Bitcoin (BTC)  $115,158.34 price After the US market opening, it fell to $ 113,988 and is moving towards daily closing. With the closure of the stock exchanges, we will see if there is another wave of volatility specific to crypto currencies. First, let’s take a quick summary and then ENA and ETH price reviews.

$115,158.34 price After the US market opening, it fell to $ 113,988 and is moving towards daily closing. With the closure of the stock exchanges, we will see if there is another wave of volatility specific to crypto currencies. First, let’s take a quick summary and then ENA and ETH price reviews.

Crypto Coins Summary

The weak employment report increased forecasts for interest rate cuts. Prepared for the effects of customs duties on the economy, the stock market started the day with a decline. The losses of crypto -oriented companies were more severe because the crypto tends to fainted more and fainting.

USA ISM Manufacturing PMI It came low and the markets are waiting for 2 discounts before the end of the year. You see how the expectation up to 6 this year has changed. Fed member Bostic says inflation is increasing, while this year, MAKS 1 interest rate reduction expects. As we move on to Saturday, we will see in the graphics that everything that happened this week melts in a crucible and something similar to. The risk of decrease is evident.

Ethereum and ENA COIN

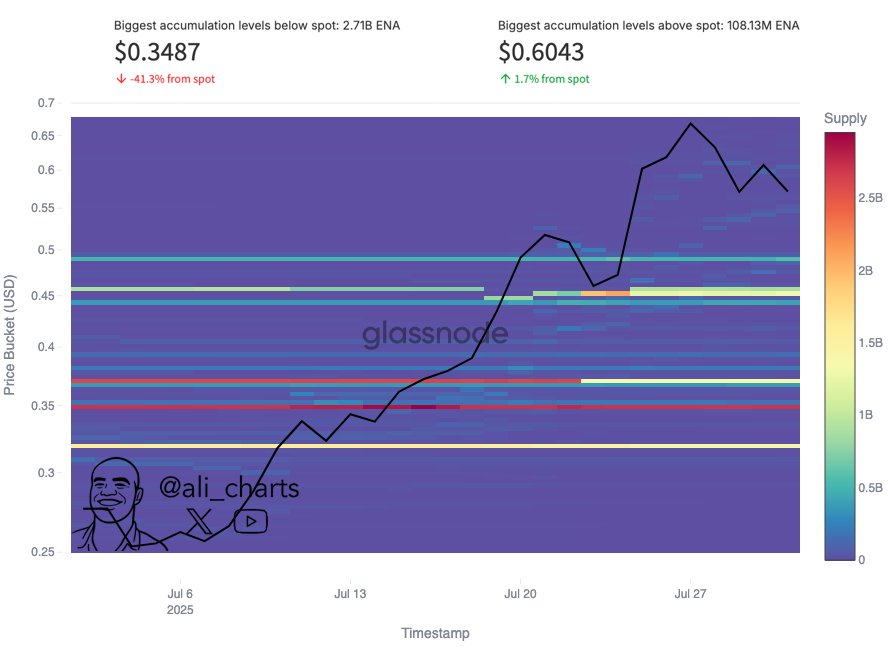

Ali Martinez pointed out the following support levels for ENA Coin, according to cost -based distribution data. When one of them is broken, the price can go fast because it is thought to the other. In futures, it is usually trying to turn into a gaining movement with a strong acceleration between the two range. ENA COIN Important support levels for $ 0.47 and $ 0.44 after $ 0.35.

Poppe Eth He wrote the following;

“July has been an important month of an important increase for ETH. This is directed by the markets where we will rise significantly in the coming months.

However, this does not mean that there will be no corrections. This is one of them, a good moment for the entrance. ”

Even though it says a good moment for the entrance, the concern of new developments that will be experienced next week if we enter the weekend volume lack of volume today can justify big rudeness. Time will show whether Poppe will be right.

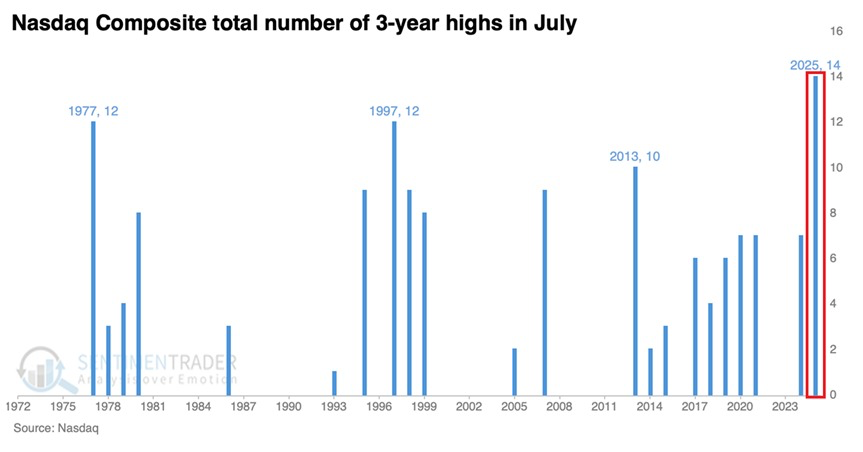

There is no doubt that July is impressive. US -based Crypto ETFIn July, we saw 12.8 billion dollars. With the asset management exceeding $ 10 trillion, even Vanguard’s S&P 500 fund was behind Bitcoin. Moreover, he did this when it was a historical July month for the stock market.

“According to Sentimentrader, Nasdaq Composite reached the highest level of all time in July 14 times and broke the record of July. This figure has twice the sum of 2024 and exceeded the previous July records broken in 1977 and 1997.”

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.