Bitcoin  $116,780.90The founder and CEO of Cryptoquant, who declared that the cycle theory has ended Ki Young JuAt the beginning of April, the warning of the “Taurus cycle is over” did not reflect the truth. At that time, Bitcoin was at the level of $ 80,000, and Ju had the opinion that intense sales pressure prevented the rise. However, the biggest crypto currency in July with 123 thousand 236 dollars renewed the record by renewing him unfair. Addressing his followers, “I will present data -oriented insights” wished.

$116,780.90The founder and CEO of Cryptoquant, who declared that the cycle theory has ended Ki Young JuAt the beginning of April, the warning of the “Taurus cycle is over” did not reflect the truth. At that time, Bitcoin was at the level of $ 80,000, and Ju had the opinion that intense sales pressure prevented the rise. However, the biggest crypto currency in July with 123 thousand 236 dollars renewed the record by renewing him unfair. Addressing his followers, “I will present data -oriented insights” wished.

The estimated output was wrong, he apologized

JU on April 4 StrategyEven the billions of dollars of purchases of billions of dollars could not withdraw the price of the bear market counted. According to him, the market entered a stage insensitive to the new capital and there was no possibility of a significant rise in the short term.

The facts progressed in the opposite direction to Ju’s expectations. In mid -May BitcoinThe price of 112 thousand dollars passed, in July, the highest level of all time, and the analyst’s prediction of the investors, approximately 54 percent of the potential earnings of the potential earnings. Ju today revised his thesis with the statement “Trade is no longer meaningless. The number of investors has exceeded the number of trades”. Crypto investors’ application – the reason will surprise you!

In his message on his social media account, “I apologize if my guess has negatively affected your investment decision, I will not be surprised by the numbers after that,” said Ju, stressed that he will give priority to data -based analyzes.

New reasons for the Bitcoin cycle theory died

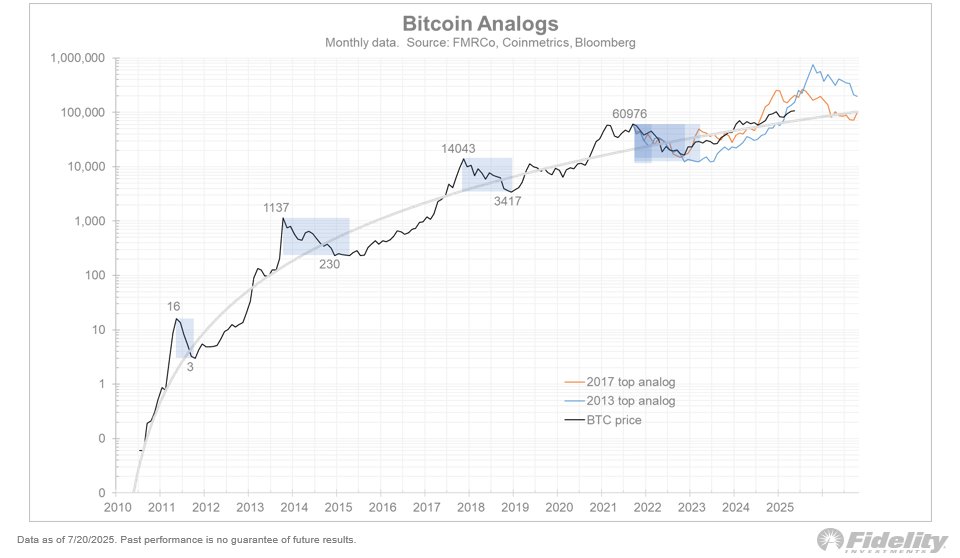

According to the analyst, the classic bull cycle, where large whales accumulated and reached the summit of individual interest, went to profit purchases. Whales now coinIt transfers their treasury reserves to long -term corporate investors who want to create a Treasury reserve, which softens price fluctuations. In this way, the rise trends become more permanent. From Fidelity Jurrien Timmer A opposite argument, stating that the four -year cycle still continued with a surprising accuracy recently. with presenting It came up.

Nevertheless, Ju, high demand, added that crypto currency reserve strategies have radically changed the market and that it is risky to predict with older models. In addition, the treasury companies will support the price of aggressive purchases for a long time, JU, instead of focusing on technical indicators, he advised to monitor in -blockchain fund flows.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.