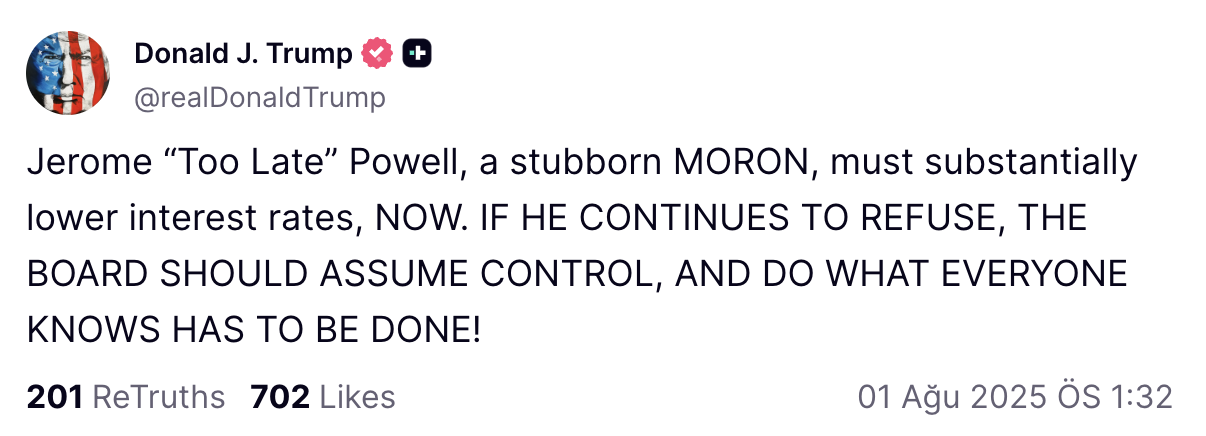

US President Donald TrumpOnce again, the Central Bank (Fed) President JErome PowellHe targeted and invited the Fed to take action. Trump, who shared at Truth Social on August 1, criticized Powell in a harsh language, targeting the Fed’s policy interest in the range of 4.25-4.50, and said, “The Board should take control if the Powell does not download interest”. FED President, after the FOMC meeting on July 30, at a press conference in Washington, the inflation target was still far away and patiently confused the markets by stating that they would follow the data.

Trump’s pressure on Fed continues

Fed officials ended on July 30 FOMC In a statement made after the meeting, the tariffs of customs pushed the prices up and decided to pass the interest rate cut for the fifth time. Following the announcement of the interest rate decision, Powell said that they followed a very selective approach and that they would look for clearer signals to download interest at the September meeting. On the other hand, Trump reiterated the call of ıyla step quickly in favor of American debtors verilen, citing Europe’s interest repeatedly, and described the independence of the Fed as “so -called”.

Trump did today exit Although it is a continuation of the “Board must take action” message on July 23, it carries a harder tone. In the last interest rate decision, two FED members have fallen into the “immediately interest rate reduction” output. But Powell still has the support of the majority. In accordance with the Fed Law, the Board of Seven and the Five Regional Presidents vote together. This balance makes Trump’s demand for “institutional control” in the act.

Experts, Trump’s output Fed He says that he can increase the political pressure on him, but it does not seem possible that the Board will change the path to interest without dismissing Powell. In case of in-house discussions, it is said that the calls for reform calls for double-target (price stability-confidence) mandate can be moved to the congress agenda. Nevertheless, Powell continues to offer a determined image to protect the institutional line by saying “independence is very important”.

It brought a decline in crypto coins

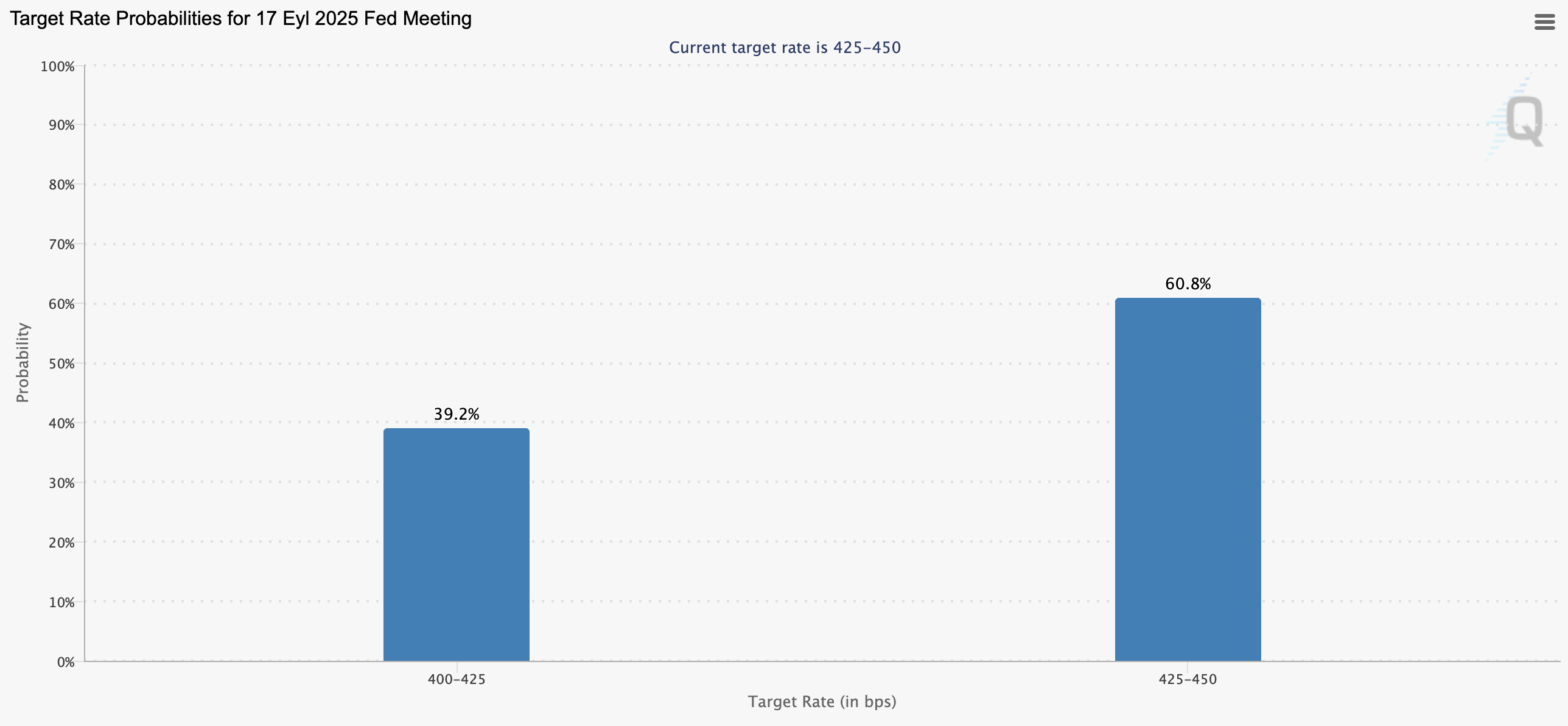

Fedwatch According to the data, the possibility of a 25 -base discount in September is 58 percent, while the interest rate decision is 58 percent, for 39.2 percent after Powell’s statements. declined. Mortgage interest rates increased by 20 basis while the return curve is horizontal. The S&P 500 reacted with a limited decline because the last interest rate decision came within the expectations, but Powell’s statements and Trump’s last customs tariffs on July 31 Crypto Money Market brought a decline in global markets, including.

The biggest crypto currency Bitcoin (BTC)  $115,158.343.23 percent in the last 24 hours with a decrease to $ 114 thousand 705, while the guide of the Altcoin market Ethereum (ETH)

$115,158.343.23 percent in the last 24 hours with a decrease to $ 114 thousand 705, while the guide of the Altcoin market Ethereum (ETH)  $3,628.69 In the same period, 6.31 percent decreased to 3 thousand 600 dollars. Investors are now waiting for the employment and August inflation data to be announced in the coming days.

$3,628.69 In the same period, 6.31 percent decreased to 3 thousand 600 dollars. Investors are now waiting for the employment and August inflation data to be announced in the coming days.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.