Wall Street’s interest in Ethereum is heating up. According to a top strategist, institutional adoption could eventually push ETH’s price to $60,000.

In a detailed thread on X, Thomas (Tom) Lee, Managing Partner at FSInsight and a well-known Wall Street strategist, laid out why institutional investors are rapidly gravitating toward Ethereum ($ETH). His remarks come as ETH continues to trade around $3,600, far below its implied value based on historical ETH/BTC ratios.

Why Wall Street Is Buying Ethereum?

According to Lee, several key factors are making Ethereum the go-to blockchain for traditional finance:

- Legal clarity in the U.S.: ETH is widely considered the most compliant smart contract platform in the U.S.

- Impeccable uptime: Ethereum has experienced zero downtime in its 10-year history.

- Network effect: Major institutions like JPMorgan and Robinhood are building or tokenizing assets on Ethereum.

“Wall Street is running to ETH,” Lee said, noting that Ethereum’s narrative is stronger today than it was a year ago.

Wall Street Will Stake ETH

Lee emphasized that Wall Street isn’t just using Ethereum; it will stake ETH to participate in the network’s value layer.

This trend is part of a larger shift where real-world assets (RWAs) are being tokenized on Ethereum.

Lee noted, “As Wall Street financializes the world onto the blockchain, they will stake ETH to be involved in Ethereum’s growth.”

- Also Read :

- Visa and Mastercard Say Stablecoins Are Not a Threat

- ,

Is Ethereum Price Undervalued?

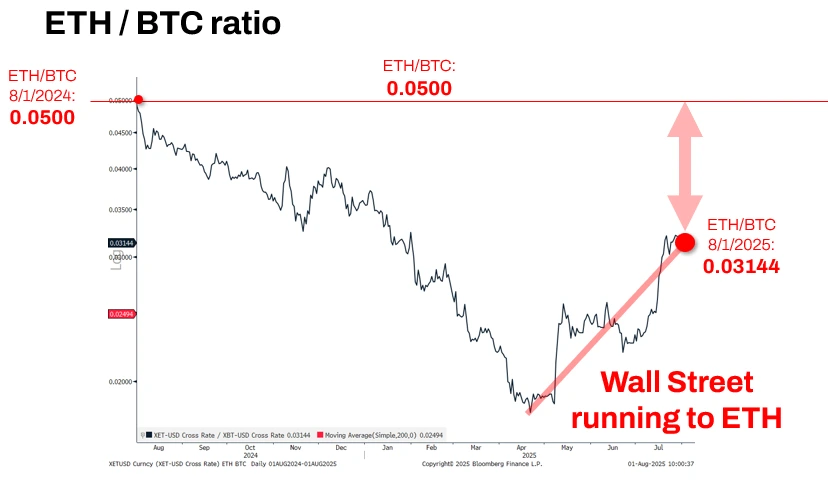

Lee pointed to the ETH/BTC ratio as a key indicator. A year ago, the ratio stood at 0.0500. With Bitcoin currently around $114,000, this implies an ETH valuation of approximately $5,707 a significant premium to the current market price.

“This argues the ETH/BTC ratio should recover,” Lee stated, emphasizing the disconnect between current pricing and Ethereum’s growing dominance.

“The ETH story is stronger today than August 2024,” said Lee.

ETH Price to $60,000?

Lee predicted that if Ethereum becomes the foundation for financial markets, the ETH price could be worth $60,000 or more in the future.

He’s clear that this isn’t a forecast, just a possibility. But given the way institutions are aligning with Ethereum, it’s a scenario that’s suddenly not so far-fetched.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Yes. The ETH/BTC ratio implies $5,707 ETH price (vs current $3,600). Analysts note disconnect between pricing and Ethereum’s growing institutional dominance.

Beyond transactions, institutions will stake ETH to participate in network growth as they tokenize real-world assets (RWAs) on Ethereum’s blockchain.

Key advantages: 10-year perfect uptime, regulatory clarity in US, and major firms already building financial infrastructure on its network.