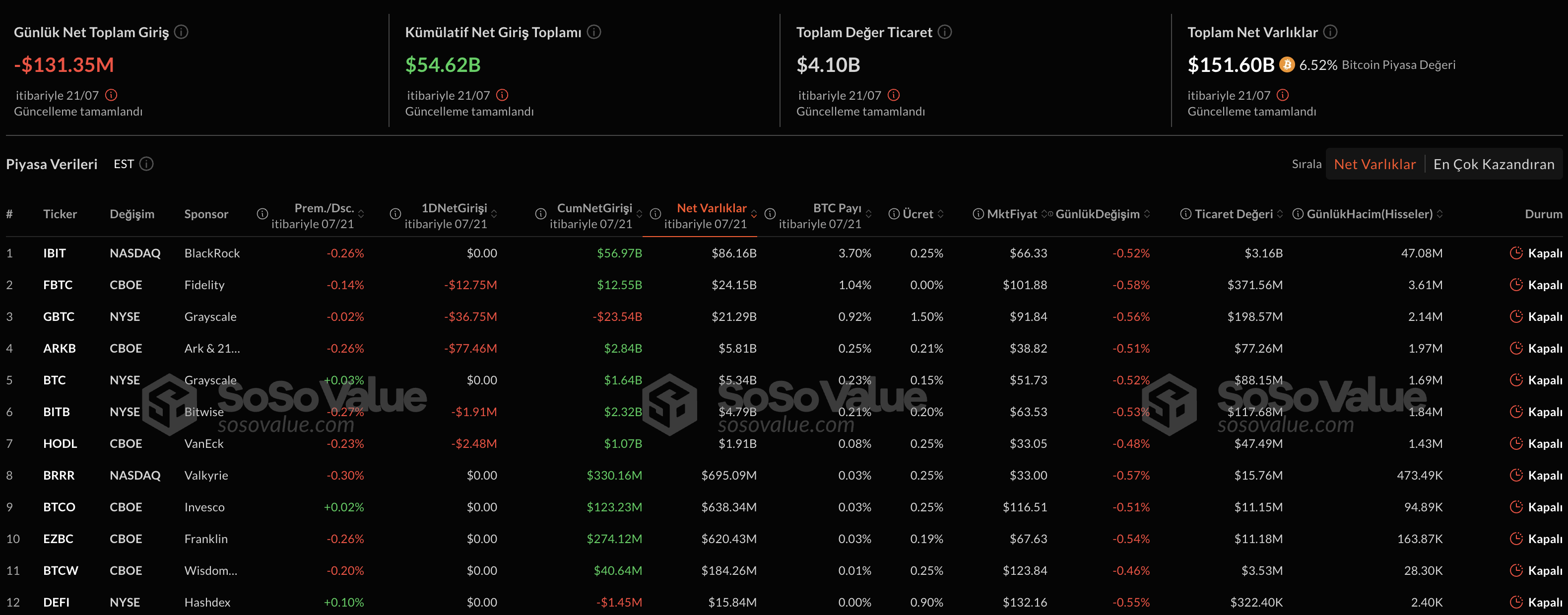

Spot on Monday Bitcoin  $118,550.58 While the 12 -day net entry series ended in ETFs, it would be $ 131.35 million, while Ethereum

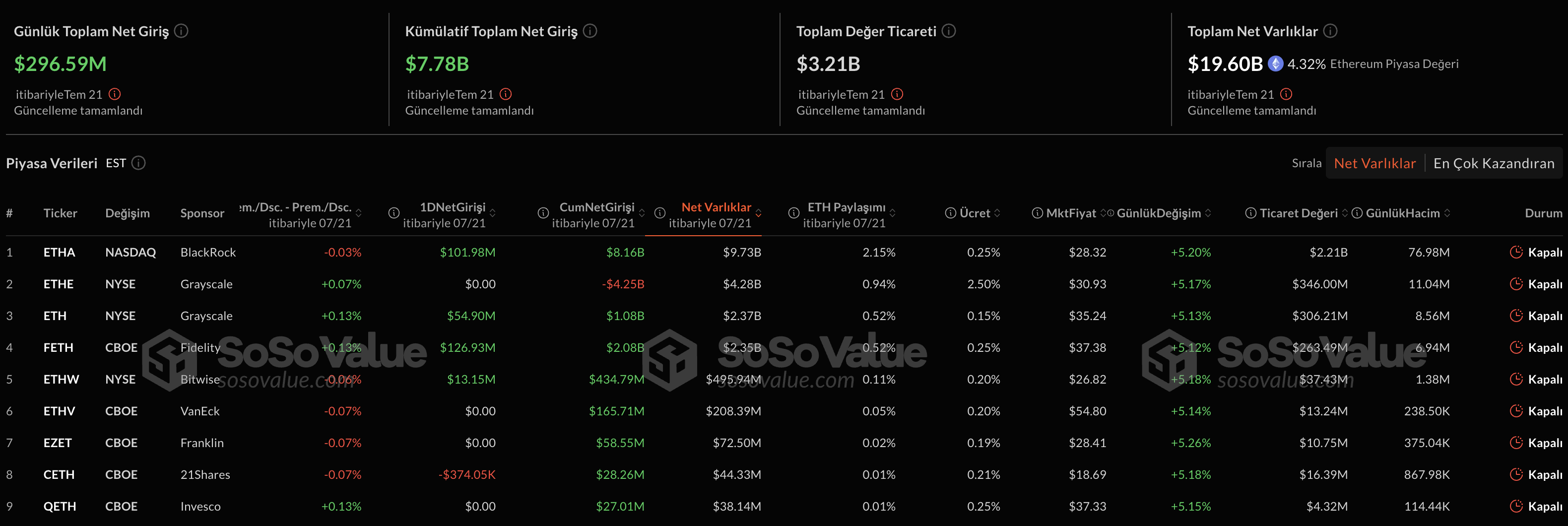

$118,550.58 While the 12 -day net entry series ended in ETFs, it would be $ 131.35 million, while Ethereum  $3,832.26 ETFs on the same day with an entrance of 296.6 million dollars in the 12th day closed. According to the Sosovalue data, the big output in the most bitcoin ETFs was at the ARKB FUND’s ARKB fund of Ark & 21shares with $ 77.46 million. Grayscale, Fidelity, Bitwise and Vaneck’in ETFs were also reported a net output. With Blackrock’s IBIT, six ETF announced zero streams. On the other hand, Fidelity’s Ethereum ETF’s conquest was 126.93 million dollars, and Blackrock’s ETHA was $ 102 million.

$3,832.26 ETFs on the same day with an entrance of 296.6 million dollars in the 12th day closed. According to the Sosovalue data, the big output in the most bitcoin ETFs was at the ARKB FUND’s ARKB fund of Ark & 21shares with $ 77.46 million. Grayscale, Fidelity, Bitwise and Vaneck’in ETFs were also reported a net output. With Blackrock’s IBIT, six ETF announced zero streams. On the other hand, Fidelity’s Ethereum ETF’s conquest was 126.93 million dollars, and Blackrock’s ETHA was $ 102 million.

Output in Bitcoin ETFs, entry into Ethereum ETFs

Sosovalue’s according to data A total of 6.12 billion dollars of net entries since July 1 Spot Bitcoin ETFHe saw the negatives on July 21st. The negative day came when IBIT reported what input or exit and other major funds reported simultaneous output.

On the Ethereum side, the table was reversed. Who has captured one of the most powerful entrance series since the launch date Spot Ethereum ETF‘s, in 12 days a total of 3.53 billion dollars in a net entered. Ethereum ETFs, which left Bitcoin several times on a daily basis, gained momentum, especially under the leadership of Fidelity and Blackrock. Grayscale Mini Ethereum Trust and Bitwise Ethw reported a positive flow. Crypto investors’ application – the reason will surprise you!

Can capital rotation trigger a large -scale subcoin season?

Presto Research Analyst Min jungETFs reflect a rotation from Bitcoin to Ethereum. For him BTCAs the next opportunity, the investor who thinks he missed the big rise in EthHe’s heading to the King of Altcoin, seeing it. Jung, Bitcoin’s market share of 5 percent in the last week as the first sign of downward shift in the risk curve.

The current market rally is mainly fed with corporate capital. Jung, therefore, it is unclear whether the movement will move beyond the great market valuable Altcoins, and that a different picture can be seen in this cycle.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.