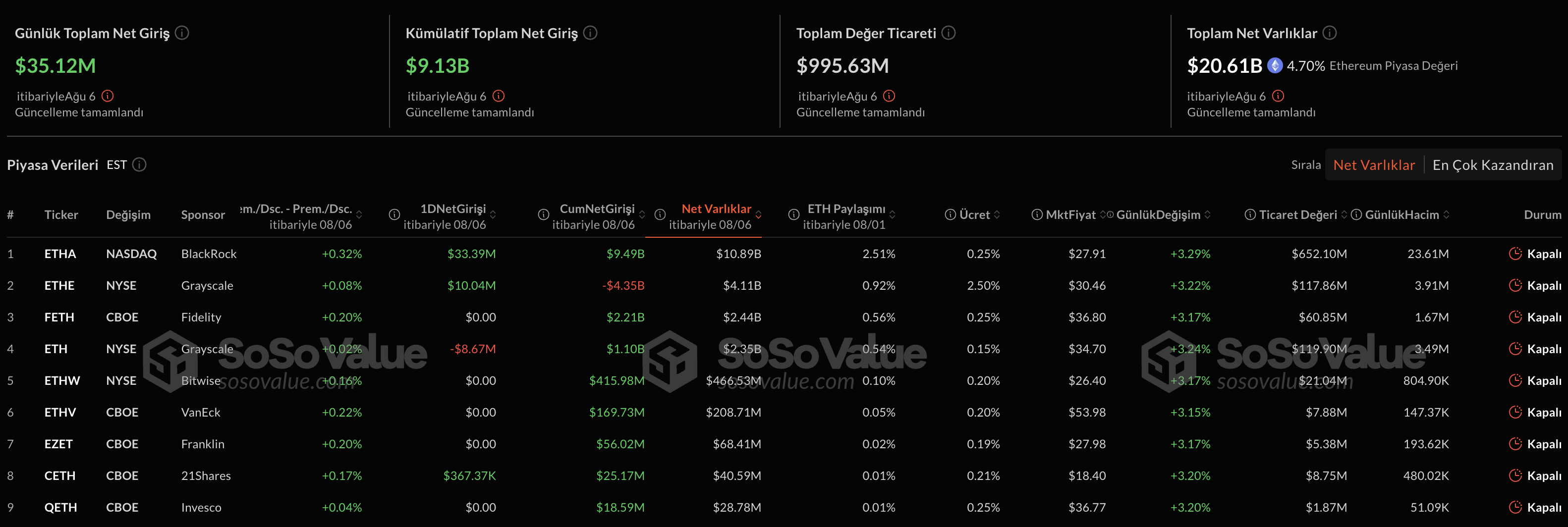

Capital began to flow to Ethereum Etfs

Again on Wednesday according to Sosovalue data Spot Ethereum  $3,623.68 ETF35,12 million dollars of net entrance to their happened. Blackrock’s ETHA fund entered $ 33.39 million, while Grayscale’s Ethe has received $ 10 million entry. Mini Ethereum Trust’dan 8.67 million dollars output was seen.

$3,623.68 ETF35,12 million dollars of net entrance to their happened. Blackrock’s ETHA fund entered $ 33.39 million, while Grayscale’s Ethe has received $ 10 million entry. Mini Ethereum Trust’dan 8.67 million dollars output was seen.

The change in the direction of capital came after a two -day negative trading session of $ 617 million. Analysts, as in Bitcoin, the price digestion phase has reduced investors’ cost average and paved the way for the recovery of the volume, he says. Corporate demand is thought to be permanent, albeit wavy.

CryptoappsyAccording to the data BTC While trading at $ 114 thousand 556 with an increase of 0.56 percent in the last 24 hours, Eth In the same period, 1.67 percent rise with 3 thousand 690 dollars changing hands.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.