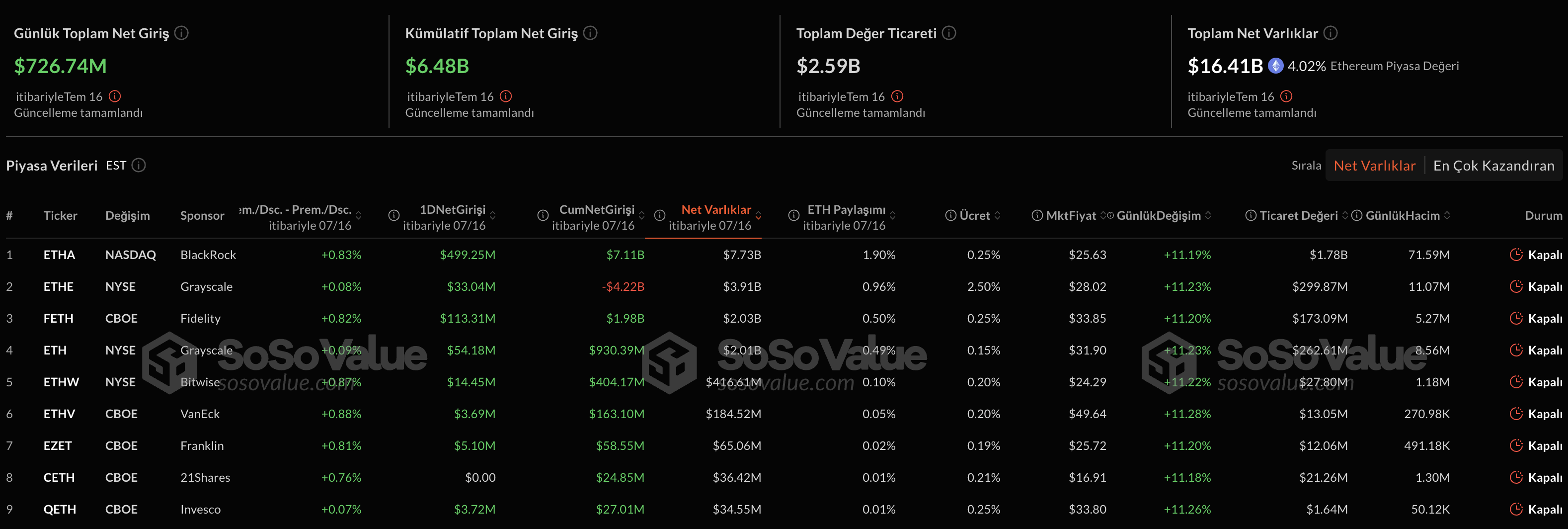

Ethereum  $3,157.06On Wednesday, July 16, 2025, the record entered the Spot Ethereum ETFs, thanks to a net introduction of 726.74 million dollars, it increased over $ 3,400 today. $ 726,74 million corresponds to the highest entrance since January. Blackrock’s ETHA funds alone $ 499 million, while eight of nine ETF reported positive flow. With these entries, the total ETF entrance in July reached $ 2.27 billion. Analysts EthHe emphasizes that it is no longer a short -term trade instrument, but as a long -term corporate portfolio presence.

$3,157.06On Wednesday, July 16, 2025, the record entered the Spot Ethereum ETFs, thanks to a net introduction of 726.74 million dollars, it increased over $ 3,400 today. $ 726,74 million corresponds to the highest entrance since January. Blackrock’s ETHA funds alone $ 499 million, while eight of nine ETF reported positive flow. With these entries, the total ETF entrance in July reached $ 2.27 billion. Analysts EthHe emphasizes that it is no longer a short -term trade instrument, but as a long -term corporate portfolio presence.

Corporate Request gives ETH Coin strength

To Sosovalue’s data according to Spot Ethereum ETFTotal assets under the control of their’s reached about 4 percent of Altcoin’s market value. BTC Markets Analyst Rachael LucasHe added that this ratio carries ETH to the corporate showcase and supports the rise formations of transaction volume exceeding $ 2.5 billion per day.

Director of LVRG Research Nick Ruck ETH as a treasure presence of public companies accelerated acceleration by accumulating ETH. Consensys -supported Sharplink Gaming’s existing reserve consisting of 280 thousand 706 ETH Ethereum Foundation, while leaving behind on Wednesday, 20 thousand 279 ETH demands continued. Ruck notes that limited supply growth directs the capital looking for a return to Ethereum and that the historical summit of 4,600 dollars of 4,600 dollars has entered the target.

Mobility in the Altcoin Market increased

ETH’s rally other big altcoinHe jumped to the s. XRP For $ 3.05 with a 5 percent rise, Solana 5.16 percent of $ 170.96 with an increase, Bnb 3.44 percent rise to $ 710 with an increase. Bitcoin in the same period  $118,893.62 Only 0.71 percent of the rise of 118 thousand 395 dollars, while tradingView’s data according to The largest crypto currency on the market decreased by 2.59 points on a weekly basis to 62.72 percent.

$118,893.62 Only 0.71 percent of the rise of 118 thousand 395 dollars, while tradingView’s data according to The largest crypto currency on the market decreased by 2.59 points on a weekly basis to 62.72 percent.

Lucas, historically, the decline in Bitcoin’s dominance on the market Altcoin season reminded that there was a signal before. While ETH Stinging is expected to increase the risk appetite in the market with the merger of corporate purchases and supportive macro factors, investors agree that Ethereum can reach out to new records.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.