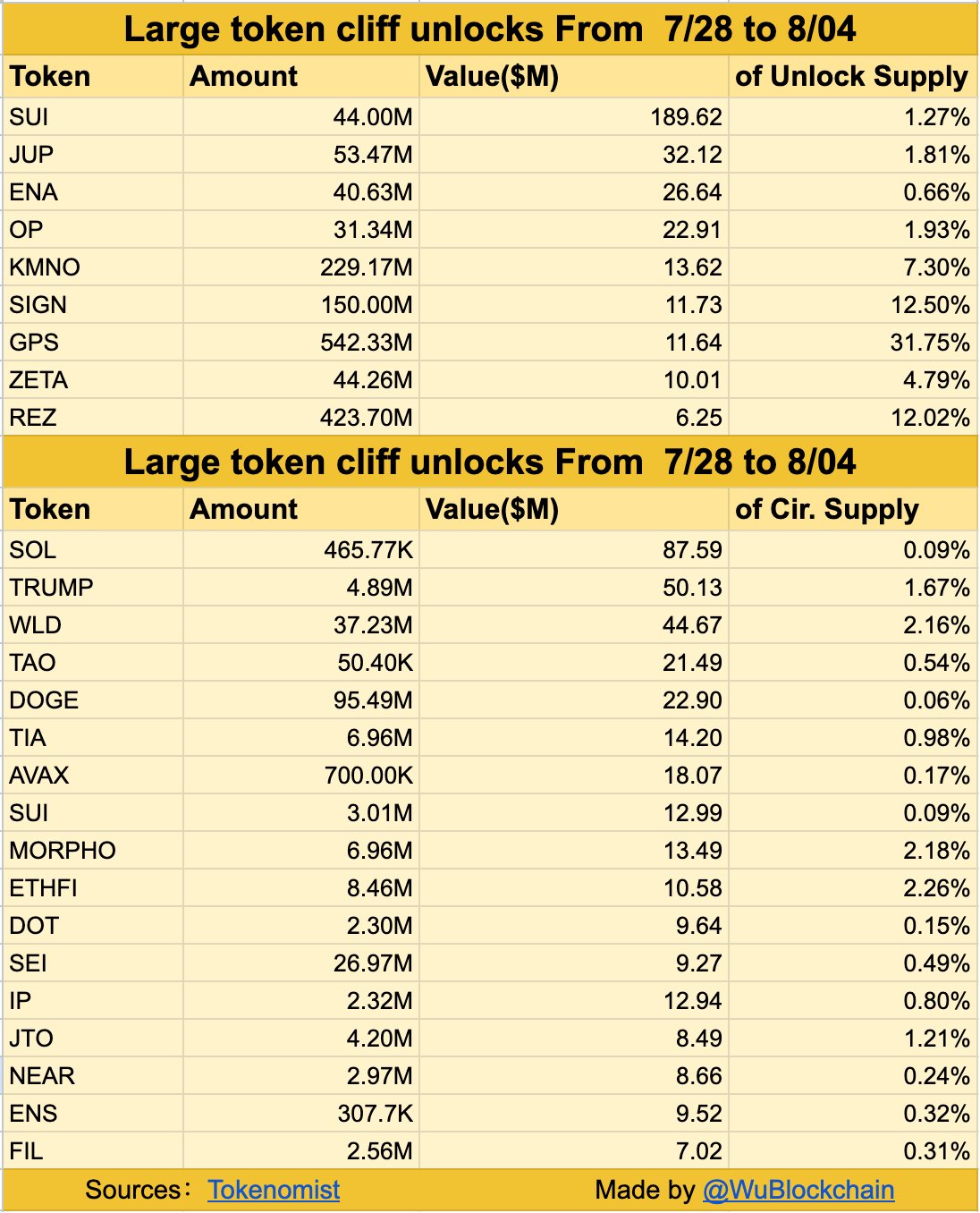

According to the key opening data compiled by Wublockchain Dogcoin  $0.240277Between 28 July and 4 August, 95.5 million DOGE to circulate sting. Although this supply expansion of 22.9 million dollars seems to create sales pressure at first glance, it is not expected to disrupt the price of the price thanks to the daily volume of exceeding $ 700 million in stock exchanges. Investors are pre -prepared, as the process is part of Dogecoin’s transparent and predictable supply calendar. Currently, Dogge, which travels horizontally around $ 0.24, is facing support at $ 0.22 in the short term and resistance at 0.28 dollars. Despite the opening Coin key opening, the market is focused on possible breakage in the $ 0.25 dollars.

$0.240277Between 28 July and 4 August, 95.5 million DOGE to circulate sting. Although this supply expansion of 22.9 million dollars seems to create sales pressure at first glance, it is not expected to disrupt the price of the price thanks to the daily volume of exceeding $ 700 million in stock exchanges. Investors are pre -prepared, as the process is part of Dogecoin’s transparent and predictable supply calendar. Currently, Dogge, which travels horizontally around $ 0.24, is facing support at $ 0.22 in the short term and resistance at 0.28 dollars. Despite the opening Coin key opening, the market is focused on possible breakage in the $ 0.25 dollars.

Could Coin lock opening may cause a decrease?

Dogecoin has deep order books on the biggest stock markets 95.5 million units DogIt prevents the liquidity from shaking liquidity. Because the amount in question corresponds only to a small portion of the daily transaction volume. The shifts that may occur in the orders are compensated within seconds thanks to the high market liquidity. Moreover Dogecoin supply It does not create a surprise effect as it is distributed to the market with regular monthly lock openings instead of sudden lock openings. This predictability keeps the seller pressure at the lowest level. Investors see the process as a monetary policy that works like a clock.

The Dogecoin community refers to the fact that similar Coin key opening in the past months have a minimal impact on the price. Although the price is tested against volume, the price fluctuates for a short time, but the long -term trend is protected without being affected. This constitutes an important historical defense line that nurtures confidence in the market. Crypto investors’ application – the reason will surprise you!

Critical levels in Dogecoin’s price chart

In the beginning of July, the price of snow purchases from the $ 0.28 summit attracted the price to $ 0.24. Here, an average of 50 -day exponential moving is a powerful ground of around 0.22 dollars. If the sellers cannot break this barrier, the investor interest may rise again. The technical appearance indicates a new jam in the $ 0.25 – 0.28 dollar band with shallow shifts supported by the volume.

Approaching coin lock openingVolatility may remain low if the potential sales of $ 22.9 million will be caused by a volume of $ 22.9 million. In this scenario, the eyes will be accelerating that the permanent closing over $ 0.25 can trigger. Conversely, an unexpected volume contraction may have tested $ 0.22 support, but in history, even in such a case, it is necessary to underline that the decreases are limited.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.