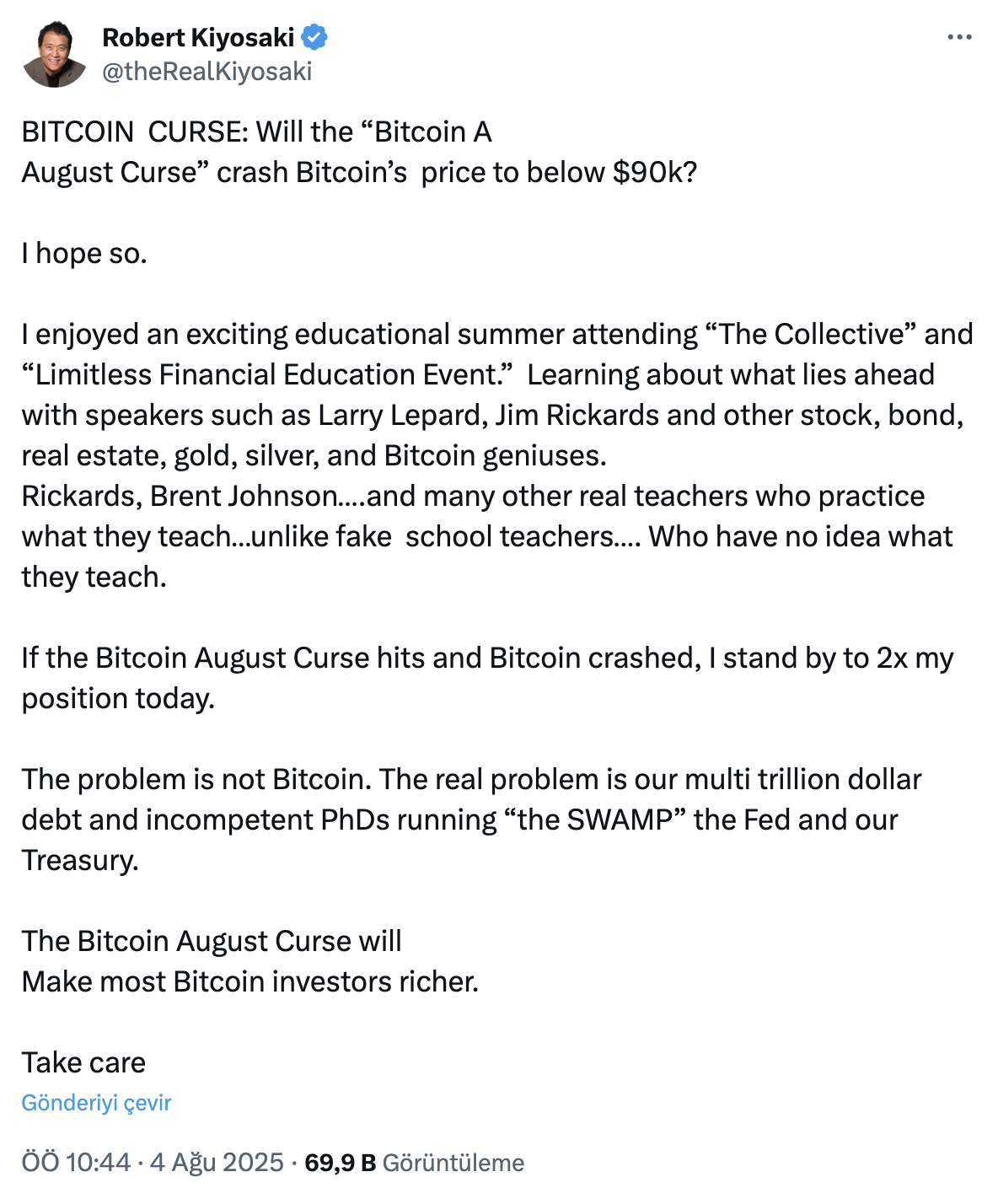

Financial writer Robert KiyosakiBitcoin  $113,966.40‘s (BTC) price falls below 90 thousand dollars will double the amount of BTC announced. Kiyosaki, the US’s increasing debt and the Fed’s monetary policy on Bitcoin as the largest external pressures, while the largest crypto currency reiterated that “real money”. The famous name believes that the possible correction in Bitcoin can be triggered with the “August effect ve and the price in the long run can rise to $ 200,000.

$113,966.40‘s (BTC) price falls below 90 thousand dollars will double the amount of BTC announced. Kiyosaki, the US’s increasing debt and the Fed’s monetary policy on Bitcoin as the largest external pressures, while the largest crypto currency reiterated that “real money”. The famous name believes that the possible correction in Bitcoin can be triggered with the “August effect ve and the price in the long run can rise to $ 200,000.

Background of Kiyosaki’s Bitcoin purchase plan

Kiyosaki, in the past, as the opportunity to buy price decreases. To repeat this model now Preparing. The plan is quite simple and BitcoinAs soon as the price breaks the $ 90 thousand dollars, it is in the form of direct additional purchase. According to him, the retreat at the price will not be permanent because weakness is not the basis of the presence, but from macroeconomic winds.

The model, which he calls the “August effect”, is based on the assumption that sales pressure will increase with the fall of liquidity in the summer. Kiyosaki reminded that it made significant profits in previous cycles by using these decreases as an opportunity to purchase these decreases. Technical analysts say that the demand wall stacked below $ 90,000 strengthens the region pointed out by Kiyosaki.

Kiyosaki defending the same plan in his past statements, reminded that the periods of fear are the most productive periods to create a reserve.

The impact of US debt and FED policies on the market

Macro Front USArapidly increasing debt and FedThe strict monetary policy of the analysts is in the focus of analysts. Kiyosaki believes that the increasing debt burden will gnaw the purchasing power of the dollar and that Bitcoin will maintain its value with its limited supply. According to CoinMarketCAP data, the biggest crypto currency At the time of the news, 114 thousand 617 dollars are traded.

Market participants believe that Kiyosaki’s statements can echo on social media and increase the purchase appetite on the individual side. Nevertheless, it is emphasized that the fed determinant in the price will be determined by Fed’s monetary policy decisions, regulatory signals and developing network technologies. While the regulatory front has not yet expected a major movement, technological updates are considered to soften possible price fluctuations.

Analysts, on the other hand, stating that the price of over $ 100 thousand remains strong despite the news flow and that the possible decline can be recovered in a limited time, warns against the risk of volatility.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.