Ethereum is showing signs of cooling off after a strong rally, slipping slightly from its recent highs near $3,900. While the broader crypto market remains resilient, a recent on-chain move has raised concerns among traders: a potential institutional sell-off could be underway.

$47 Million ETH Transfer to OKX

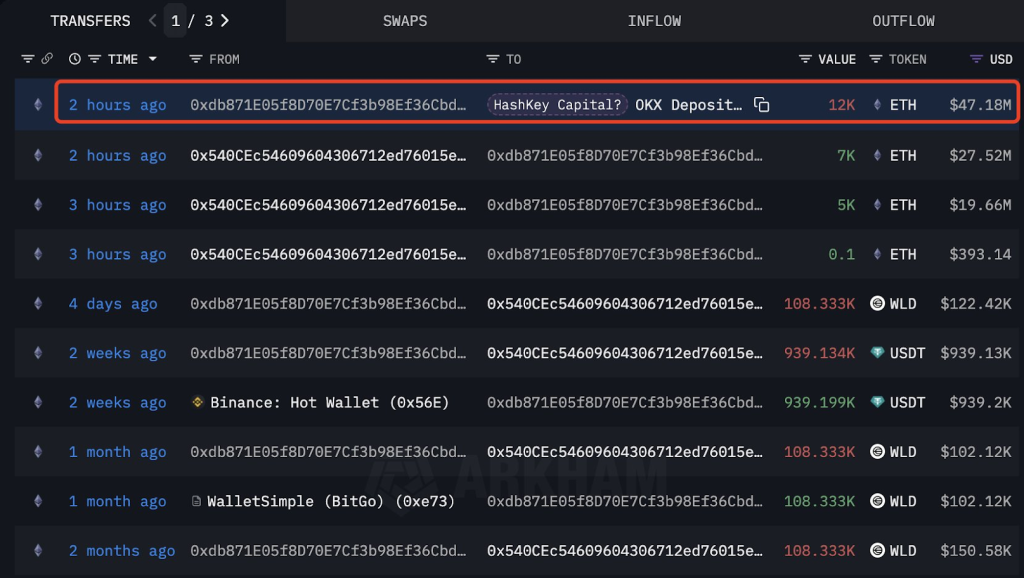

According to on-chain tracking platform Lookonchain, a wallet likely linked to HashKey Capital, a major crypto investment firm, transferred 12,000 ETH (worth approximately $47.18 million) to the OKX exchange just two hours ago.

Such large transfers to centralized exchanges often indicate that the sender is preparing to sell, leading to speculation that HashKey may be taking profits after Ethereum’s recent price surge.

Ethereum Rally at a Turning Point?

This move comes just days before the U.S. Federal Reserve’s interest rate decision, a key macro event that could affect risk assets like crypto. Analysts suggest some institutions might be de-risking or locking in profits before potential market volatility.

Ethereum had seen a solid breakout earlier this month, but whale activity like this often signals short-term corrections—especially when markets are on edge ahead of macroeconomic catalysts.

Ethereum Price Analysis

Top crypto analyst Michaël van de Poppe also weighed in on Ethereum’s price action. He noted that although ETH recently broke out, the move lacked strong momentum.

“I wouldn’t be surprised to see a short correction or a liquidity sweep before the next leg up,” he said.

Van de Poppe believes the recent volatility can present opportunities for short-term traders, but might shake confidence among long-term holders.

- Also Read :

- Top 3 Altcoins, Which Will Rally This Week

- ,

Despite the sell-off fears, Ethereum remains technically strong:

- Current Price: $3,887

- RSI: Neutral at 59.21

- MACD: Slight bearish crossover

- Support Zones: Fair Value Gaps around $3,865–$3,870

- Major Support: Holding above $3,800 critical level

This suggests that while a short-term correction is possible, ETH remains in an uptrend unless $3,800 is broken decisively.

Is This Just a Dip or Start of a Larger Move?

Ethereum’s fundamentals remain strong, backed by institutional interest, upcoming developments in DeFi, and speculation around spot ETH ETFs. If macro conditions remain favorable, many analysts still expect ETH to retest $4,000 and higher in the coming weeks.

However, with large players like HashKey potentially offloading holdings, short-term caution is warranted. All eyes now turn to the Fed’s rate decision, which could either trigger a broader market rally—or deepen profit-taking.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

A wallet tied to HashKey Capital moved 12,000 ETH to OKX, signaling a potential institutional sell-off.

A hawkish Fed stance could trigger profit-taking, while dovish signals may boost Ethereum toward $4,000.

Large ETH transfers to exchanges often signal selling, raising short-term correction risks for Ethereum.