Crypto Money Market It was shaken with harsh sales on 1 August. The total market value decreased by 2.4 percent in the last 24 hours to 3.78 trillion dollars. To CoinMarketcap’s data according to Bitcoin (BTC)  $118,426.75 While decreasing more than 2 percent to 115 thousand 957 dollars, Ethereum (ETH)

$118,426.75 While decreasing more than 2 percent to 115 thousand 957 dollars, Ethereum (ETH)  $3,842.37 3.6 percent decreased to 3 thousand 717 dollars. Solana (left) 4.8 percent, Cardano (island)

$3,842.37 3.6 percent decreased to 3 thousand 717 dollars. Solana (left) 4.8 percent, Cardano (island)  $0.779847 4.89 percent, dogecoin

$0.779847 4.89 percent, dogecoin  $0.222723 (Doge) lost 5.87 percent and XRP depreciated by about 3.7 percent. The Altcoin season index decreased to 35 out of 100, and the market domination shifted to Bitcoin again.

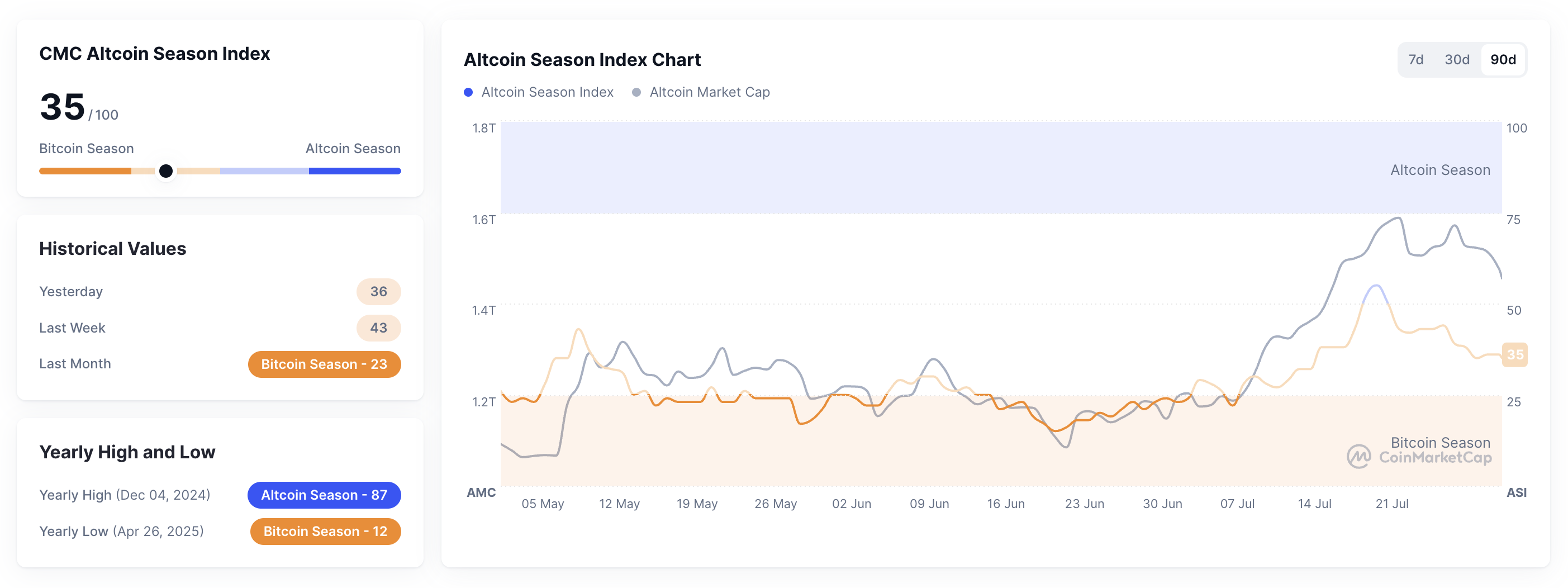

$0.222723 (Doge) lost 5.87 percent and XRP depreciated by about 3.7 percent. The Altcoin season index decreased to 35 out of 100, and the market domination shifted to Bitcoin again.

Daily depreciation in the crypto money market

Bitcoin with EthereumThe decline in the Altcoins triggered harder losses. Investors quickly exit the assets at the lower end of the risk scale. Solana While having difficulty holding at $ 171, CARDANO And Dogcoin He gave back a significant part of his five -month earnings. XRPWhen the 3.7 percent decline in the process volume, the cautious atmosphere in the market reinforced.

CoinMarketcap Altcoin Season Indexto 35 levels of descending It shows that capital is consolidated in Bitcoin, which is seen as a safe port. The fact that the index was found at 43 levels last week reveals how intense the sales pressure of the last 24 hours is on the Altcoin front.

In the meantime, only a day of 631.98 million dollars in the market was deleted from the market. This is using leverage crypto currency It means that investors are caught unprepared for the decline.

Macroeconomic printing and tariff effect came to the fore in the fall

US central bank (FED) On Wednesday, leaving the interest rates constant, he gave harsh warnings pointing to economic slowdown. Although the White House’s call for clearer regulations provides short -term recovery in the market, the statements from the Fed front rated the risk appetite. With the withdrawal of liquidity, the most fragile class was crypto coins again.

Moreover, the president Donald TrumpThe aggressive tariff application, which was activated on August 1, strengthened the sales wave. Traditional markets pricked the risk of inflation and exchange volatility due to tariffs, while short -term uncertainty pushed crypto currency investors to close positions. Even Bitcoin, which is usually seen for long -term protection purposes, has received its share of the desire to return in cash. Altcoins were shaken by deeper losses.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.