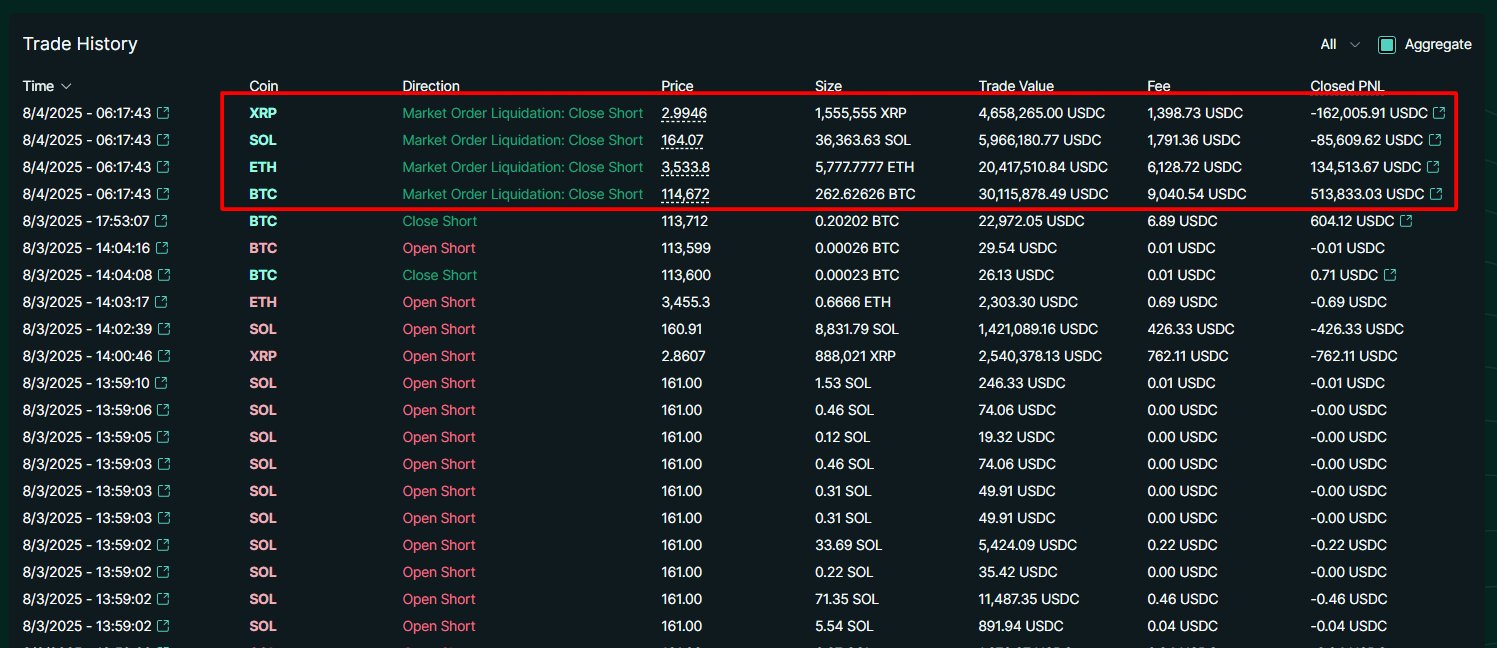

Decentralized derivative platform HyperliquidAn investor using the name Qwatio in the case of the XRP’s price exceeding the $ 2,894 threshold with a damage exceeding $ 650 thousand was partially liquidated. Whale Bitcoin in the position basket with a total of 18.6 million dollars  $113,966.4040X, Ethereum

$113,966.4040X, Ethereum  $3,487.7125x, solana 20x and XRP 20x leverage by playing a decline by playing short position. Onchain lens data XRP It shows that the liquidation in the position took place on the morning of 4 August 2025. The heaviest blow among the positions of the investor XRP position altcoinWith the rise of the opposite direction in Solana, the damage increased the damage.

$3,487.7125x, solana 20x and XRP 20x leverage by playing a decline by playing short position. Onchain lens data XRP It shows that the liquidation in the position took place on the morning of 4 August 2025. The heaviest blow among the positions of the investor XRP position altcoinWith the rise of the opposite direction in Solana, the damage increased the damage.

Other high leverage positions such as XRP are also at risk

Onchain Lens According to the data he reported The liquidation started with the triggering of the margin requirement and swept most of the position position in the order book. The rise in the price of the XRP caught the liquidation price of the whale, not the profit target, and caused hundreds of thousands of dollars in a single item in a single item. Solana The second coup came when he recovered strongly. Although the investor’s Bitcoin and Ethereum Short are still open, these high leverage positions are at risk. Analysts warn that such a risk profile can be a millionaire or reset within seconds.

Approximately 650 thousand dollars of damage stands out as the largest XRP liquidation of the whale recorded. The rest of the position remained vulnerable to the volatility in the market, while the Hyperliquid collateral rate was based on the critical threshold. As the liquidity buffer of the investor narrows, additional liquidations are likely to come.

Investor’s gigantic loss series

In June, the same investor had lost a total of 10 million dollars as a liquidation six times in three days. In July, the deletion of the Short basket, which contained $ 334 million, led to an additional loss of 25 million dollars. The first big Long trials in March, which has leverage rates up to 50x, are the US strategic crypto currency When the reserve coincided with the rumors of the rumors, he triggered the discussions of “information from inside”.

The most dramatic decrease in the assets of the investor took place at the beginning of July. The account balance fell from 16.3 million dollars to 67 thousand dollars. The last partial liquidation shows that the whale maintains the same aggressive strategy and that high volatility creates a greater danger to it in every new move. Analysts state that such high leverage use will push investors to the “win or bit” point, and state that it may continue to melt.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.