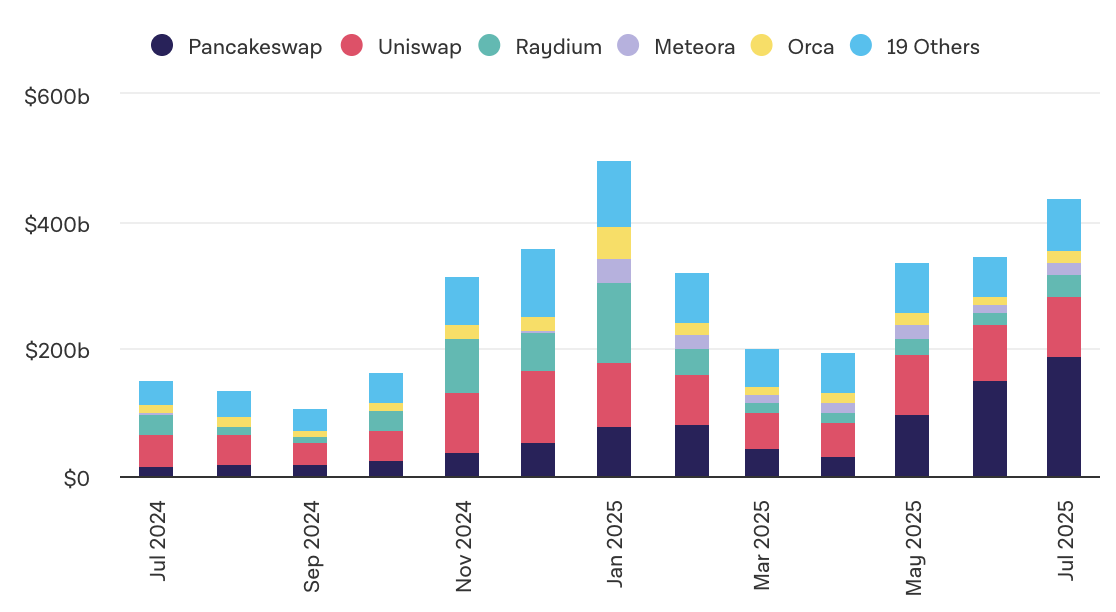

Altcoin project behind Cake Coin’s decentralized crypto currency exchange Pancakeswap In July, he strengthened his leadership with a Spot transaction volume of $ 188 billion. According to the fashion show data, the stock market has left behind the volume performance of 151 billion dollars in June and assumed approximately 43 percent of the total -decentralized stock market transactions. The closest competitor of the platform Uniswap (UNI) was able to reach only 94 billion dollars. This difference made Pancakeswap’s superiority prove. This result, which was caught in the second month, reflects that the decentralized stock market ecosystem has clearly shifted the center of grain to the BNB Chain -based project.

Record Spot Volume from 188 million dollars in July

At the end of June, the decentralized stock market – Central Stock Exchange Spot transaction rate was moved to the historical summit with 27.9 percent, but Pancakeswap’s share remained constant, even though Temmmuz decreased to 23.3 percent. The volume of $ 188 billion recorded in July corresponds to more than two -fifth of all spot transactions on non -decentralized stock exchanges. This size Raydium (Ray) or Aerodrome (Aero) left behind the volume of other Layer-1 stock exchanges, and narrowed the market share of competitors other than BNB Chain.

The fact that Uniswap stayed at $ 94 billion allowed the deficit between the two stock market for the first time exceeding $ 90 billion in a single month. To the Data of Defilıama according to Pancakeswap’s automatic market -maker model and return farm services exceeded $ 430 million. This size makes the stock market more attractive in terms of liquidity providers.

Basic developments that support Pancakeswap’s success

Behind the volume increase in Pancakeswap, there are three critical innovations. Especially Binance Alpha Thanks to its integration, millions of users can perform decentralized stock market without changing wallets. Pancakeswap Infinity Ethereum (ETH)  $3,842.37Blockchain, which is offered in networks such as Arbitrum (ARB) and Solana (left), increased the volume by adding new liquidity channels to the stock market.

$3,842.37Blockchain, which is offered in networks such as Arbitrum (ARB) and Solana (left), increased the volume by adding new liquidity channels to the stock market.

The increase in wage revenues drew the wallets looking for returns by feeding the pool prizes to the stock market and increased the transaction volume directly. With the closing of July, the stock market has achieved permanent scale superiority in the decentralized stock market market.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.