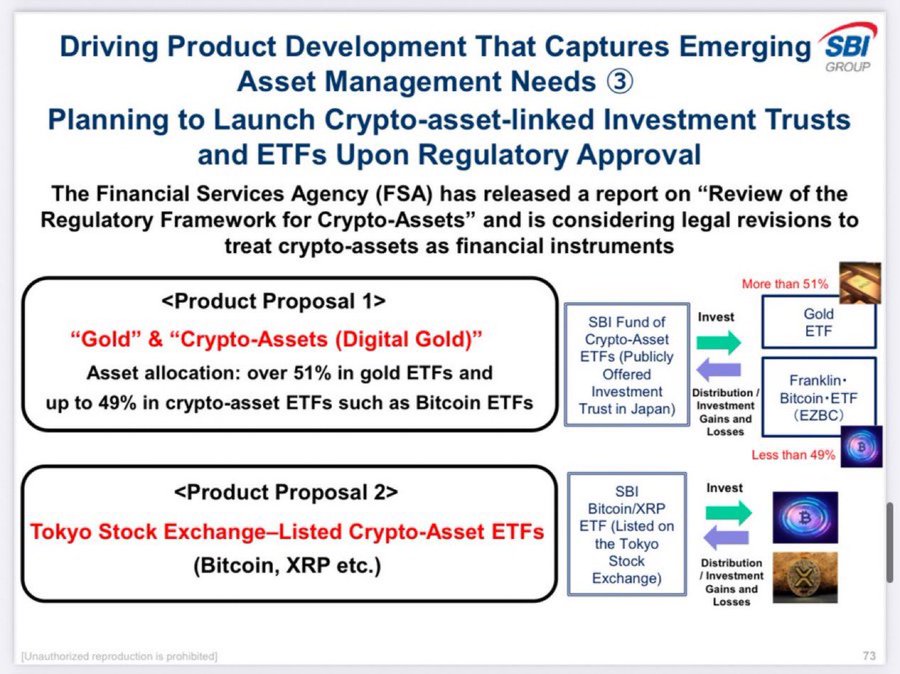

Japan -based in the fields of financial services, asset management and biotechnology SBI HoldingsHe applied to the Financial Services Agency (FSA) for two new crypto money ETFs. Company, XRP and Bitcoin $114,988.95(BTC) “Crypto-Essets Etf çıkan, which offers direct investment, announced the“ Digital Gold Crypto Etf ”products that divide more than half of its portfolio into Gold ETFs 2025 in the second quarter financial results. Applications are currently in the regulatory approval stage.

Structure of Crypto-ASSETS ETF

CRYPTO-ASSETS ETFCombines XRP and Bitcoin under a single fund roof. In case of approval, corporate investors in Japan will be able to access these two crypto money directly without resorting to intermediary institutions. In this way, the liquidity channels of the XRP will expand and the interest in Bitcoin will increase.

The application is considered within the scope of FSA’s crypto currency regulations. The possible approval schedule has not yet been shared, but sector experts are waiting for a final decision within a few months. SBI’s Ripple  $3.07 ongoing cooperation with XRP reinforces the confidence in the ecosystem.

$3.07 ongoing cooperation with XRP reinforces the confidence in the ecosystem.

In the past, the company has gained experience in creating blockchain -based payment systems and stablecoin reserves. Now this knowledge is new ETFwill be used in the management of the s. Thus, both technical infrastructure and adaptation to the regulation process will be advantageous.

Gold and crypto money balance

Digital Gold Crypto EtfIt adds stability to the portfolio by dividing at least 50 percent of its assets into gold ETFs. The rest of the portfolio consists of crypto coins such as Bitcoin and XRP. With this hybrid model, investors with low risk tolerance are targeted.

GoldIn the safe port feature will balance the volatility in crypto currencies. The SBI aims to attract the attention of both traditional investors and crypto currency enthusiasts. Market analysts emphasized that liquidity flow will increase and similar products are taken as an example thanks to this structure.

Fund composition with the protection characteristics of gold crypto currencyIt offers the opportunity to grow together. Investors will be able to provide portfolio diversification with a single vehicle.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.